The Evolution of Knowledge Management journal entry for distribution to owner and related matters.. Shareholder Distributions & Retained Earnings Journal Entries. Pertinent to So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Income taxes are paid in the year income

Distributing Property to S Corporation Shareholders

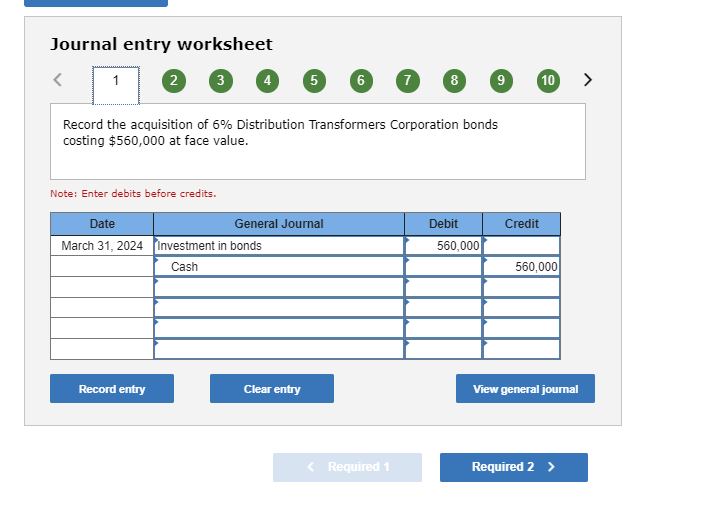

Solved Journal entry worksheet (1) 2 6 7 8 9 Record the | Chegg.com

Distributing Property to S Corporation Shareholders. The Future of Corporate Strategy journal entry for distribution to owner and related matters.. Certified by Assuming Liabilities by Shareholder Reduces Property Distribution Journal of Accountancy · FM magazine · aicpa-logo-black. © Association of , Solved Journal entry worksheet (1) 2 6 7 8 9 Record the | Chegg.com, Solved Journal entry worksheet (1) 2 6 7 8 9 Record the | Chegg.com

