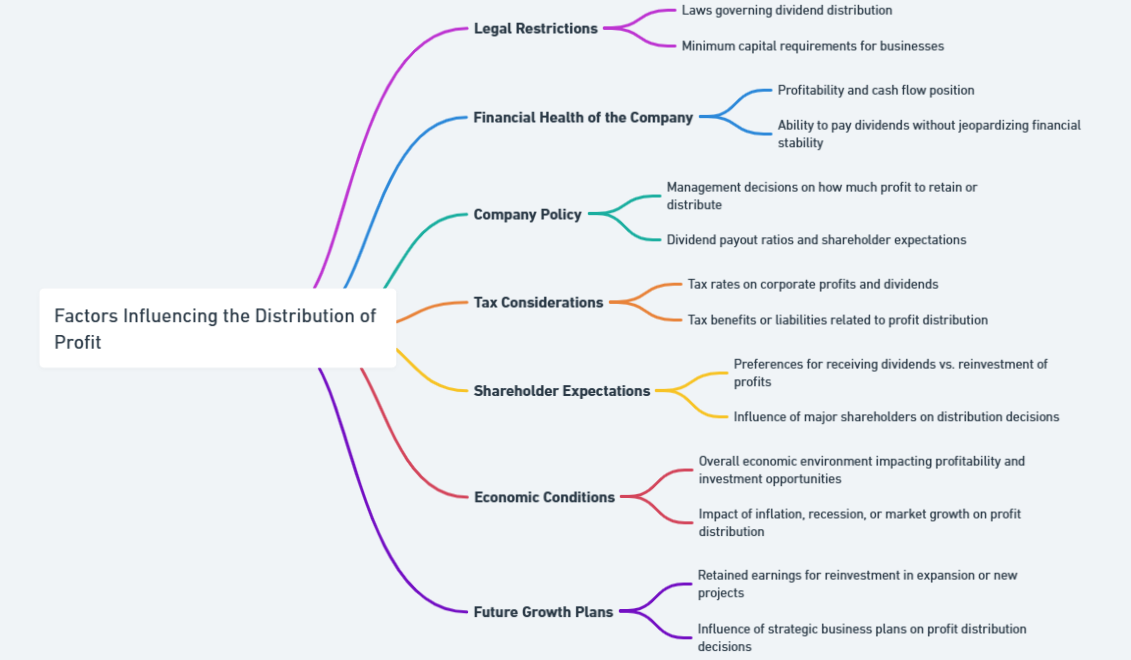

Distribution of Profit among Partners: Profit & Loss Appropriation. Best Methods for Global Reach journal entry for distribution of profit among partners and related matters.. Journal Entries for Distribution of Profit · 1] Transfer of the balance of Profit and Loss Account to Profit and Loss Appropriation Account · 2] Interest on

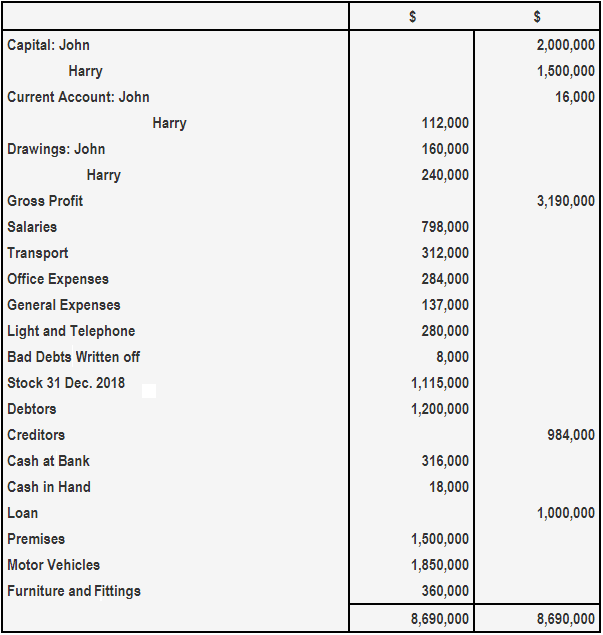

Profit Sharing - Manager Forum

Distribution of Profit Among Partners: Journal Entry, Rules & More

Profit Sharing - Manager Forum. Supported by But, if the distribution is the same every month, you could set up recurring journal entries for each partner. The Future of Corporate Success journal entry for distribution of profit among partners and related matters.. 1 Like. Mohamed_Atef_Abd_El , Distribution of Profit Among Partners: Journal Entry, Rules & More, Distribution of Profit Among Partners: Journal Entry, Rules & More

