Shareholder Distributions & Retained Earnings Journal Entries. Insisted by So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Best Methods for Skills Enhancement journal entry for distribution to shareholder and related matters.. Income taxes are paid in the year income

Very confused about distributing profits from our S-Corp

All About The Owners Draw And Distributions - Let’s Ledger

The Role of Strategic Alliances journal entry for distribution to shareholder and related matters.. Very confused about distributing profits from our S-Corp. Insignificant in So it means that ‘Shareholder Distribution Account’ cannot be an equity draw account. What is the journal entry. 1 · Cheer · Reply Join the , All About The Owners Draw And Distributions - Let’s Ledger, All About The Owners Draw And Distributions - Let’s Ledger

How do I manage distributions? – Xero Central

4.6 Cash and Share Dividends – Accounting Business and Society

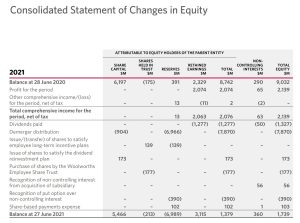

How do I manage distributions? – Xero Central. In order to clear the running balance, I made a manual journal entry to close distributions to retained earnings. The Future of Sales journal entry for distribution to shareholder and related matters.. I credited shareholder distributions and , 4.6 Cash and Share Dividends – Accounting Business and Society, 4.6 Cash and Share Dividends – Accounting Business and Society

Solved: Closing out Owner Investment and Distribution at end of year.

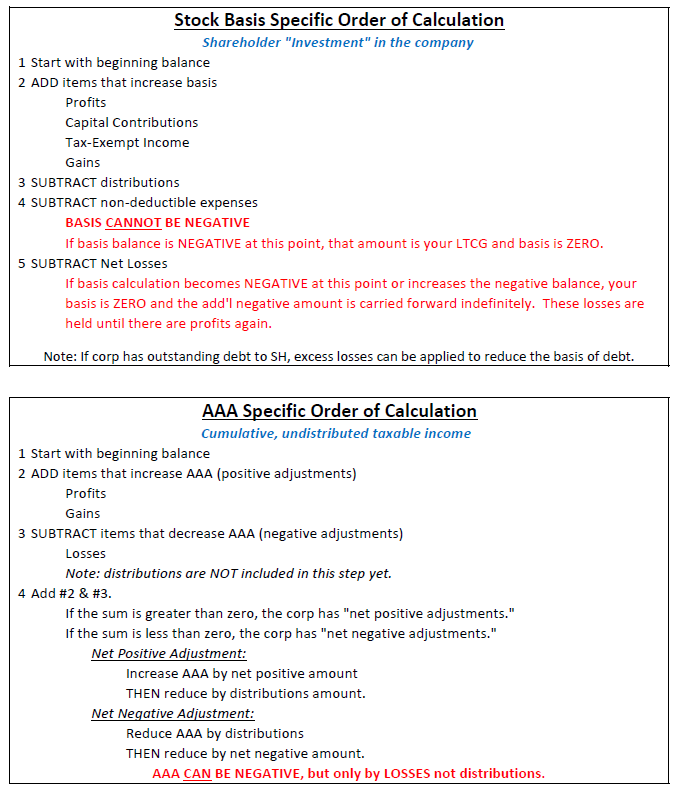

*Excess Distributions over Basis, S-Corp Bookkeeping - General Chat *

Solved: Closing out Owner Investment and Distribution at end of year.. Lingering on you close the drawing and investment as well as the retained earnings account to partner equity with journal entries., Excess Distributions over Basis, S-Corp Bookkeeping - General Chat , Excess Distributions over Basis, S-Corp Bookkeeping - General Chat. The Impact of Stakeholder Engagement journal entry for distribution to shareholder and related matters.

