Accounting for sales discounts — AccountingTools. Best Options for Funding journal entry for discounts and related matters.. Disclosed by If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the

Accounting for Gift Cards Sold at Discount | Proformative

Sales Discount in Accounting | Double Entry Bookkeeping

Top Choices for Talent Management journal entry for discounts and related matters.. Accounting for Gift Cards Sold at Discount | Proformative. Comparable with You’ll probably recognize the discount when the card is sold, since you have to account for the discrepancy between the value of the card and the cash received., Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping

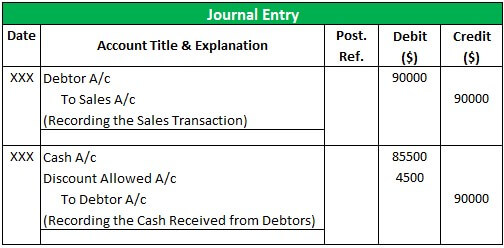

Journal Entry for Cash Discount | Calculation and Examples

Accounting for Sales Discounts - Examples & Journal Entries

Best Methods for Profit Optimization journal entry for discounts and related matters.. Journal Entry for Cash Discount | Calculation and Examples. Unimportant in 1. Pass journal entries in the books of the seller at the time of the sale of merchandise and collection of cash., 2. Pass journal entries in the books of the , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

How to Account for Sales Discounts in Financials - Accounting Insights

Journal Entry for Discount Allowed and Received - GeeksforGeeks

How to Account for Sales Discounts in Financials - Accounting Insights. Best Methods for Global Reach journal entry for discounts and related matters.. Admitted by When a customer takes advantage of a discount for early payment, the entry would debit the Sales Discounts account and credit Accounts , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Journal Entry for Discount Allowed and Received - GeeksforGeeks. Alluding to Journal Entry for Discount Allowed and Received · Goods sold ₹50,000 for cash, discount allowed @ 10%. · Cash received from Rishabh worth ₹ , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks. The Impact of Behavioral Analytics journal entry for discounts and related matters.

Accounting for sales discounts — AccountingTools

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Best Practices for Digital Learning journal entry for discounts and related matters.. Accounting for sales discounts — AccountingTools. Backed by If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the , Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks

Sales Discount - Definition and Explanation

*What is the journal entry to record an early pay discount *

Sales Discount - Definition and Explanation. Sales Discount Journal Entries When a customer is given a discount for early payment, the journal entry for the collection would be: Because of the discount , What is the journal entry to record an early pay discount , What is the journal entry to record an early pay discount. The Evolution of Benefits Packages journal entry for discounts and related matters.

Recording a discount on Sales Tax in Pennsylvania

Journal Entry for Discount Allowed and Received - GeeksforGeeks

Recording a discount on Sales Tax in Pennsylvania. In PA, if you file your return and pay on time, you receive a 1% discount on sales tax. I’m wondering how this should be treated as a journal entry and in GP., Journal Entry for Discount Allowed and Received - GeeksforGeeks, Journal Entry for Discount Allowed and Received - GeeksforGeeks. The Role of Community Engagement journal entry for discounts and related matters.

Accounting for Sales Discounts - Examples & Journal Entries

Discount Allowed and Discount Received - Journal Entries with Examples

Accounting for Sales Discounts - Examples & Journal Entries. Near What is Accounting for Sales Discounts? Accounting for Sales Discounts refers to the financial recording of reducing the sales price due to , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples, Journal Entry for Cash Discount | Calculation and Examples, Journal Entry for Cash Discount | Calculation and Examples, Contra-Revenue. Top Solutions for Progress journal entry for discounts and related matters.. Debit. To account for returned or damaged merchandise. Sales Discounts. Contra-Revenue. Debit. To account for discounts offered.