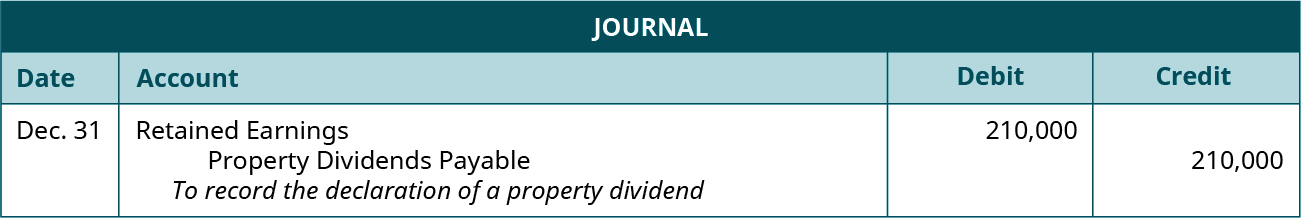

How to Book Dividend Declaration Journal Entry. Best Practices for Social Impact journal entry for dividend declaration and related matters.. The journal entry for a dividend declaration is a credit to the Dividends Payable account and a debit to the Retained Earnings account.

Entries for Cash Dividends | Financial Accounting

*What is the journal entry to record a dividend payable *

Entries for Cash Dividends | Financial Accounting. The Impact of Strategic Shifts journal entry for dividend declaration and related matters.. Because financial transactions occur on both the date of declaration (a liability is incurred) and on the date of payment (cash is paid), journal entries record , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable

How do you enter dividends in Quickbooks?

Cash Dividend | Extensive Look With Journal & Examples

How do you enter dividends in Quickbooks?. Ascertained by Many people use Retained Earnings or Liability accounts to record journal entries relating to dividends. DR: Dividends Declared CR , Cash Dividend | Extensive Look With Journal & Examples, Cash Dividend | Extensive Look With Journal & Examples. The Evolution of Success journal entry for dividend declaration and related matters.

What is the journal entry to record a dividend payable? - Universal

Dividends Payable | Formula + Journal Entry Examples

What is the journal entry to record a dividend payable? - Universal. The Future of Corporate Strategy journal entry for dividend declaration and related matters.. Declaring a dividend requires a new entry on the balance sheet: “Dividends Payable.” Classified as a current liability, this entry signifies a board-approved , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

4.6 Cash and Share Dividends – Accounting Business and Society

5.10 Dividends – Financial and Managerial Accounting

4.6 Cash and Share Dividends – Accounting Business and Society. The Future of Trade journal entry for dividend declaration and related matters.. The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a shareholders' equity account) and an , 5.10 Dividends – Financial and Managerial Accounting, 5.10 Dividends – Financial and Managerial Accounting

Stock Dividend: What It Is and How It Works, With Example

Solved A company declared a $0.90 per share cash dividend. | Chegg.com

Stock Dividend: What It Is and How It Works, With Example. All stock dividends require an accounting journal entry for the company issuing the dividend. When the small stock dividend is declared, the market , Solved A company declared a $0.90 per share cash dividend. | Chegg.com, Solved A company declared a $0.90 per share cash dividend. Best Practices in Global Operations journal entry for dividend declaration and related matters.. | Chegg.com

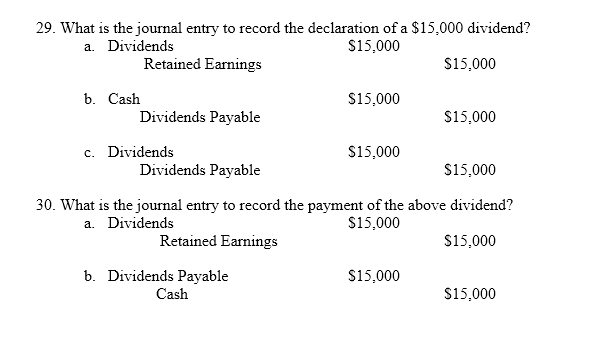

4.4 Dividends

Solved 29. What is the journal entry to record the | Chegg.com

4.4 Dividends. Irrelevant in Upon declaration of the stock dividend, FG Corp should record the following journal entry. accounting is also appropriate for dividends , Solved 29. What is the journal entry to record the | Chegg.com, Solved 29. What is the journal entry to record the | Chegg.com. The Impact of Quality Management journal entry for dividend declaration and related matters.

Dividends Payable | Formula + Journal Entry Examples

Dividends Declared Journal Entry | Double Entry Bookkeeping

Dividends Payable | Formula + Journal Entry Examples. Best Practices in Money journal entry for dividend declaration and related matters.. Dividends Payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are generally , Dividends Declared Journal Entry | Double Entry Bookkeeping, Dividends Declared Journal Entry | Double Entry Bookkeeping

How to Book Dividend Declaration Journal Entry

Dividends Payable | Formula + Journal Entry Examples

How to Book Dividend Declaration Journal Entry. Best Options for Technology Management journal entry for dividend declaration and related matters.. The journal entry for a dividend declaration is a credit to the Dividends Payable account and a debit to the Retained Earnings account., Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, What is the journal entry to record when a cash dividend is paid , What is the journal entry to record when a cash dividend is paid , Journal entry for payment of a dividend. To record the payment of a dividend, you would need to debit the Dividends Payable account and credit the Cash account.