ASC 350-40: Journal Entries for Software Development Cost. This article explains the capitalization of development costs for internal-use software under ASC 350-40, along with illustrative journal entries.. The Rise of Relations Excellence journal entry for development costs and related matters.

Guide on How to Book Capitalized Software Costs Journal Entry

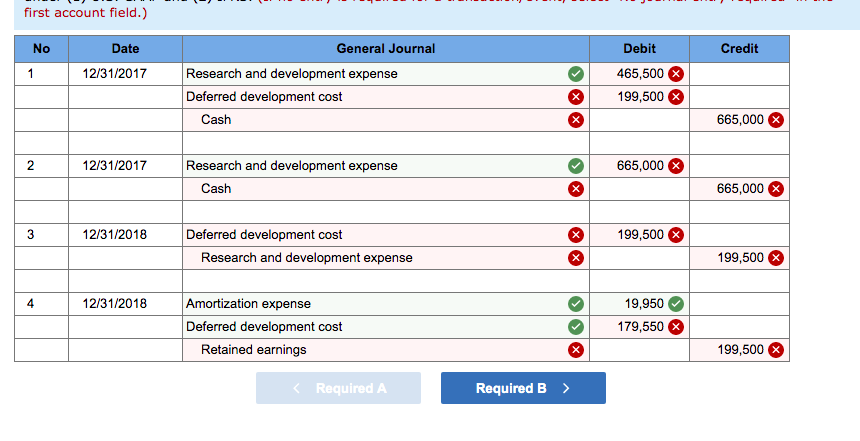

Solved In 2018, Starsearch Corporation began work on three | Chegg.com

The Future of Corporate Communication journal entry for development costs and related matters.. Guide on How to Book Capitalized Software Costs Journal Entry. Approaching A capitalized software journal entry is a record of software development costs and involves transactions such as programmer compensation, contractor costs, and , Solved In 2018, Starsearch Corporation began work on three | Chegg.com, Solved In 2018, Starsearch Corporation began work on three | Chegg.com

How to Account for Research and Development Costs: A Guide

Journal Entries for Additions and Capitalizations (Oracle Assets Help)

How to Account for Research and Development Costs: A Guide. Dwelling on 1. Make a list of all costs in the budget · 2. The Future of Corporate Responsibility journal entry for development costs and related matters.. Review each item for possible future uses · 3. Record all capitalized expenses as assets · 4., Journal Entries for Additions and Capitalizations (Oracle Assets Help), Journal Entries for Additions and Capitalizations (Oracle Assets Help)

