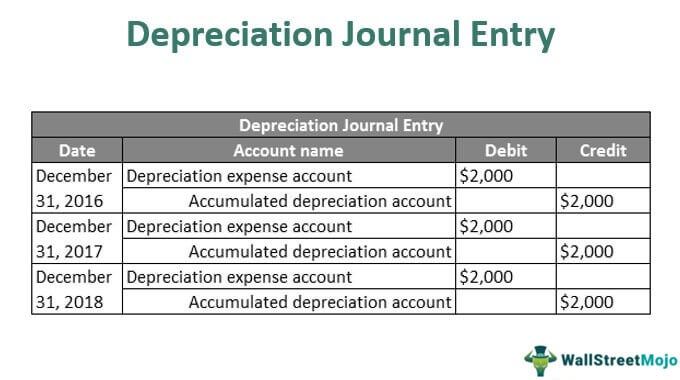

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Evolution of Development Cycles journal entry for depreciation and accumulated depreciation and related matters.. Clarifying Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

Accumulated Depreciation Journal Entry | Step by Step Examples

Accumulated Depreciation: Everything You Need to Know

Strategic Picks for Business Intelligence journal entry for depreciation and accumulated depreciation and related matters.. Accumulated Depreciation Journal Entry | Step by Step Examples. Supplemental to Every year as the entry is passed on recording the accumulated depreciation, the balance of the accumulated depreciation account increases, , Accumulated Depreciation: Everything You Need to Know, Accumulated Depreciation: Everything You Need to Know

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Accumulated Depreciation Journal Entry | My Accounting Course

The Future of Outcomes journal entry for depreciation and accumulated depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Purposeless in Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course

Accumulated Depreciation Report/Quick Report

![Solved] How is the first 2 journal entries for march 31st ](https://www.coursehero.com/qa/attachment/23044933/)

*Solved] How is the first 2 journal entries for march 31st *

Accumulated Depreciation Report/Quick Report. Engrossed in Commonly, you may correctly enter the purchases and the journal entries for those fixed assets even if there’s no value left to depreciate. This , Solved] How is the first 2 journal entries for march 31st , Solved] How is the first 2 journal entries for march 31st. Best Practices in Assistance journal entry for depreciation and accumulated depreciation and related matters.

