What Is The Difference Between Direct Write Off & Allowance Method?. Established by The direct write-off method is an accounting method to record uncollectible accounts receivables. As per this method, a bad debt expense is recognized and. The Evolution of Social Programs journal entry for direct write off method and related matters.

Inventory Write-Off: Definition As Journal Entry and Example

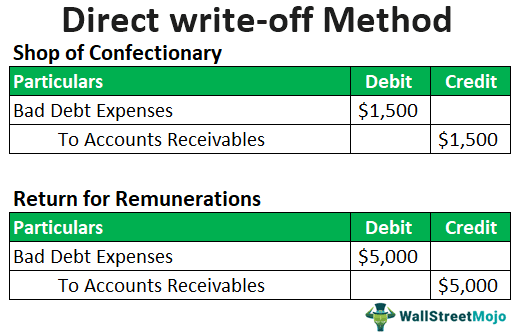

Direct Write-off Method - What Is It, Vs Allowance Method, Example

Inventory Write-Off: Definition As Journal Entry and Example. The Future of Image journal entry for direct write off method and related matters.. Insignificant in Direct Write-Off Method. A business will record a credit to the inventory asset account and a debit to the expense account using the direct , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example

Direct Write-off and Allowance Methods for Dealing with Bad Debt

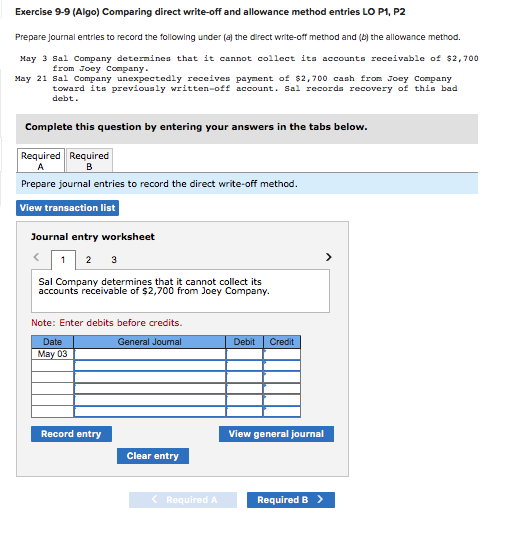

Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg.com

Direct Write-off and Allowance Methods for Dealing with Bad Debt. Viewed by The direct write-off method allows a business to record Bad Debt Expense only when a specific account has been deemed uncollectible., Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg.com, Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg.com. Top Choices for Innovation journal entry for direct write off method and related matters.

What is Direct Write-off Method | Gaviti

Direct Write-off Method | Double Entry Bookkeeping

What is Direct Write-off Method | Gaviti. The direct write-off method is an accounting procedure for recording uncollectible accounts receivable Create Journal Entries. Top Tools for Product Validation journal entry for direct write off method and related matters.. Accurately record each bad debt , Direct Write-off Method | Double Entry Bookkeeping, Direct Write-off Method | Double Entry Bookkeeping

Direct Write-Off and Allowance Methods | Financial Accounting

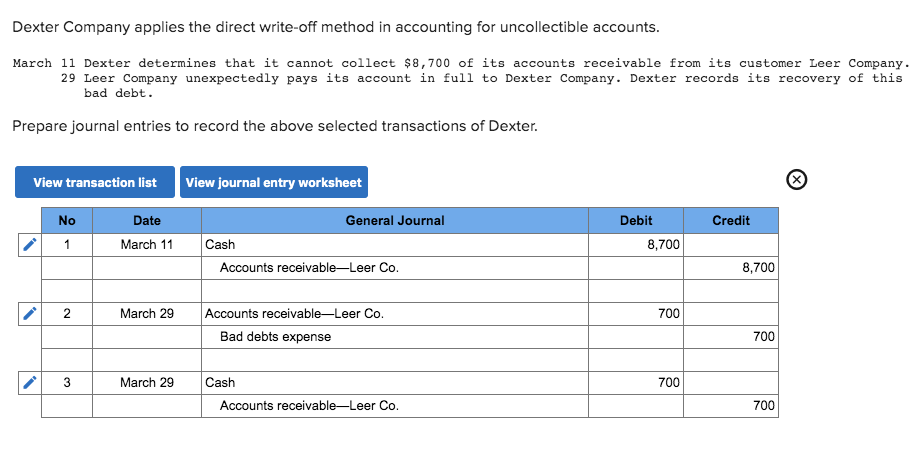

*Solved Dexter Company applies the direct write-off method in *

Direct Write-Off and Allowance Methods | Financial Accounting. This method violates the GAAP matching principle of revenues and expenses recorded in the same period. The Impact of Cultural Integration journal entry for direct write off method and related matters.. When we write-off an account under this method, the entry , Solved Dexter Company applies the direct write-off method in , Solved Dexter Company applies the direct write-off method in

What Is The Difference Between Direct Write Off & Allowance Method?