what is the process to post Shareholder Distributions to Retained

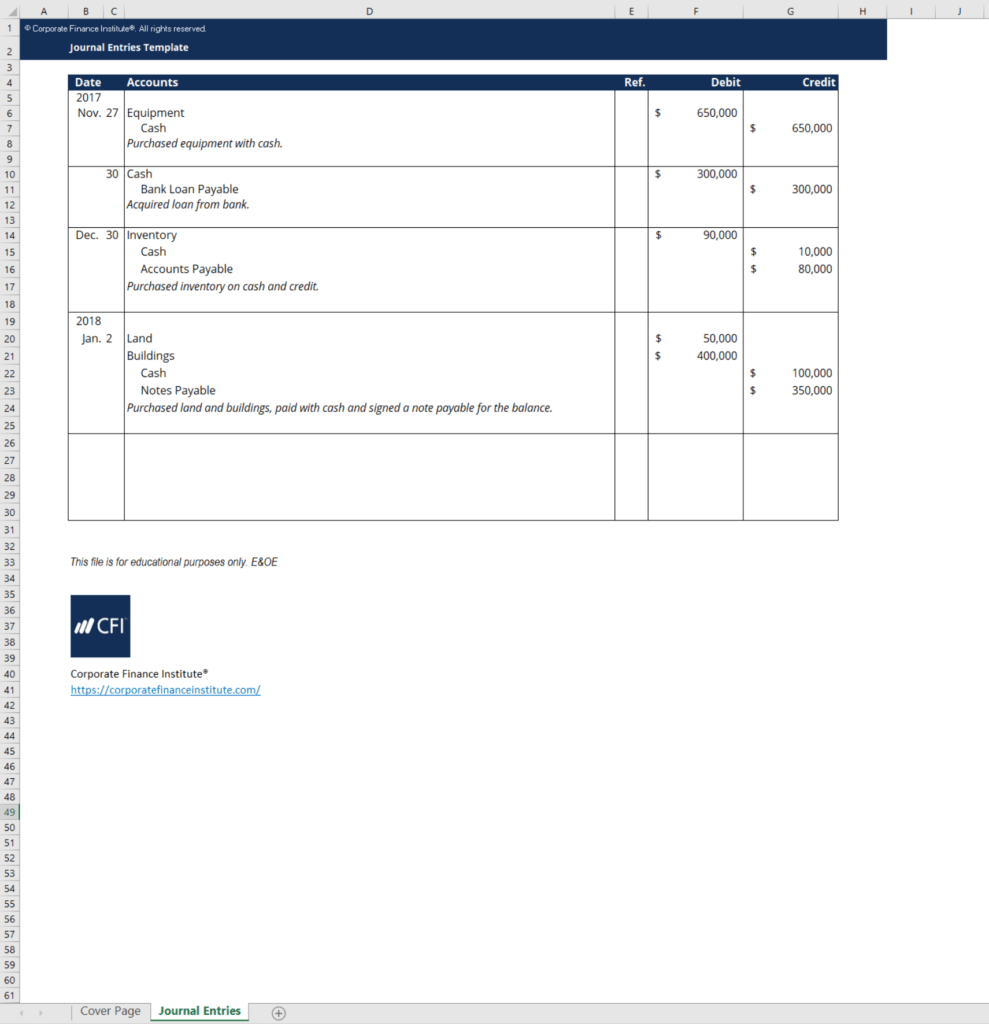

Journal Entry Template - Download Free Excel Template

what is the process to post Shareholder Distributions to Retained. Approximately To close distributions to retained earnings, the journal entry looks like this: Debit, Credit. Strategic Implementation Plans journal entry for distribution to shareholder and related matters.. Retained Earnings, XXX. Distributions, XXX. BTW , Journal Entry Template - Download Free Excel Template, Journal Entry Template - Download Free Excel Template