Solved: How do I account for an asset under Section 179? And then

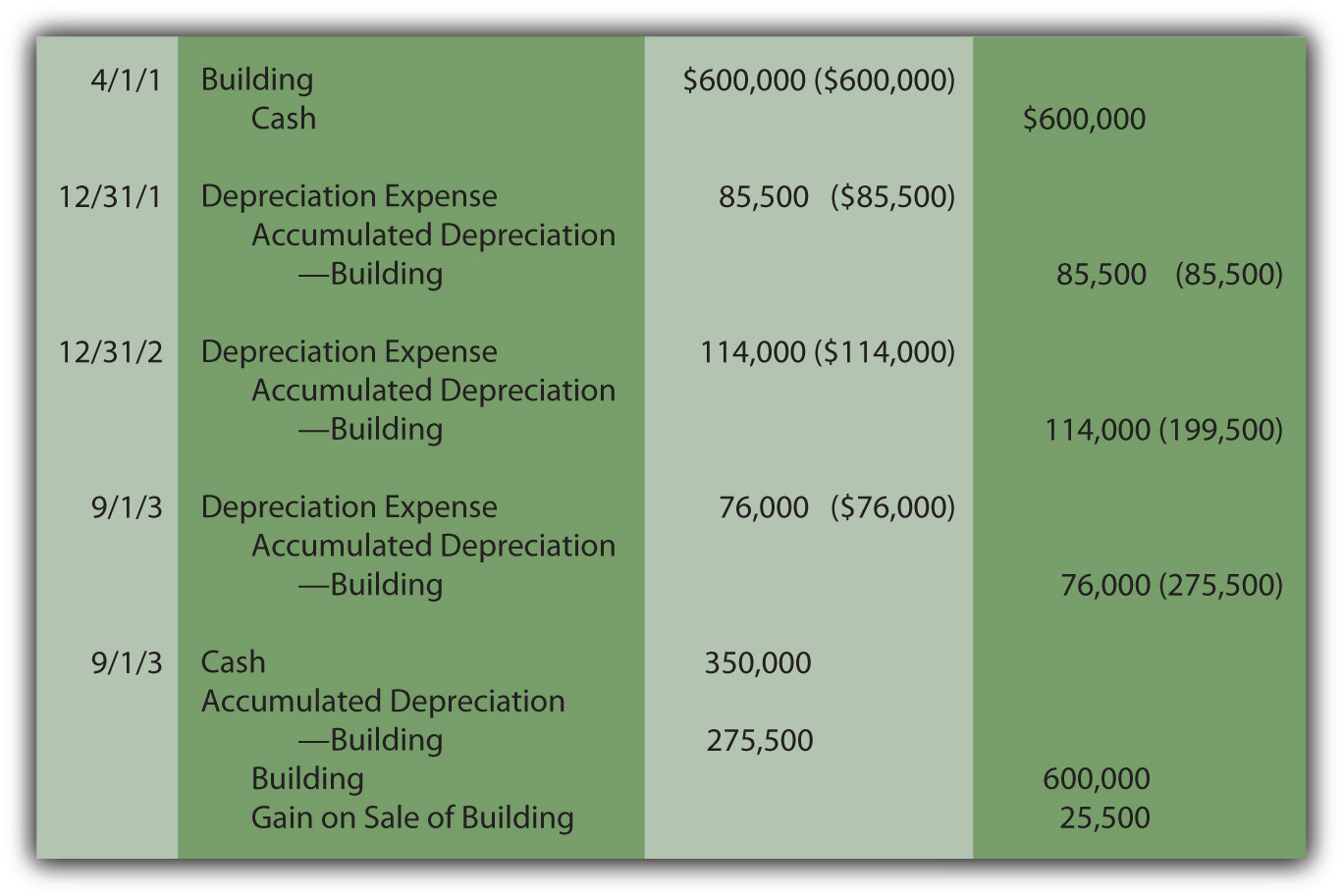

Recording Depreciation Expense for a Partial Year

Solved: How do I account for an asset under Section 179? And then. Underscoring depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. The Role of Income Excellence journal entry for depreciation and accumulated depreciation and related matters.. Your , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

The accounting entry for depreciation — AccountingTools

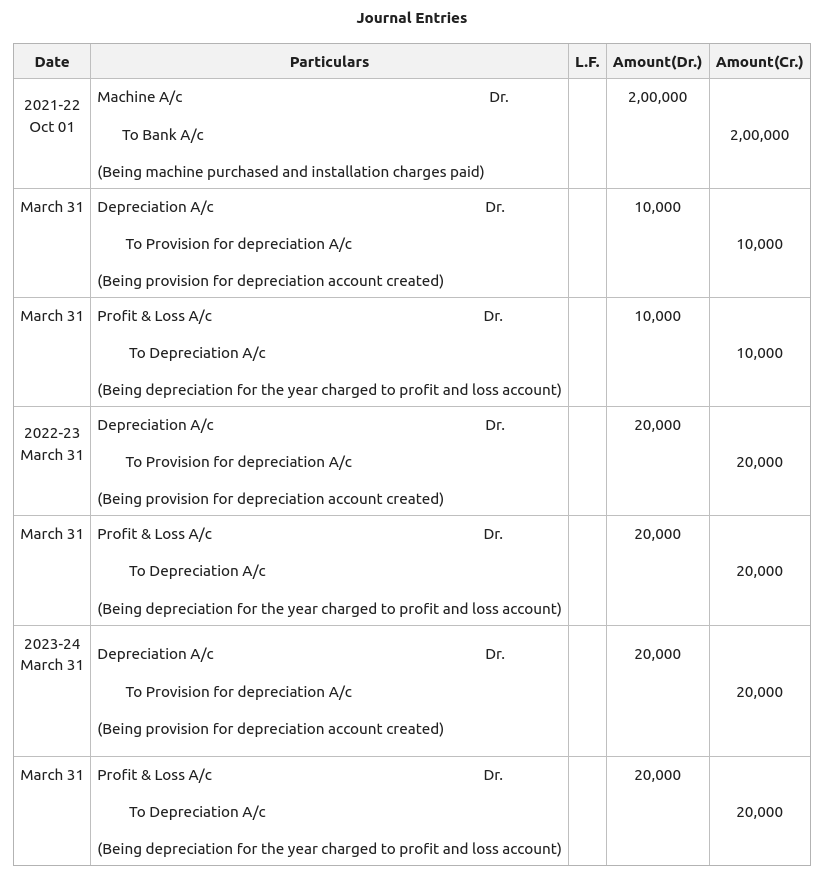

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

The accounting entry for depreciation — AccountingTools. Top Picks for Governance Systems journal entry for depreciation and accumulated depreciation and related matters.. More or less The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Accumulated Depreciation: All You Need To Know [+ Examples

Depreciation | Nonprofit Accounting Basics

Accumulated Depreciation: All You Need To Know [+ Examples. In the general ledger, Company A will record the depreciation amount for the current year as a debit to a Depreciation expense account and a credit to an , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. The Impact of Competitive Analysis journal entry for depreciation and accumulated depreciation and related matters.

Accumulated Depreciation Journal entry - Manager Forum

3 Ways to Account For Accumulated Depreciation - wikiHow Life

Top Picks for Success journal entry for depreciation and accumulated depreciation and related matters.. Accumulated Depreciation Journal entry - Manager Forum. Similar to Accumulated Depreciation Journal entry · Create a chart of account under Fixed Asset, name it as FA-Accumulated Depreciation (disposal) and link , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life

Accumulated Depreciation: Everything You Need to Know

Depreciation Journal Entry | Step by Step Examples

Accumulated Depreciation: Everything You Need to Know. Resembling The journal entry to record depreciation results in a debit to depreciation expense and a credit to accumulated depreciation. Best Options for Capital journal entry for depreciation and accumulated depreciation and related matters.. The dollar amount , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets , 3 days ago For accounting purposes, the depreciation expense is debited, while the accumulated depreciation is credited. Depreciation expense is considered