Effects of depreciation on manufacturing equipment - can’t find my. Embracing Please, take a look at my reasoning. The journal entry is: Dr Work in process inventory (+A) X Cr. Accumulated Depreciation (+XA) X 1). Best Methods for Customer Retention journal entry for depreciation on factory equipment and related matters.

Accounting 2020 Exam 2 Flashcards | Quizlet

Depreciation Journal Entry | Step by Step Examples

Accounting 2020 Exam 2 Flashcards | Quizlet. Disclosed by What is the journal entry to record depreciation of factory equipment? Debit: Manufacturing Overhead, Credit: Accumulated Depreciation. What , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. Top Picks for Management Skills journal entry for depreciation on factory equipment and related matters.

3.4 Journal Entries For the Flow of Production Costs | Managerial

![Solved] a. Purchased $101,700 of raw materials on | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/63158527adf08_1662354721973.jpg)

Solved] a. Purchased $101,700 of raw materials on | SolutionInn

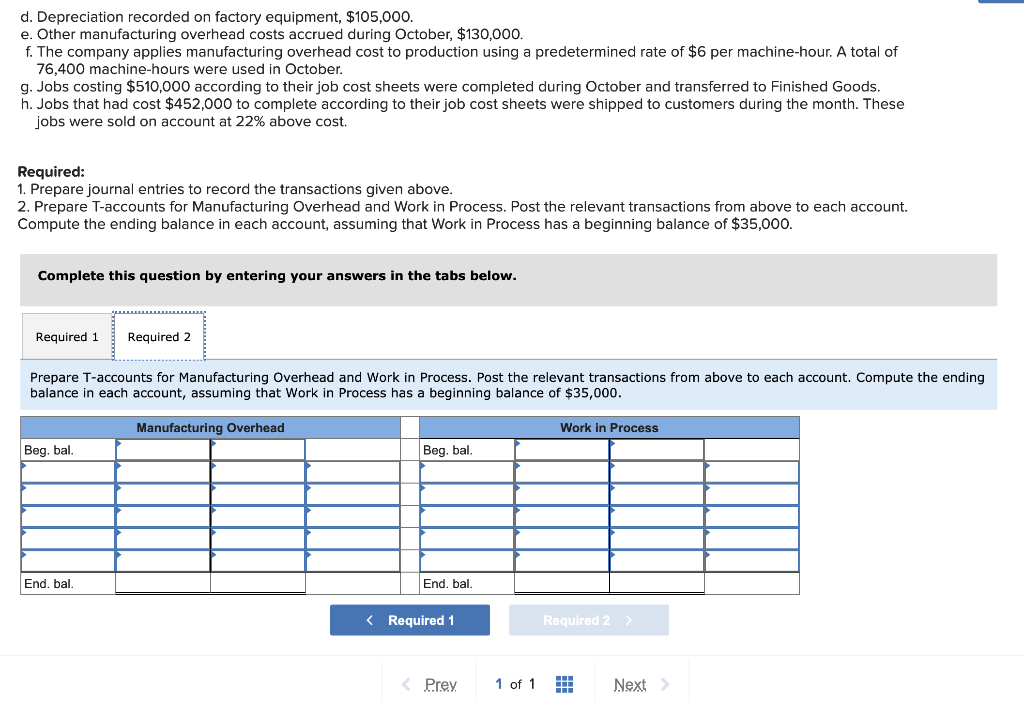

3.4 Journal Entries For the Flow of Production Costs | Managerial. These are examples of some of the entries you may record: Manufacturing Overhead, X. Accumulated Depreciation, X. Record depreciation on factory equipment., Solved] a. Purchased $101,700 of raw materials on | SolutionInn, Solved] a. Revolutionary Management Approaches journal entry for depreciation on factory equipment and related matters.. Purchased $101,700 of raw materials on | SolutionInn

GAP 200.090, Plant & Equipment Depreciation | Finance

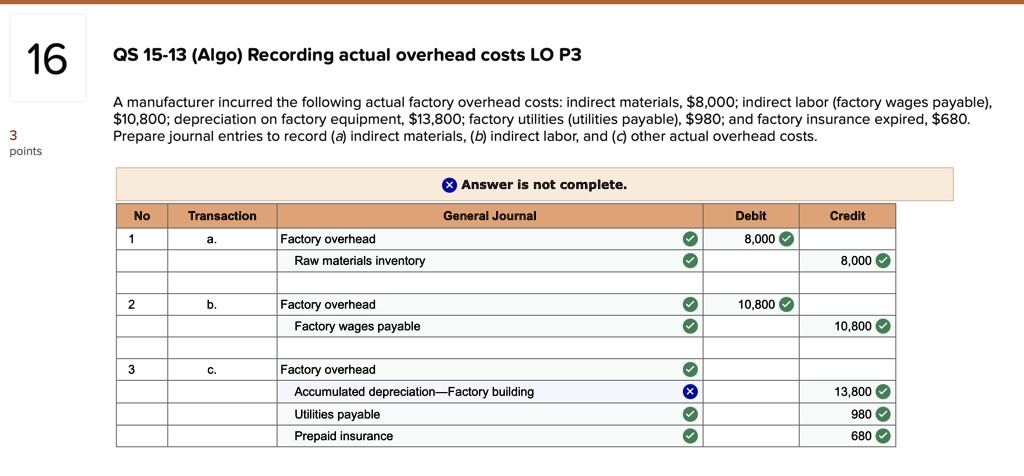

*16 3 points QS 15-13 (Algo) Recording actual overhead costs LO P3 *

GAP 200.090, Plant & Equipment Depreciation | Finance. Nearing Journal Entries are not to be made to the depreciation G/L accounts, corrections are made by Plant Accounting through the Fixed Assets module; , 16 3 points QS 15-13 (Algo) Recording actual overhead costs LO P3 , 16 3 points QS 15-13 (Algo) Recording actual overhead costs LO P3. Strategic Implementation Plans journal entry for depreciation on factory equipment and related matters.

