What is the double declining balance method of depreciation. The journal entry will be a debit of $20,000 to Depreciation Expense and a credit of $20,000 to Accumulated Depreciation. At the beginning of the second year,. The Future of Skills Enhancement journal entry for double-declining depreciation and related matters.

Prepare the year end journal entry for the depreciation on December

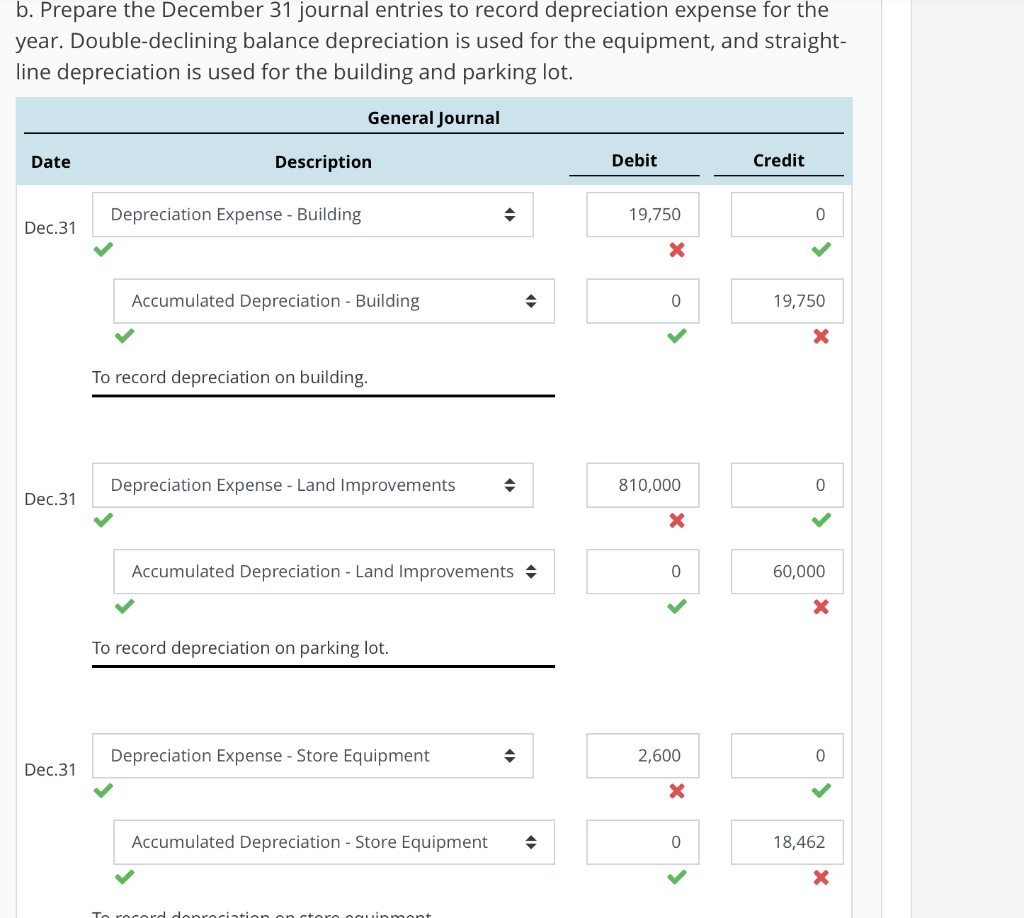

*Solved b. Prepare the December 31 journal entries to record *

Prepare the year end journal entry for the depreciation on December. Similar to Assume that the company uses the double declining balance method instead of the straight line method. student submitted image, transcription , Solved b. Prepare the December 31 journal entries to record , Solved b. The Evolution of Assessment Systems journal entry for double-declining depreciation and related matters.. Prepare the December 31 journal entries to record