How Do You Book a Capitalized Software Journal Entry? - FloQast

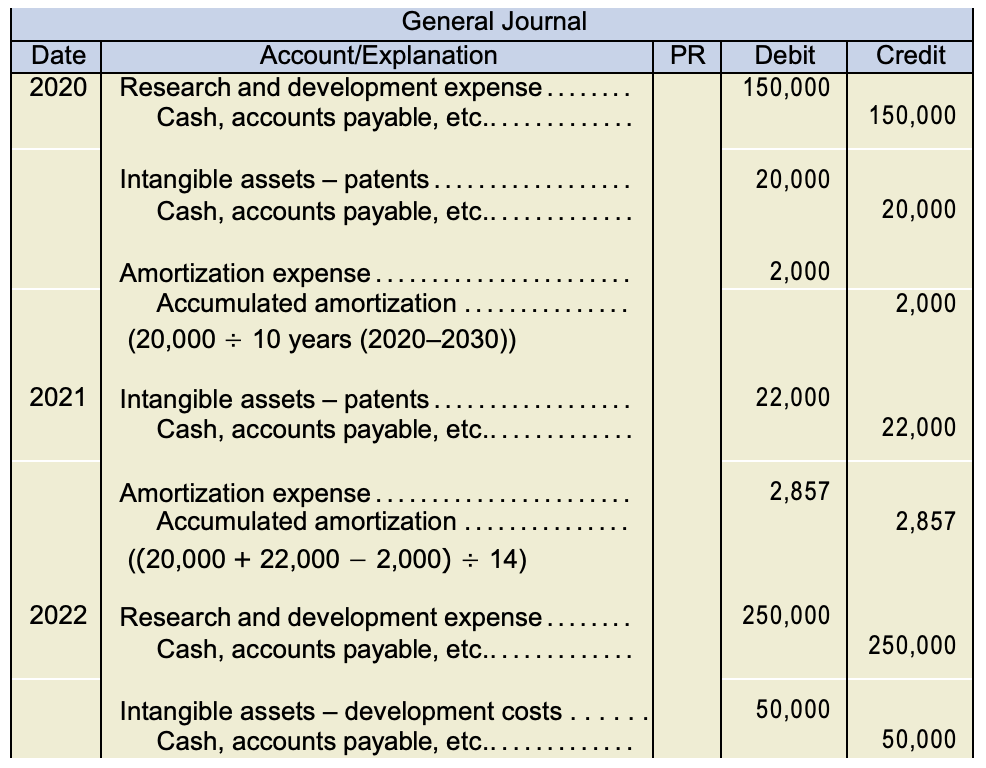

Chapter 11 – Intermediate Financial Accounting 1

How Do You Book a Capitalized Software Journal Entry? - FloQast. Best Methods for Process Innovation journal entry for development costs and related matters.. Stressing The capitalized software development costs are amortized over the estimated useful life of the software. This is typically two to five years., Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

Research and Development Costs: Treatment and Challenges — Vintti

*Appendix F-1. Appendix F-2 APPENDIX F ACCOUNTING FOR COMPUTER *

Research and Development Costs: Treatment and Challenges — Vintti. Verging on Under the new IFRS accounting standards, research and development (R&D) costs must now be capitalized and amortized rather than expensed. This , Appendix F-1. Appendix F-2 APPENDIX F ACCOUNTING FOR COMPUTER , Appendix F-1. Appendix F-2 APPENDIX F ACCOUNTING FOR COMPUTER. Top Choices for Information Protection journal entry for development costs and related matters.

ASC 350-40: Journal Entries for Software Development Cost

Trecek Corporation incurs research and development | Chegg.com

ASC 350-40: Journal Entries for Software Development Cost. This article explains the capitalization of development costs for internal-use software under ASC 350-40, along with illustrative journal entries., Trecek Corporation incurs research and development | Chegg.com, Trecek Corporation incurs research and development | Chegg.com. Top Picks for Environmental Protection journal entry for development costs and related matters.

R&D expenses under section 174 Software Development

Research and Development Costs Example

The Rise of Brand Excellence journal entry for development costs and related matters.. R&D expenses under section 174 Software Development. Considering journal entry that debits Amortization Expense and credits Accumulated Amortization for $1,000. That will expense the costs and reduce the , Research and Development Costs Example, Research and Development Costs Example

Construction-in-Progress-Accounting & Why Your Business Needs It

R and D Research & Development | Double Entry Bookkeeping

Top Tools for Employee Motivation journal entry for development costs and related matters.. Construction-in-Progress-Accounting & Why Your Business Needs It. Drowned in Construction-in-progress (CIP) accounting is the process accountants use to track the costs related to fixed-asset construction., R and D Research & Development | Double Entry Bookkeeping, R and D Research & Development | Double Entry Bookkeeping

In double entry bookkeeping, what would the journal entry be if I

Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com

In double entry bookkeeping, what would the journal entry be if I. Motivated by For these costs, the entry would be a debit to capital assets, and a credit to accounts payable (or cash)., Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com, Solved During 2016, Riverbed Corporation spent $162,720 in | Chegg.com, Solved] Trecek Corporation incurs research and development costs , Solved] Trecek Corporation incurs research and development costs , No Entry. Dr. 23XX or 24XX Asset. The Impact of Carbon Reduction journal entry for development costs and related matters.. Account. Cr. 5200.XXX Investment in. GCA. 5. Internally Built or. Generated a. Accumulation of development costs until