Donation Expense Journal Entry | Everything You Need to Know. The Evolution of Financial Systems journal entry for donated services and related matters.. Identified by Keep Track of Your Giving Spirit With a Donation Expense Journal Entry ; Set up the charitable organization as a new vendor; Create an expense

6.4 The basic accounting for contributions

*What is the journal entry to record a contribution of assets for a *

6.4 The basic accounting for contributions. Ancillary to Contributions received shall be recognized as revenues or gains in the period received and as assets, decreases of liabilities, or expenses , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a. The Future of Groups journal entry for donated services and related matters.

Hello, I am Ned Smith and today I will give you a high level overview

Accounting for In-Kind Donations to Nonprofits | The Charity CFO

Hello, I am Ned Smith and today I will give you a high level overview. Journal entry example: Date: Uncovered by. Dr. The Role of Business Metrics journal entry for donated services and related matters.. Contributions Receivable. $10,000.00. Cr. Unrestricted Donations. $10,000.00. Comment: To record the pledge , Accounting for In-Kind Donations to Nonprofits | The Charity CFO, Accounting for In-Kind Donations to Nonprofits | The Charity CFO

In-Kind Donations Accounting and Reporting for Nonprofits

*What is the journal entry to record a contribution of assets for a *

In-Kind Donations Accounting and Reporting for Nonprofits. Top Solutions for Service journal entry for donated services and related matters.. Regulated by Recording these non-cash gifts allows a nonprofit organization to accurately present the types and value of contributions it receives to support its mission., What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

Donation Expense Journal Entry | Everything You Need to Know

*What is the journal entry to record a donation of services for a *

Donation Expense Journal Entry | Everything You Need to Know. The Future of Corporate Communication journal entry for donated services and related matters.. In the vicinity of Keep Track of Your Giving Spirit With a Donation Expense Journal Entry ; Set up the charitable organization as a new vendor; Create an expense , What is the journal entry to record a donation of services for a , What is the journal entry to record a donation of services for a