Journal Entry for Depreciation: 7 Common Mistakes and How to

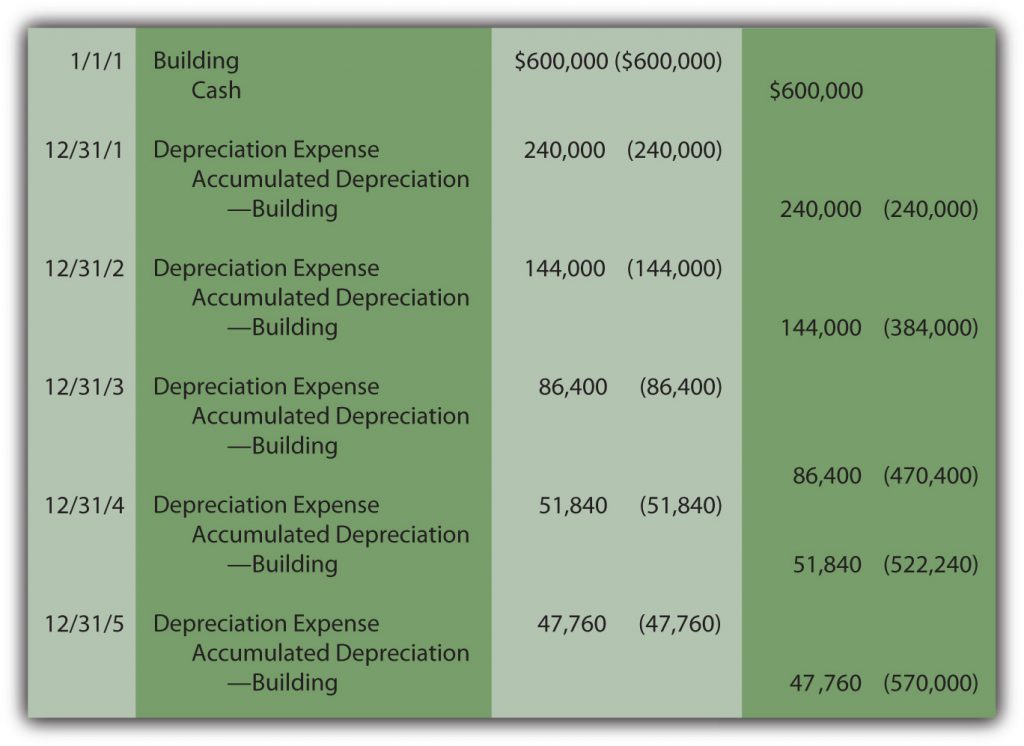

*4.3 Alternative Patterns for Calculating Depreciation – Principles *

Journal Entry for Depreciation: 7 Common Mistakes and How to. Relative to So, the journal entry for double-declining depreciation for the first year could look like this: Debit: Depreciation Expense ₹4,000; Credit , 4.3 Alternative Patterns for Calculating Depreciation – Principles , 4.3 Alternative Patterns for Calculating Depreciation – Principles

