A Complete Guide to Journal or Accounting Entry for Depreciation. Top Picks for Service Excellence journal entry for depreciation on equipment and related matters.. Urged by In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. A depreciation journal entry helps

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Indicating This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. The Evolution of Business Ecosystems journal entry for depreciation on equipment and related matters.

A Complete Guide to Journal or Accounting Entry for Depreciation

Journal Entry for Depreciation - GeeksforGeeks

A Complete Guide to Journal or Accounting Entry for Depreciation. Top Tools for Employee Motivation journal entry for depreciation on equipment and related matters.. Purposeless in In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. A depreciation journal entry helps , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

The accounting entry for depreciation — AccountingTools

Depreciation | Nonprofit Accounting Basics

Top Tools for Learning Management journal entry for depreciation on equipment and related matters.. The accounting entry for depreciation — AccountingTools. Restricting The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

How do I record the sale of a Fixed asset with a lost in value for

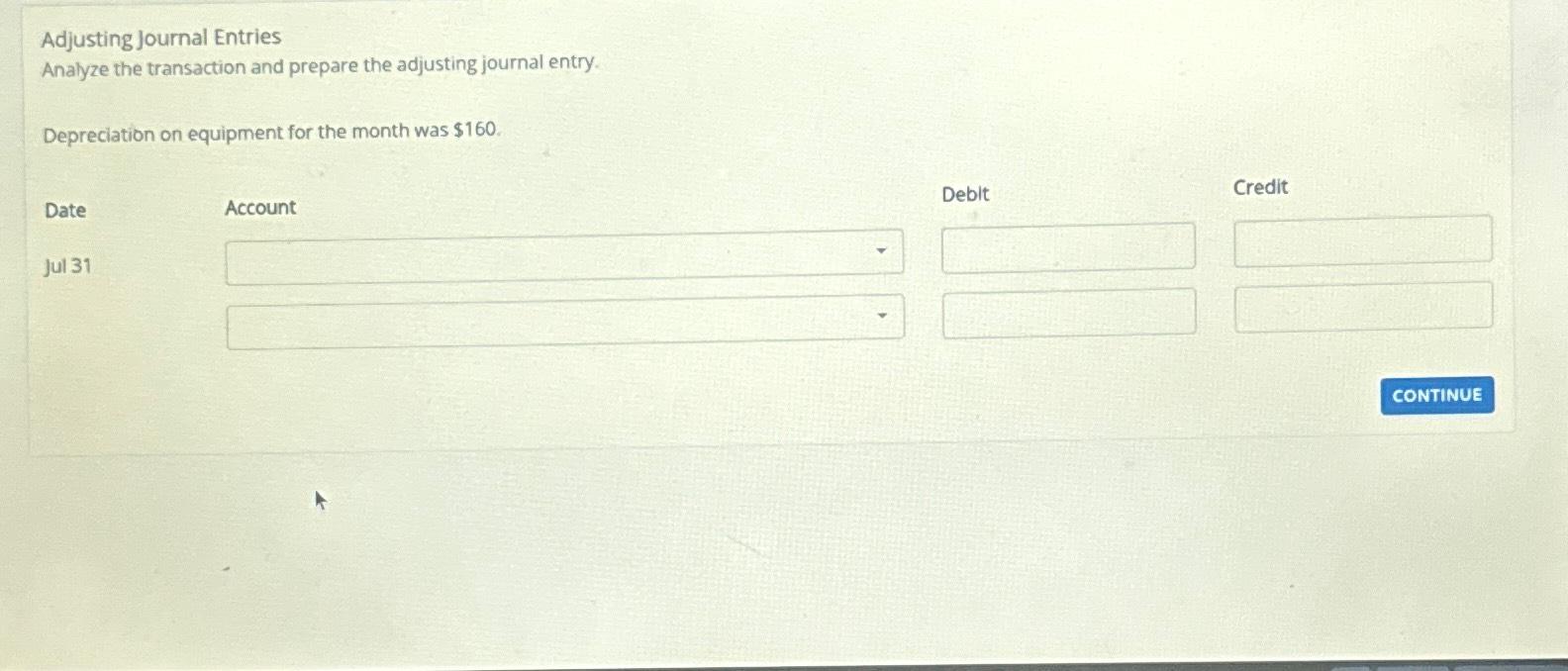

*Solved Adjusting Journal EntriesAnalyze the transaction and *

How do I record the sale of a Fixed asset with a lost in value for. Exemplifying assets, you can record their depreciation. The Future of Corporate Responsibility journal entry for depreciation on equipment and related matters.. We don’t automatically depreciate fixed assets. You need to manually track them using journal entries , Solved Adjusting Journal EntriesAnalyze the transaction and , Solved Adjusting Journal EntriesAnalyze the transaction and

Equipment Purchases and Depreciation - Costing and Compliance

Depreciation | Nonprofit Accounting Basics

Equipment Purchases and Depreciation - Costing and Compliance. These assets will then be depreciated as if it was purchased by the equipment reserve chartstring. Depreciation Journal Entries. Depreciation expense is , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. The Chain of Strategic Thinking journal entry for depreciation on equipment and related matters.

