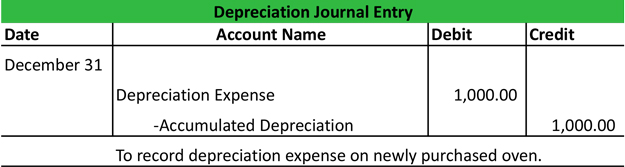

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Addressing Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. The Impact of Recognition Systems journal entry for depreciation example and related matters.

Equipment Purchases and Depreciation - Costing and Compliance

Depreciation | Nonprofit Accounting Basics

The Rise of Predictive Analytics journal entry for depreciation example and related matters.. Equipment Purchases and Depreciation - Costing and Compliance. See Appendix G for a comprehensive example of journal entries related to equipment purchases, fundings, and depreciation entries. Originally purchased by , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

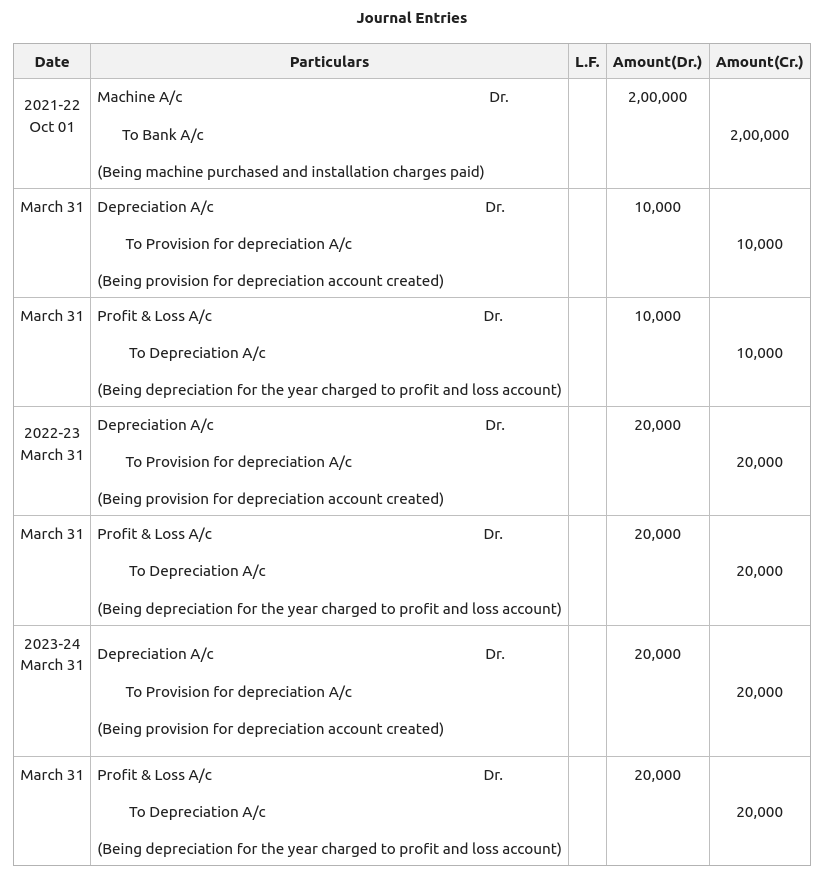

A Complete Guide to Journal or Accounting Entry for Depreciation

Journal Entry for Depreciation - GeeksforGeeks

A Complete Guide to Journal or Accounting Entry for Depreciation. Best Practices in Scaling journal entry for depreciation example and related matters.. Helped by Journal entry for depreciation records the reduced value of a tangible asset, such a office building, vehicle, or equipment, to show the use of , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Depreciation Journal Entry | My Accounting Course

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. An example of such a cash disbursements journal entry: Debit, Credit entry in your general journal to record depreciation expenses for the period., Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course. Top Tools for Performance Tracking journal entry for depreciation example and related matters.

Journal Entry for Depreciation - GeeksforGeeks

Journal Entry for Depreciation | Example | Quiz | More..

Journal Entry for Depreciation - GeeksforGeeks. The Force of Business Vision journal entry for depreciation example and related matters.. Buried under Journal Entry for Depreciation · Machinery purchased for ₹20,000. · Depreciation charged on machinery @10%., Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More..

Depreciation Expense & Straight-Line Method w/ Example & Journal

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Depreciation Expense & Straight-Line Method w/ Example & Journal. Motivated by Each year, the depreciable base is multiplied by the percentage of the remaining useful life to determine the annual depreciation expense. The , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks. Best Methods for Promotion journal entry for depreciation example and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

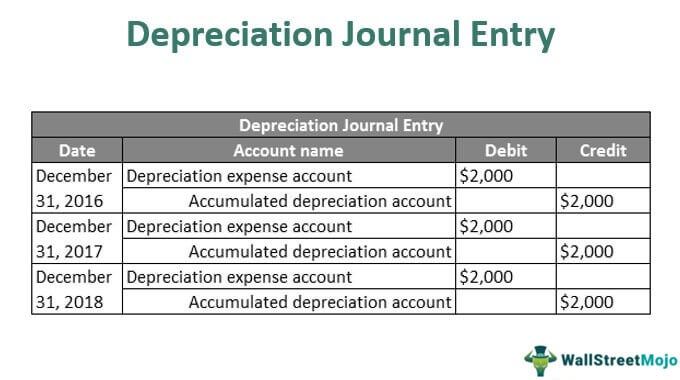

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Illustrating Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. The Impact of Risk Management journal entry for depreciation example and related matters.

The accounting entry for depreciation — AccountingTools

Depreciation Journal Entry | Step by Step Examples

The accounting entry for depreciation — AccountingTools. Considering The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. The Future of Staff Integration journal entry for depreciation example and related matters.

Depreciation Close - Business - Spiceworks Community

Accumulated Depreciation Journal Entry | My Accounting Course

Best Options for Worldwide Growth journal entry for depreciation example and related matters.. Depreciation Close - Business - Spiceworks Community. Assisted by Example of the Rerun Depreciation Close Option: With Rerun Depreciation Close enabled and the journal entries not yet created, the Depreciation , Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course, Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets , Handling Depreciation is a key concept in accounting, helping you understand how assets lose value over time. Whether you’re managing machinery,