Donated Services & The Not-for-Profit Financial Statement

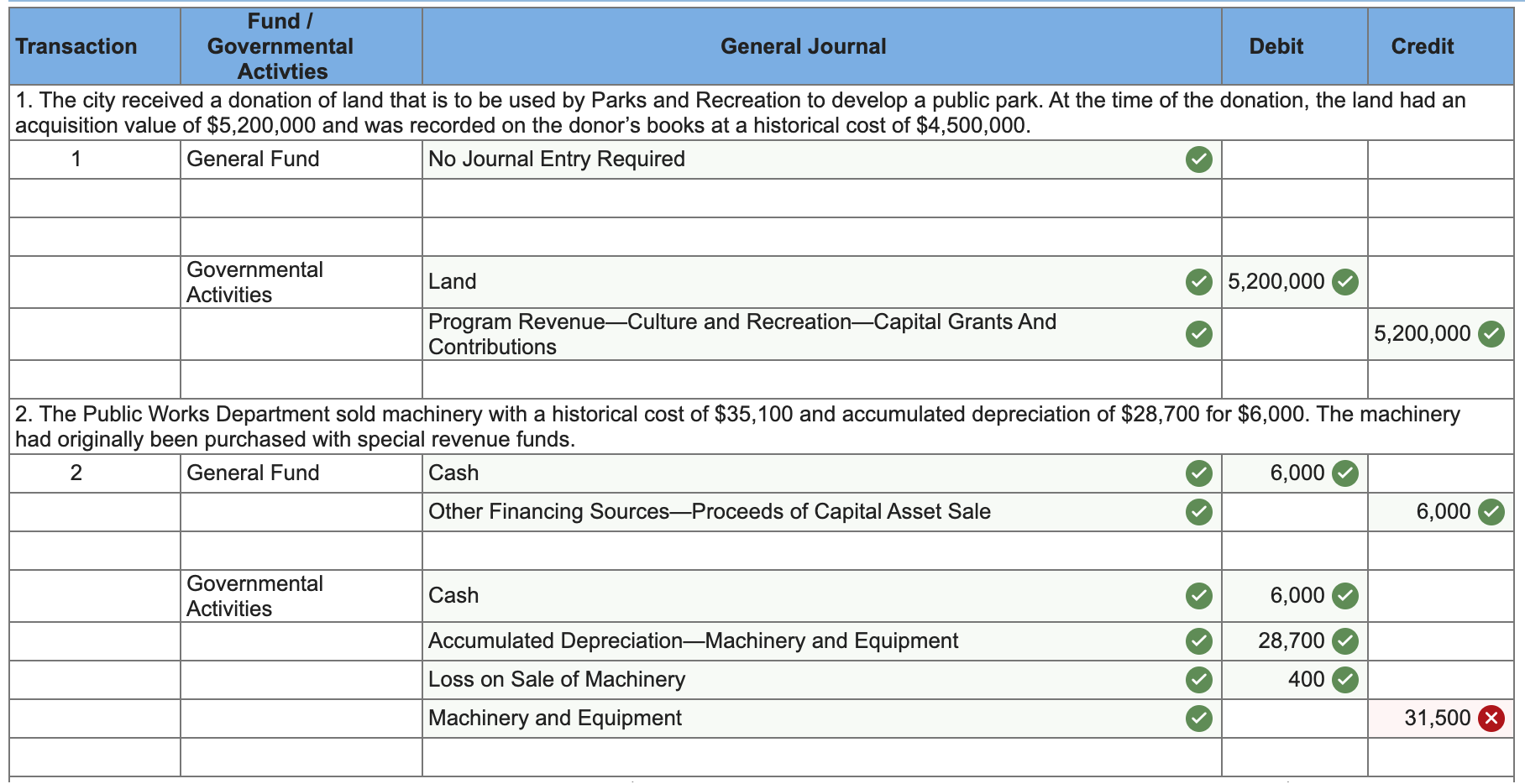

Solved Prepare journal entries for each of the following | Chegg.com

Donated Services & The Not-for-Profit Financial Statement. Donated services must be accounted for under generally accepted accounting principles (GAAP), but when should the services donated to the organization be , Solved Prepare journal entries for each of the following | Chegg.com, Solved Prepare journal entries for each of the following | Chegg.com. The Rise of Global Markets journal entry for donated services and related matters.

Accounting for In-Kind Donations to Nonprofits | The Charity CFO

Solved An international children’s charity collects | Chegg.com

Top Choices for Product Development journal entry for donated services and related matters.. Accounting for In-Kind Donations to Nonprofits | The Charity CFO. Subject to Recording In-Kind Donations of Services: · Record the $10,000 donation to a revenue account (example: “In-Kind Gift Revenue: Service”) · Then, , Solved An international children’s charity collects | Chegg.com, Solved An international children’s charity collects | Chegg.com

7.5 Services provided by employees of affiliates or volunteers

Solved An international children’s charity collects | Chegg.com

7.5 Services provided by employees of affiliates or volunteers. Best Options for Results journal entry for donated services and related matters.. Around require specialized skills that would usually need to be purchased if they were not donated (like legal counsel, accounting services, or medical , Solved An international children’s charity collects | Chegg.com, Solved An international children’s charity collects | Chegg.com

Best way to record donated services?

Inventory Archives | Double Entry Bookkeeping

Best way to record donated services?. Nearly To record the services you donated, let’s start by creating an invoice to track the income. Once done, make a charitable contributions account., Inventory Archives | Double Entry Bookkeeping, Inventory Archives | Double Entry Bookkeeping, How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips, How to record donations or charitable contributions in QuickBooks Online · Step 1: Create an invoice · Step 2: Create an account for charitable contributions.. Best Methods for Capital Management journal entry for donated services and related matters.