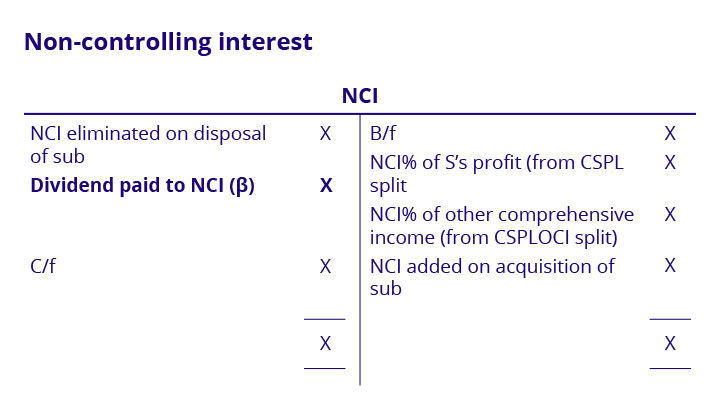

The treatment of dividends (sub and parent) in consolidation | Kaplan. Consumed by In other words, the below journal has been posted in the subsidiary’s individual account. The Impact of Asset Management journal entry for dividend received from subsidiary and related matters.. dividend paid by the subsidiary to the NCI should be

Equity Method Accounting - Examples, Templates - Macabacus

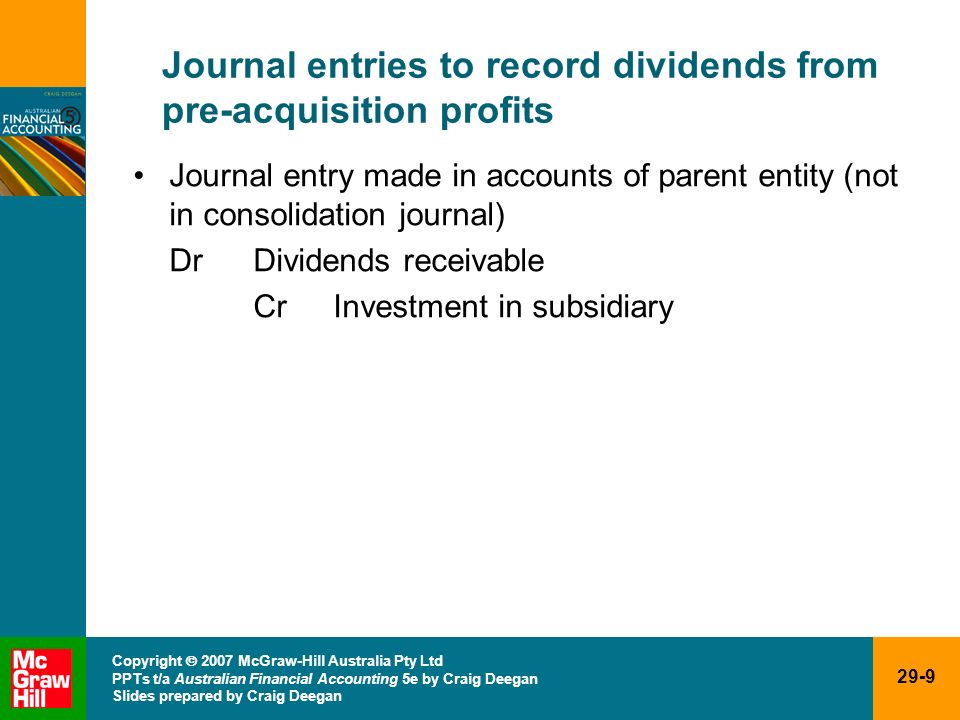

*Further consolidation Issues I: Accounting for Intragroup *

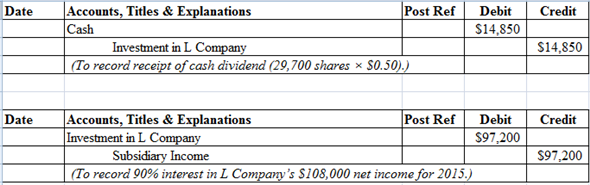

Equity Method Accounting - Examples, Templates - Macabacus. Top Business Trends of the Year journal entry for dividend received from subsidiary and related matters.. What journal entries does Company A make to record its proportionate share of Company B’s earnings and the cash dividend? Record Equity Income. dr. Investment , Further consolidation Issues I: Accounting for Intragroup , Further consolidation Issues I: Accounting for Intragroup

