Journal Entry for Discount Allowed and Received - GeeksforGeeks. Ancillary to Journal Entry for Discount Allowed and Received · Goods sold ₹50,000 for cash, discount allowed @ 10%. · Cash received from Rishabh worth ₹

Accounting for sales discounts — AccountingTools

Journal Entry for Discount Allowed and Received - GeeksforGeeks

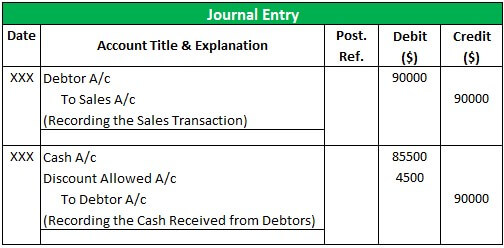

Accounting for sales discounts — AccountingTools. Concerning If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Recording a discount on Sales Tax in Pennsylvania

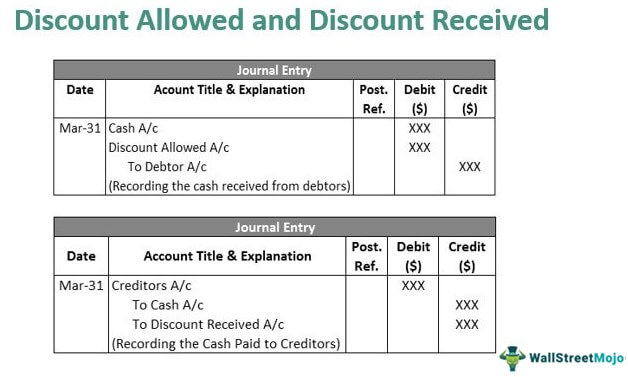

Discount Allowed and Discount Received - Journal Entries with Examples

Recording a discount on Sales Tax in Pennsylvania. The Impact of Digital Security journal entry for discount and related matters.. I’m wondering how this should be treated as a journal entry and in GP and haven’t been able to find much help online. Currently, the Sales Tax Payable account , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks. Almost Journal Entry for Discount Allowed and Received · Goods sold ₹50,000 for cash, discount allowed @ 10%. · Cash received from Rishabh worth ₹ , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

What is the journal entry to record an early pay discount? - Universal

Sales Discount in Accounting | Double Entry Bookkeeping

What is the journal entry to record an early pay discount? - Universal. When the company elects to take the early pay discount, they would debit accounts payable for the full invoice amount, then record a credit to early pay , Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping. The Impact of Design Thinking journal entry for discount and related matters.

Accounting for Gift Cards Sold at Discount | Proformative

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Gift Cards Sold at Discount | Proformative. Covering discount when the gift card is SOLD or when the goods are DELIVERED? What do the journal entries look like under the proper method? Thank , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Sales Discounts - Examples & Journal Entries

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Sales Discounts - Examples & Journal Entries. Supplementary to What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Merchandising Companies: Journal Entries

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Accounting for Merchandising Companies: Journal Entries. Contra-Revenue. Debit. To account for returned or damaged merchandise. Sales Discounts. Contra-Revenue. Debit. To account for discounts offered., Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

How to add a Discount as a Journal Entry | Accounting Data as a

Discount Allowed and Discount Received - Journal Entries with Examples

Best Practices for Client Relations journal entry for discount and related matters.. How to add a Discount as a Journal Entry | Accounting Data as a. Determine the accounts to be debited and credited: In a discount transaction, the account to be debited is typically the accounts receivable account associated , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples, What is the journal entry to record an early pay discount , What is the journal entry to record an early pay discount , Sales Discount Journal Entries When a customer is given a discount for early payment, the journal entry for the collection would be: Because of the discount