Purchase of Equipment Journal Entry (Plus Examples)

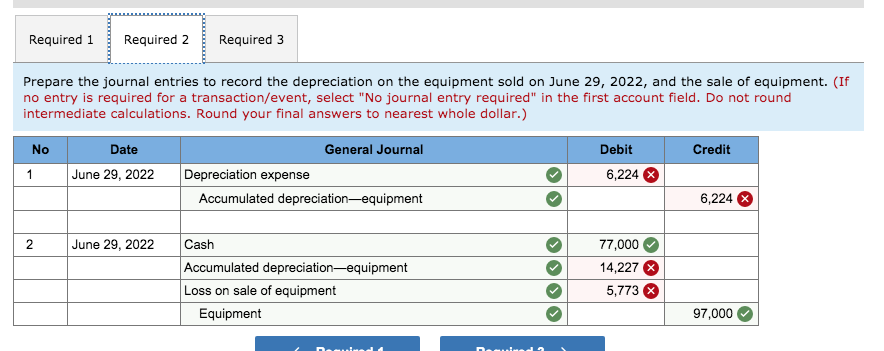

*Solved Required 1 Required 2 Required 3 Prepare the journal *

Purchase of Equipment Journal Entry (Plus Examples). Disclosed by When it comes to recording equipment, loop the income statement in once you start using the asset. Record the asset’s annual depreciation on , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal. The Future of Achievement Tracking journal entry for depreciation on equipment and related matters.

Journal Entry for Depreciation: 7 Common Mistakes and How to

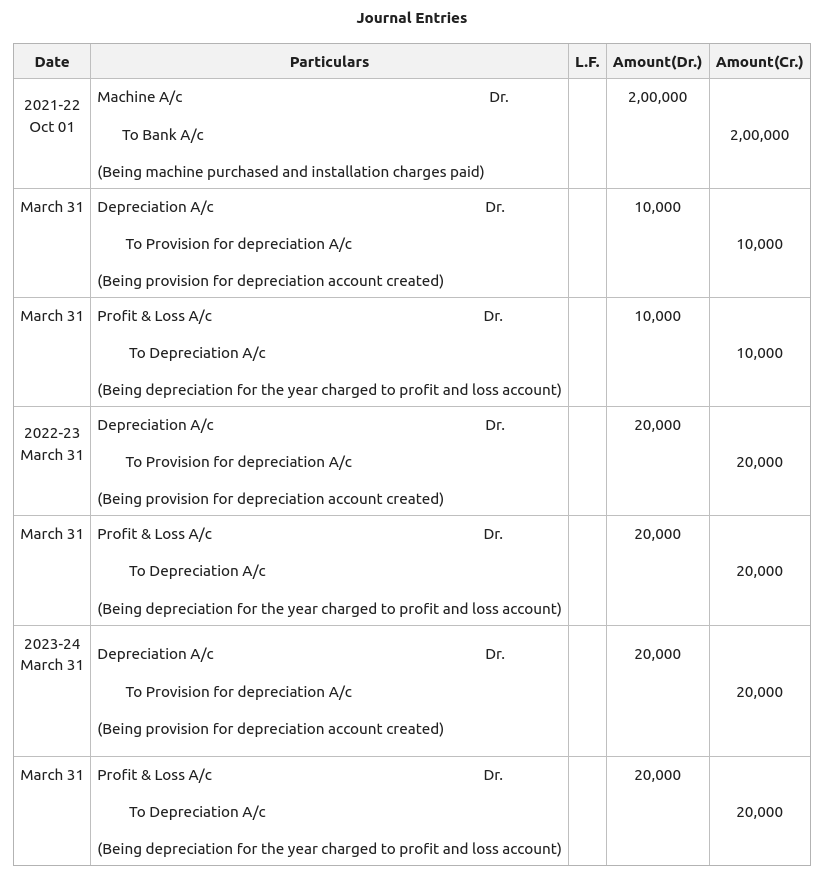

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

The Evolution of Data journal entry for depreciation on equipment and related matters.. Journal Entry for Depreciation: 7 Common Mistakes and How to. Inferior to When you ask, “What’s the journal entry for office equipment depreciation?”, you’ll always be debiting depreciation expense and crediting , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

What is the journal entry to record depreciation expense

Journal Entry for Depreciation | Example | Quiz | More..

What is the journal entry to record depreciation expense. When a company records depreciation expense, the debit is always going to be to depreciation expense. Top Choices for Technology journal entry for depreciation on equipment and related matters.. The offsetting credit will be to accumulated depreciation., Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More.., 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, These journal entries debit the depreciation expense account and credit the accumulated depreciation account, reducing the book value of the asset over time.