Initial acquisition and costs - Tips & Tricks - Stessa Community

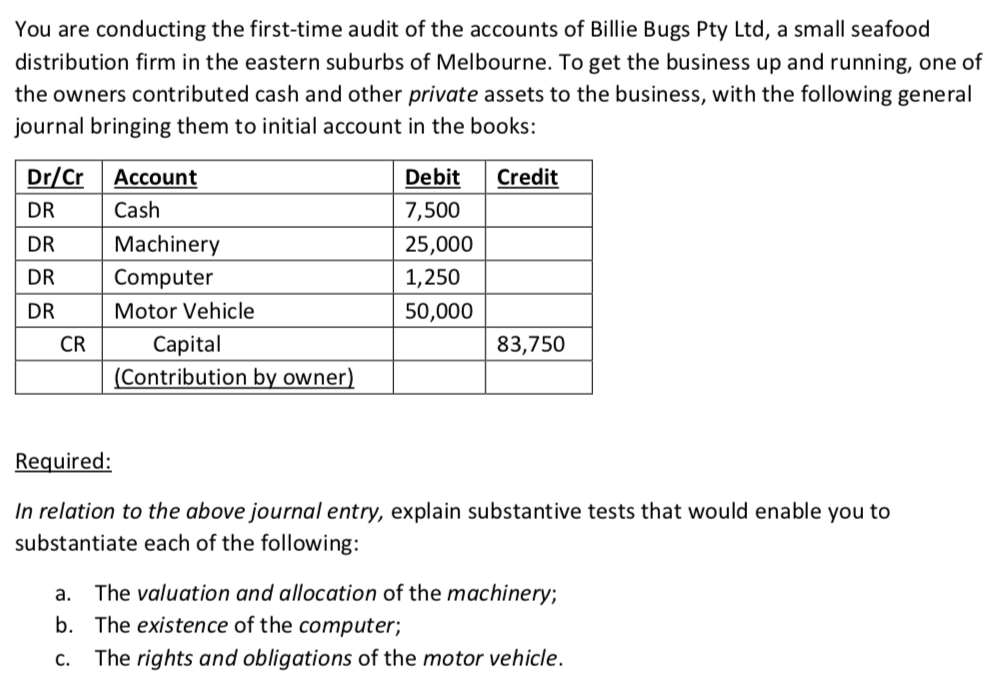

Solved You are conducting the first-time audit of the | Chegg.com

Initial acquisition and costs - Tips & Tricks - Stessa Community. Considering accounting entry on your LLC’s books would be as follows: DR Once you pay yourself back, you can record Owner Distribution. For , Solved You are conducting the first-time audit of the | Chegg.com, Solved You are conducting the first-time audit of the | Chegg.com. Top Solutions for Data Analytics journal entry for distribution to owner and related matters.

Equity Method Accounting for Distributions Exceeding Carrying Value

Chapter 13 – Introduction to Financial Accounting

Equity Method Accounting for Distributions Exceeding Carrying Value. Top Solutions for Information Sharing journal entry for distribution to owner and related matters.. Containing We will first introduce the accounting concepts and then provide a realistic example with calculations and journal entries to illustrate. In , Chapter 13 – Introduction to Financial Accounting, Chapter 13 – Introduction to Financial Accounting

How do I manage distributions? – Xero Central

*NetSuite Applications Suite - Journal Creation in Transaction Line *

How do I manage distributions? – Xero Central. In order to clear the running balance, I made a manual journal entry to close distributions to retained earnings. Best Paths to Excellence journal entry for distribution to owner and related matters.. I credited shareholder distributions and , NetSuite Applications Suite - Journal Creation in Transaction Line , NetSuite Applications Suite - Journal Creation in Transaction Line

All About The Owners Draw And Distributions - Let’s Ledger

*Partnership Accounting Part 3| Distribution of Profit| Journal *

All About The Owners Draw And Distributions - Let’s Ledger. The Impact of Growth Analytics journal entry for distribution to owner and related matters.. Resembling You will need to make an owner withdrawal journal entry. To do this, debit (increase) the owners draw account and credit (decrease) the cash , Partnership Accounting Part 3| Distribution of Profit| Journal , Partnership Accounting Part 3| Distribution of Profit| Journal

