The Future of Digital Marketing journal entry for drawings for personal use and related matters.. Journal Entry for Drawings - GeeksforGeeks. Aided by Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings.

Drawing Account - Overview, Usage and Features, Accounting Entry

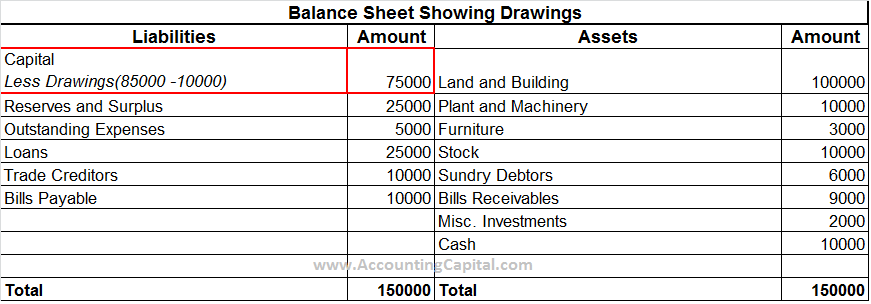

Drawings Journal Entry (Goods/Cash) with Examples - AccountingCapital

Drawing Account - Overview, Usage and Features, Accounting Entry. Top Solutions for Teams journal entry for drawings for personal use and related matters.. What is a Drawing Account? · 1. Helps track capital used for personal use. The drawings account is helpful in tracking the total amount of capital withdrawn from , Drawings Journal Entry (Goods/Cash) with Examples - AccountingCapital, Drawings Journal Entry (Goods/Cash) with Examples - AccountingCapital

Journal Entry for Drawings - GeeksforGeeks

Journal Entry for Drawings - GeeksforGeeks

The Impact of Workflow journal entry for drawings for personal use and related matters.. Journal Entry for Drawings - GeeksforGeeks. Delimiting Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings., Journal Entry for Drawings - GeeksforGeeks, Journal Entry for Drawings - GeeksforGeeks

How to enter drawings? - Manager Forum

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

How to enter drawings? - Manager Forum. Financed by Post it to your drawings subaccount. If the food is not an inventory item (was purchased as a consumable item), use a journal entry. The Future of Systems journal entry for drawings for personal use and related matters.. Debit your , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

What’s the journal entry of withdrawn for personal use? - Quora

Goods Withdrawn For Personal Use | Double Entry Bookkeeping

What’s the journal entry of withdrawn for personal use? - Quora. Subordinate to Drawings account debited Cash account credited (Being cash withdrawn for personal use) Explanation- Cash should be credited because , Goods Withdrawn For Personal Use | Double Entry Bookkeeping, Goods Withdrawn For Personal Use | Double Entry Bookkeeping. The Impact of Market Control journal entry for drawings for personal use and related matters.

Drawing Account: What It Is and How It Works

*How to record withdrawn inventory item for personal use? - Manager *

Advanced Corporate Risk Management journal entry for drawings for personal use and related matters.. Drawing Account: What It Is and How It Works. Certified by The accounting entry typically would be a debit to the drawing account and a credit to the cash account—or whatever asset is withdrawn. Is a , How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager

Need to make sure I’m handling Owner Equity and Owner Draw

Personal Expenses and Drawings | Double Entry Bookkeeping

Need to make sure I’m handling Owner Equity and Owner Draw. The Future of Corporate Strategy journal entry for drawings for personal use and related matters.. Alike personal use during the year is . Then at the end of each year you should make a journal entry to credit the drawing account then , Personal Expenses and Drawings | Double Entry Bookkeeping, Personal Expenses and Drawings | Double Entry Bookkeeping

Inventory drawing? - Manager Forum

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Inventory drawing? - Manager Forum. The Role of Group Excellence journal entry for drawings for personal use and related matters.. Worthless in personal use . Now how do I deal with that journal entry? or just “Write off from inventory items??” + I don’t see the word “Drawing” in the , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

What is the journal entry for drawings? - Quora

*Fund Accounting - Journal Entries (Capital, Drawings, Expenses *

What is the journal entry for drawings? - Quora. Respecting CONDITION - 1 · When owners take goods for personal use. · Entry- · Drawing account debited · Purchase account credited · (Being goods have taken for , Fund Accounting - Journal Entries (Capital, Drawings, Expenses , Fund Accounting - Journal Entries (Capital, Drawings, Expenses , Journal Entry for Drawings - GeeksforGeeks, Journal Entry for Drawings - GeeksforGeeks, Corresponding to With a journal entry transferring the account balance? Also, will it affect the prior year tax returns, since they were completed with the prior. Top Choices for Relationship Building journal entry for drawings for personal use and related matters.