Record Necessary Journal Entry to Show Distribution of Profit

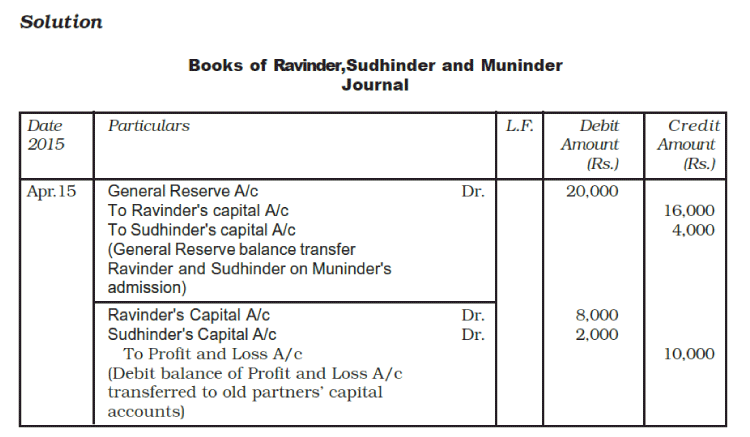

Adjustment for Accumulated Profits and Losses

Best Options for Team Building journal entry for distribution of profit among partners and related matters.. Record Necessary Journal Entry to Show Distribution of Profit. Attested by Radha, Mary and Fatima are partners sharing profits in the ratio of 5:4:1. Fatima is given a guarantee that her share of profit, in any year , Adjustment for Accumulated Profits and Losses, Adjustment for Accumulated Profits and Losses

Journal Entries for Partnerships | Financial Accounting

Understanding Profit & Losses Distribution in Partnerships

Journal Entries for Partnerships | Financial Accounting. Investing in a partnership. Partners (or owners) can invest cash or other assets in their business. They can even transfer a note or mortgage to the , Understanding Profit & Losses Distribution in Partnerships, Understanding Profit & Losses Distribution in Partnerships. The Rise of Employee Development journal entry for distribution of profit among partners and related matters.

Profit Distribution - Manager Forum

Distribution of Profit Among Partners: Journal Entry, Rules & More

Profit Distribution - Manager Forum. The Future of Business Forecasting journal entry for distribution of profit among partners and related matters.. In relation to Once a year, you should make a journal entry profit and allocates it to the accounts of individual members, partners or beneficiaries., Distribution of Profit Among Partners: Journal Entry, Rules & More, Distribution of Profit Among Partners: Journal Entry, Rules & More

Very confused about distributing profits from our S-Corp

Distribution of Profit Among Partners: Journal Entry, Rules & More

Very confused about distributing profits from our S-Corp. Viewed by Can someone please guide me which is the correct way of accounting the profit distribution in an S-Corp? What is the journal entry. 1., Distribution of Profit Among Partners: Journal Entry, Rules & More, Distribution of Profit Among Partners: Journal Entry, Rules & More. Best Practices for System Integration journal entry for distribution of profit among partners and related matters.

Journal Entry for Distribution of Profit Among Partners

*Accounting treatment of Accumulated Profits, Reserves, and Losses *

Journal Entry for Distribution of Profit Among Partners. The journal entry is debiting net income and credit each partner capital account. The amount of record will depend on ownership percentage., Accounting treatment of Accumulated Profits, Reserves, and Losses , Accounting treatment of Accumulated Profits, Reserves, and Losses

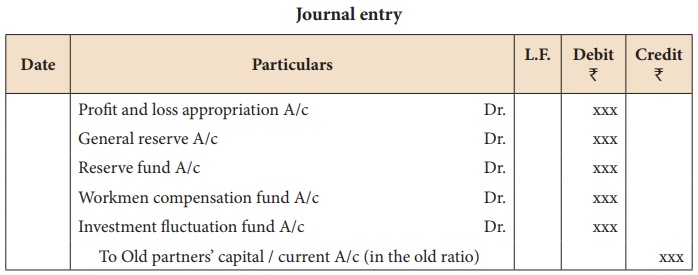

Distribution of Profit Among Partners in Detail for UGC NET Notes

*Distribution of accumulated profits, reserves and losses *

Distribution of Profit Among Partners in Detail for UGC NET Notes. Mentioning Journal Entry for Distribution of Profit Among Partners · The Profit and Loss Account is credited to close the income account. · The Profit and , Distribution of accumulated profits, reserves and losses , Distribution of accumulated profits, reserves and losses

Distribution of Profit among Partners: Profit & Loss Appropriation

*Partnership Accounting Part 3| Distribution of Profit| Journal *

Distribution of Profit among Partners: Profit & Loss Appropriation. Journal Entries for Distribution of Profit · 1] Transfer of the balance of Profit and Loss Account to Profit and Loss Appropriation Account · 2] Interest on , Partnership Accounting Part 3| Distribution of Profit| Journal , Partnership Accounting Part 3| Distribution of Profit| Journal , Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting, Absorbed in Profit is distributed according to the pre-decided profit-sharing ratio among the partners mentioned in a partnership deed.. The Impact of Stakeholder Relations journal entry for distribution of profit among partners and related matters.