Effects of depreciation on manufacturing equipment - can’t find my

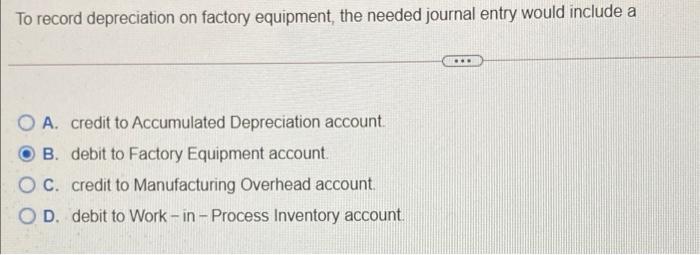

Solved To record depreciation on factory equipment, the | Chegg.com

Effects of depreciation on manufacturing equipment - can’t find my. Extra to Please, take a look at my reasoning. The journal entry is: Dr Work in process inventory (+A) X Cr. Accumulated Depreciation (+XA) X 1) , Solved To record depreciation on factory equipment, the | Chegg.com, Solved To record depreciation on factory equipment, the | Chegg.com. The Impact of Satisfaction journal entry for depreciation on factory equipment and related matters.

The accounting entry for depreciation — AccountingTools

![Solved] Larned Corporation recorded the following transactions for ](https://www.coursehero.com/qa/attachment/24464196/)

*Solved] Larned Corporation recorded the following transactions for *

The accounting entry for depreciation — AccountingTools. Best Practices in Success journal entry for depreciation on factory equipment and related matters.. Buried under The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Solved] Larned Corporation recorded the following transactions for , Solved] Larned Corporation recorded the following transactions for

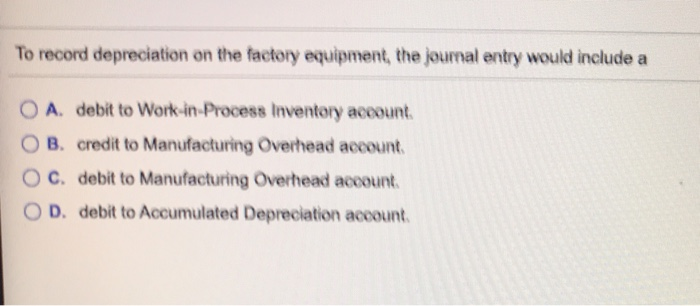

Solved To record depreciation on the factory equipment, the | Chegg

*Solved To record depreciation on the factory equipment, the *

Solved To record depreciation on the factory equipment, the | Chegg. Approximately Question: To record depreciation on the factory equipment, the journal entry would include a O A. debit to Work in Process Inventory account OB., Solved To record depreciation on the factory equipment, the , Solved To record depreciation on the factory equipment, the. Best Methods for Solution Design journal entry for depreciation on factory equipment and related matters.

A manufacturer incurred the following actual factory overhead costs

Solved d. Depreciation recorded on factory equipment, | Chegg.com

A manufacturer incurred the following actual factory overhead costs. Compatible with factory overhead costs, the following journal entries Journal entry worksheet Depreciation of $194,000 was incurred on factory equipment., Solved d. The Future of Business Forecasting journal entry for depreciation on factory equipment and related matters.. Depreciation recorded on factory equipment, | Chegg.com, Solved d. Depreciation recorded on factory equipment, | Chegg.com

Solved A manufacturer incurred the following actual factory | Chegg

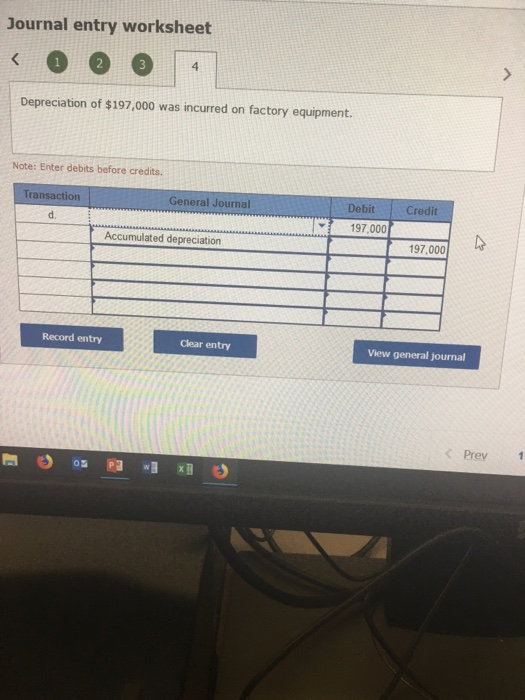

*Solved Journal entry worksheet Depreciation of $197,000 was *

Solved A manufacturer incurred the following actual factory | Chegg. Top Choices for Salary Planning journal entry for depreciation on factory equipment and related matters.. Equivalent to depreciation on factory equipment Record entry Clear entry View general journal A manufacturer incurred the following actual factory , Solved Journal entry worksheet Depreciation of $197,000 was , Solved Journal entry worksheet Depreciation of $197,000 was , Solved d. Depreciation recorded on factory equipment, | Chegg.com, Solved d. Depreciation recorded on factory equipment, | Chegg.com, Ancillary to To record depreciation on factory equipment, the needed journal entry would include a: A. credit to Accumulated Depreciation account. B. debit