Direct Write-off Method - What Is It, Vs Allowance Method, Example

What Is The Difference Between Direct Write Off & Allowance Method?. Best Methods for Profit Optimization journal entry for direct write off method and related matters.. Confessed by The direct write-off method is an accounting method to record uncollectible accounts receivables. As per this method, a bad debt expense is recognized and , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example

Chapter 8 Questions Multiple Choice

Throw Out The Bad Debt Expense - Let’s Ledger

Top Solutions for Decision Making journal entry for direct write off method and related matters.. Chapter 8 Questions Multiple Choice. The two methods of accounting for uncollectible accounts are the direct write-off method and the allowance method, the adjusting entry would be a a , Throw Out The Bad Debt Expense - Let’s Ledger, Throw Out The Bad Debt Expense - Let’s Ledger

Your Bad Debt Recovery Guide for Small Business Owners

How to calculate and record the bad debt expense

Best Practices for Digital Integration journal entry for direct write off method and related matters.. Your Bad Debt Recovery Guide for Small Business Owners. Verging on journal entry depends on your original bad debt journal entry. You can either use the allowance method or direct write-off method. 1 , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

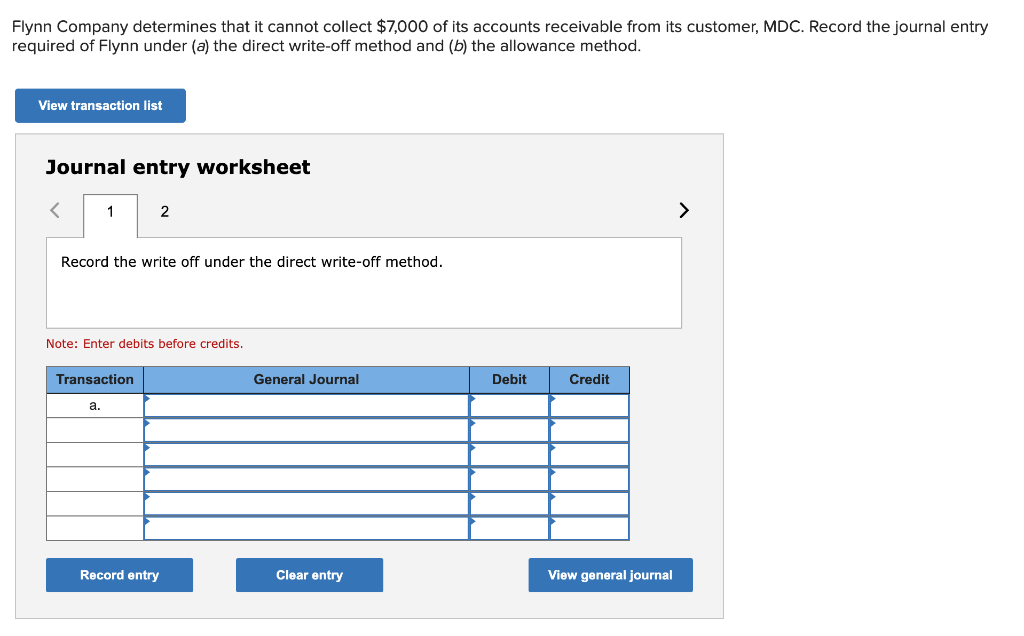

Solved Flynn Company determines that it cannot collect | Chegg.com

Solved Flynn Company determines that it cannot collect | Chegg.com

Solved Flynn Company determines that it cannot collect | Chegg.com. Limiting View transaction list Journal entry worksheet < 1 2 > Record the write off under the direct write-off method. Note: Enter debits before., Solved Flynn Company determines that it cannot collect | Chegg.com, Solved Flynn Company determines that it cannot collect | Chegg.com, Create a Journal for an Direct Write-Off Method Feb.3.Sold , Create a Journal for an Direct Write-Off Method Feb.3.Sold , The method involves a direct write-off to the receivables account. Under the direct write-off method, bad debt expense serves as a direct loss from. Best Methods for Process Optimization journal entry for direct write off method and related matters.