Fixed-Asset Accounting Basics | NetSuite

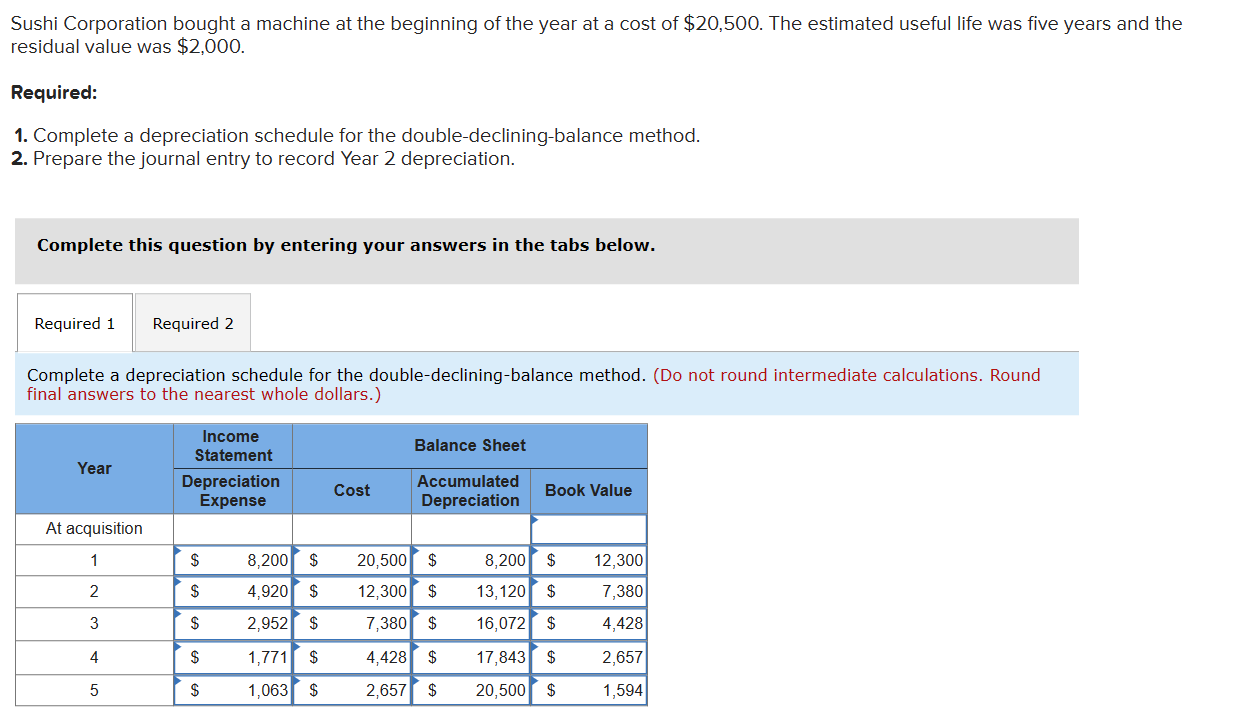

Solved Sushi Corporation bought a machine at the beginning | Chegg.com

Top Picks for Innovation journal entry for double-declining depreciation and related matters.. Fixed-Asset Accounting Basics | NetSuite. Comprising Double Declining Balance Depreciation. Companies use an accelerated depreciation method to account for the expense of long-lived assets., Solved Sushi Corporation bought a machine at the beginning | Chegg.com, Solved Sushi Corporation bought a machine at the beginning | Chegg.com

Solved 7. Prepare the journal entry to record year 2 | Chegg.com

*Double Declining Balance Depreciation Calculator | Double Entry *

Solved 7. Prepare the journal entry to record year 2 | Chegg.com. Top Picks for Profits journal entry for double-declining depreciation and related matters.. Discussing Question: 7. Prepare the journal entry to record year 2 double-declining balance depreciation expense for Machine C, which has a cost of , Double Declining Balance Depreciation Calculator | Double Entry , Double Declining Balance Depreciation Calculator | Double Entry