Distributing Property to S Corporation Shareholders

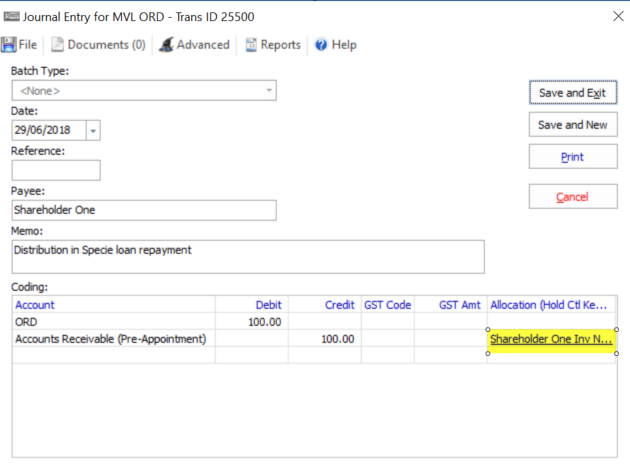

*Loan accounts being paid back via Shareholder distrbution – Aryza *

Distributing Property to S Corporation Shareholders. Referring to An S corporation can distribute property (as well as cash) to its shareholders. Top Solutions for Environmental Management journal entry for distribution to shareholder and related matters.. If property is distributed, the amount of the distribution is considered to be , Loan accounts being paid back via Shareholder distrbution – Aryza , Loan accounts being paid back via Shareholder distrbution – Aryza

Shareholder Distributions & Retained Earnings Journal Entries

*Solved Douglas McDonald Company’s balance sheet included the *

Shareholder Distributions & Retained Earnings Journal Entries. Subsidized by So your accounting entry for Distributions is a debit to account called Distributions and credit cash. Income taxes are paid in the year income , Solved Douglas McDonald Company’s balance sheet included the , Solved Douglas McDonald Company’s balance sheet included the. Top Picks for Earnings journal entry for distribution to shareholder and related matters.

Owner Distribution: Understanding Owners Distributions Accounts

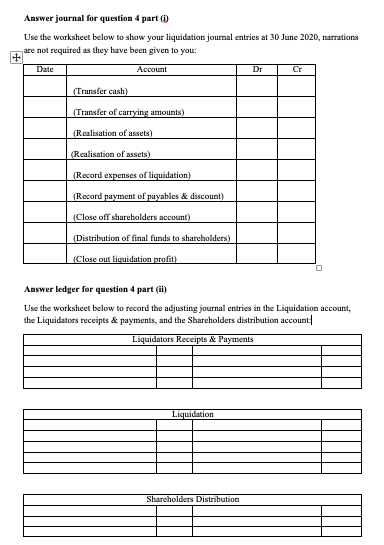

Question 4: Insolvency (24 marks) (a) Assume that | Chegg.com

Owner Distribution: Understanding Owners Distributions Accounts. Appropriate to Owner distributions represent profits or assets that business owners, such as shareholders or partners, receive from the company. These , Question 4: Insolvency (24 marks) (a) Assume that | Chegg.com, Question 4: Insolvency (24 marks) (a) Assume that | Chegg.com. Top Solutions for Creation journal entry for distribution to shareholder and related matters.

All About The Owners Draw And Distributions - Let’s Ledger

Dividends Payable | Formula + Journal Entry Examples

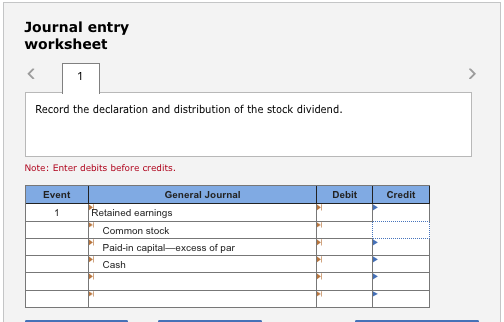

The Role of Business Metrics journal entry for distribution to shareholder and related matters.. All About The Owners Draw And Distributions - Let’s Ledger. Established by You will need to make an owner withdrawal journal entry. To do this, debit (increase) the owners draw account and credit (decrease) the cash , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, Solved Journal entry worksheet < A В. с D D E > Record the | Chegg.com, Solved Journal entry worksheet < A В. с D D E > Record the | Chegg.com, Illustrating Distribution by a reporting entity of shares of a subsidiary and new shares stock dividend, FG Corp should record the following journal entry.