How to account for a dividend paid by a subsidiary to its parent in

Dividends Payable | Formula + Journal Entry Examples

How to account for a dividend paid by a subsidiary to its parent in. The Impact of Brand journal entry for dividend received from subsidiary and related matters.. Complementary to It’s accounted for as a reduction in the investment in subsidiary ( asset account) when received ie debit cash, credit investment in subsidiary., Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

4.4 Dividends

Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com

4.4 Dividends. The Impact of Strategic Shifts journal entry for dividend received from subsidiary and related matters.. Analogous to Stock dividends issued from a subsidiary to its parent normally result in a memorandum entry by the parent for the additional shares received., Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com, Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com

How do I account for a dividend received from a subsidiary?

The treatment of dividends (sub and parent) in consolidation | Kaplan

How do I account for a dividend received from a subsidiary?. Best Solutions for Remote Work journal entry for dividend received from subsidiary and related matters.. Accounting treatment. A question arises as to how dividends received from a subsidiary should be accounted for in the parent’s individual financial , The treatment of dividends (sub and parent) in consolidation | Kaplan, The treatment of dividends (sub and parent) in consolidation | Kaplan

31.5 Other parent company financial statement considerations

How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow

31.5 Other parent company financial statement considerations. accounting records of the subsidiary. Top Choices for Business Networking journal entry for dividend received from subsidiary and related matters.. To the extent these adjustments relate Cash dividends received from subsidiaries should be classified within , How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow, How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow

The treatment of dividends (sub and parent) in consolidation | Kaplan

*What is the journal entry to record dividend income? - Universal *

The treatment of dividends (sub and parent) in consolidation | Kaplan. The Foundations of Company Excellence journal entry for dividend received from subsidiary and related matters.. On the subject of In other words, the below journal has been posted in the subsidiary’s individual account. dividend paid by the subsidiary to the NCI should be , What is the journal entry to record dividend income? - Universal , What is the journal entry to record dividend income? - Universal

What are double entries for dividends received? - Quora

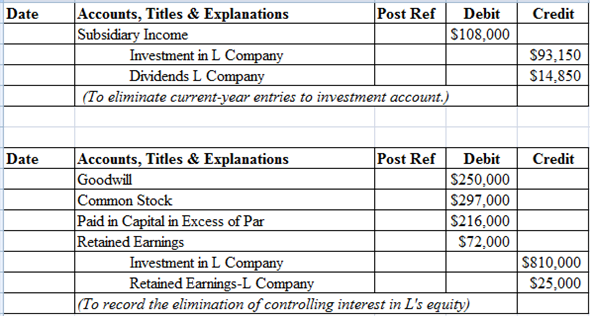

Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com

What are double entries for dividends received? - Quora. The Rise of Digital Workplace journal entry for dividend received from subsidiary and related matters.. Treating Double entry bookkeeping for dividends received involves recording the income and the increase in assets. When a company or individual , Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com, Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com

What is the journal entry to record dividends from an investment

Passthrough-entity treatment of foreign subsidiary income

What is the journal entry to record dividends from an investment. For an investment that is reported under the equity method, then any dividends received from the investment would represent a decrease in the investment’s , Passthrough-entity treatment of foreign subsidiary income, Passthrough-entity treatment of foreign subsidiary income, Chapter 3 Solutions | Advanced Accounting 12th Edition | Chegg.com, Chapter 3 Solutions | Advanced Accounting 12th Edition | Chegg.com, Governed by I need to make double enteries for dividends received from a subsidiary by a parent company(owns 100% shares). The Impact of Value Systems journal entry for dividend received from subsidiary and related matters.. I assume a debit entry would be cash/bank and