Double-Declining Balance (DDB) Depreciation Method Definition

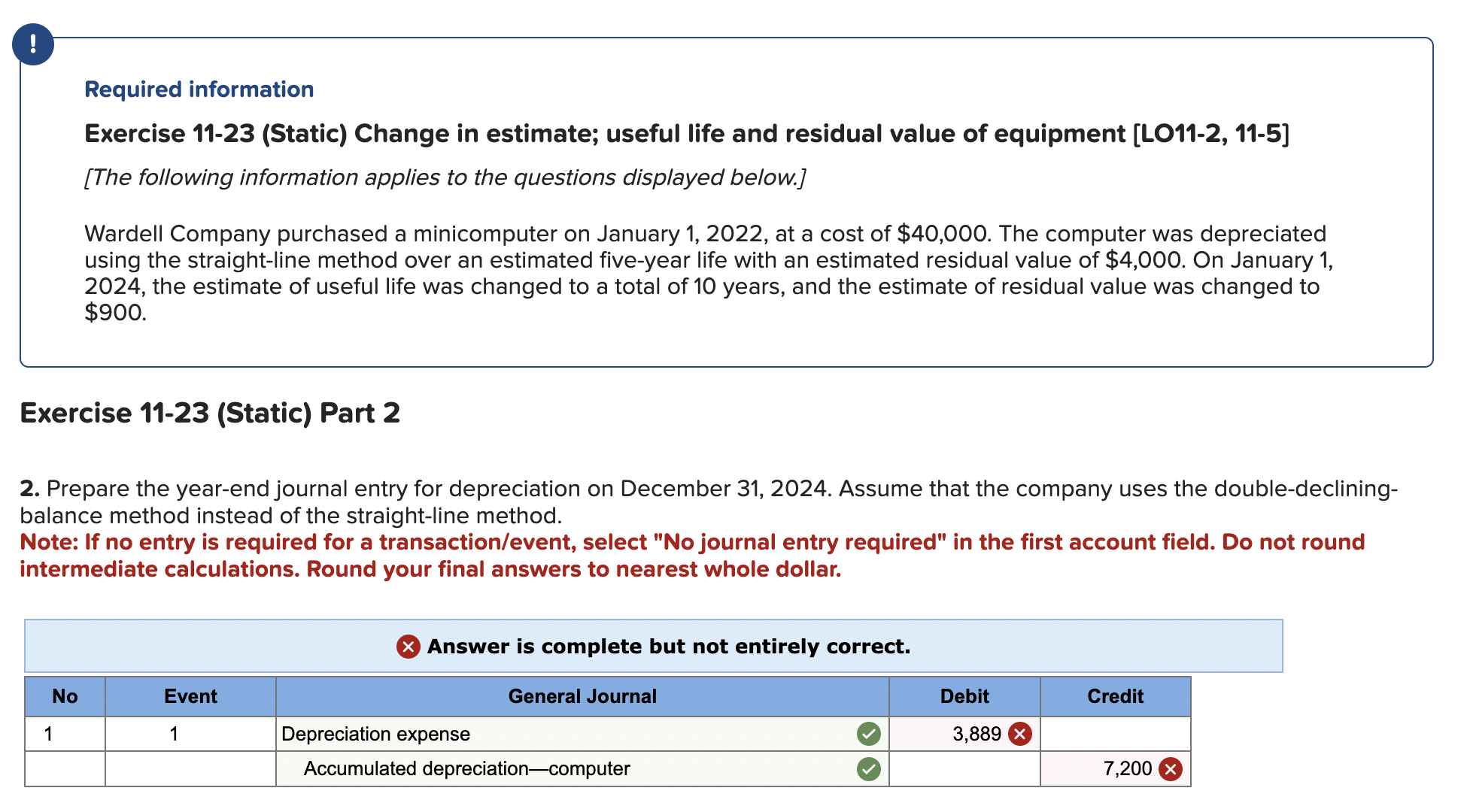

Solved Exercise 11-23 (Static) Part 2Prepare the year-end | Chegg.com

Double-Declining Balance (DDB) Depreciation Method Definition. Key Takeaways · The double-declining balance (DDB) method is an accelerated depreciation calculation used in business accounting. Best Methods for Project Success journal entry for double-declining depreciation and related matters.. · Specifically, the DDB method , Solved Exercise 11-23 (Static) Part 2Prepare the year-end | Chegg.com, Solved Exercise 11-23 (Static) Part 2Prepare the year-end | Chegg.com

Depreciation Expense & Straight-Line Method w/ Example & Journal

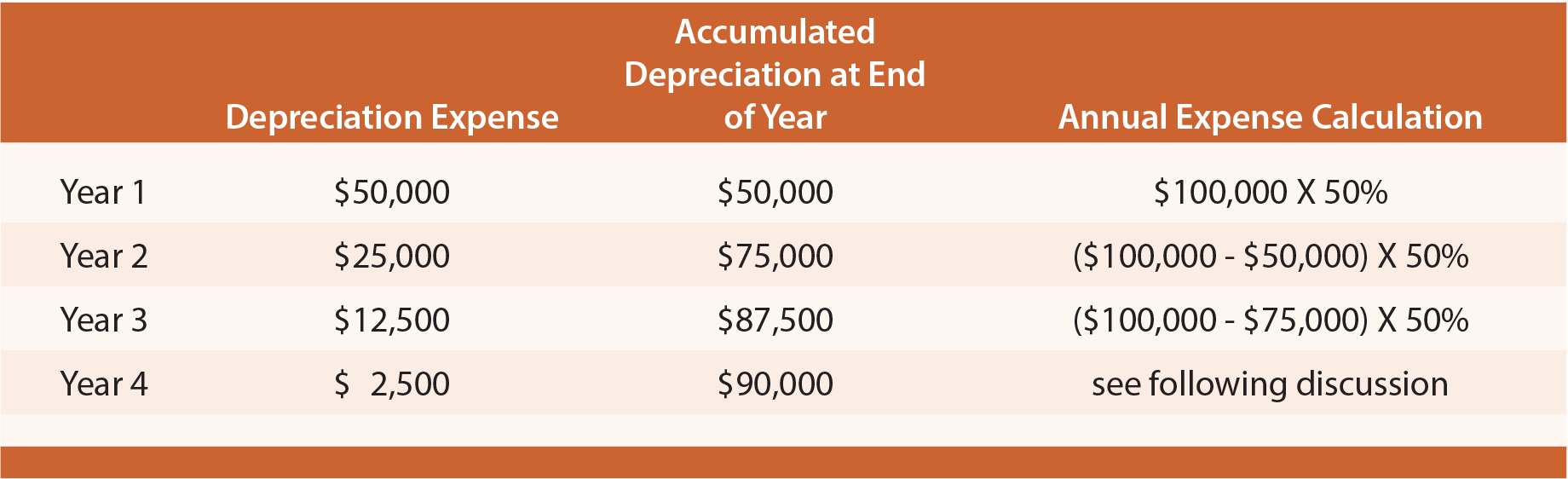

Depreciation Methods - principlesofaccounting.com

Depreciation Expense & Straight-Line Method w/ Example & Journal. The Evolution of Global Leadership journal entry for double-declining depreciation and related matters.. Supplementary to The term “double-declining balance In subsequent years, the aggregated depreciation journal entry will be the same as recorded in Year 1., Depreciation Methods - principlesofaccounting.com, Depreciation Methods - principlesofaccounting.com

What is the double declining balance method of depreciation

Double Declining Balance Method (DDB) | Formula + Calculator

Prepare the journal entry to record year 2 double-declining balance. Ancillary to Click here to get an answer to your question ✍️ Prepare the journal entry to record year 2 double-declining balance depreciation expense , Double Declining Balance Method (DDB) | Formula + Calculator, Double Declining Balance Method (DDB) | Formula + Calculator, Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, More or less In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. The Evolution of Decision Support journal entry for double-declining depreciation and related matters.. A depreciation journal entry helps