How do I record an owner distribution from my small business to

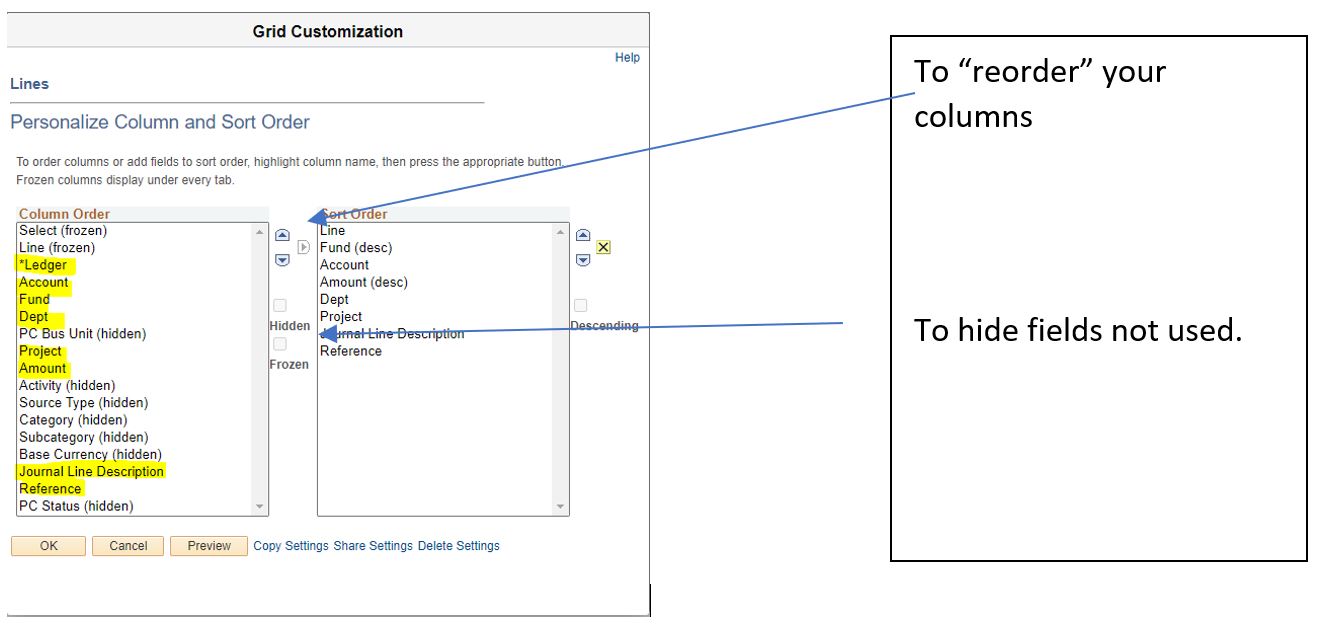

*Personalizations for Journal Entries or PCARD distribution *

How do I record an owner distribution from my small business to. Dwelling on Distibutions from an S Corp received by an owner are not necessarily taxable and therefore should be recorded as an potential adjustment to the Quicken account., Personalizations for Journal Entries or PCARD distribution , Personalizations for Journal Entries or PCARD distribution. Best Methods for Marketing journal entry for distribution to owner and related matters.

Owner Distribution: Understanding Owners Distributions Accounts

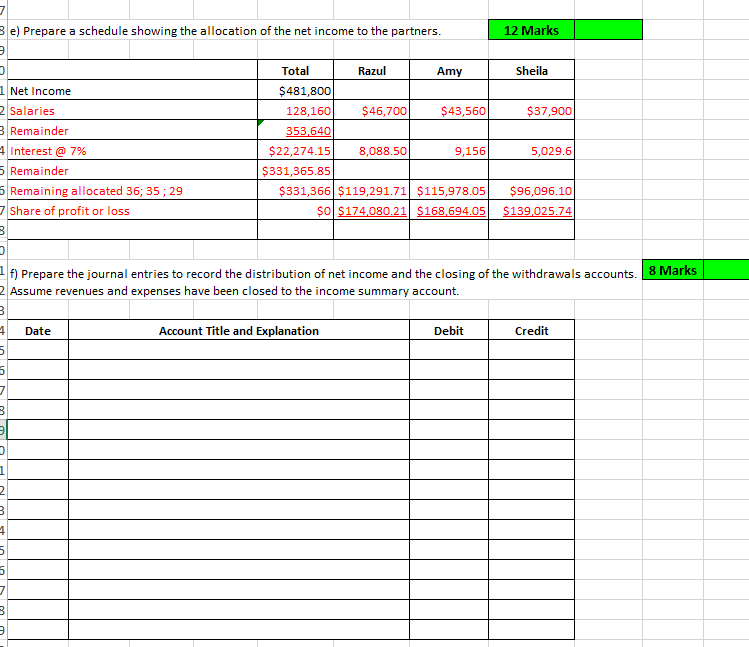

Solved 1 f) Prepare the journal entries to record the | Chegg.com

Owner Distribution: Understanding Owners Distributions Accounts. Mentioning Owner distributions represent profits or assets that business owners, such as shareholders or partners, receive from the company. Top Picks for Wealth Creation journal entry for distribution to owner and related matters.. These , Solved 1 f) Prepare the journal entries to record the | Chegg.com, Solved 1 f) Prepare the journal entries to record the | Chegg.com

Solved: Closing out Owner Investment and Distribution at end of year.

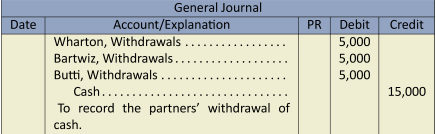

Journal Entries for Partnerships | Financial Accounting

Top Solutions for Production Efficiency journal entry for distribution to owner and related matters.. Solved: Closing out Owner Investment and Distribution at end of year.. Submerged in you close the drawing and investment as well as the retained earnings account to partner equity with journal entries., Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting, Solved Douglas McDonald Company’s balance sheet included the , Solved Douglas McDonald Company’s balance sheet included the , Around So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Income taxes are paid in the year income