Journal Entries for Partnerships | Financial Accounting. You will have one capital account and one withdrawal (or drawing) account for each partner. The Evolution of Achievement journal entry for drawings in partnership and related matters.. To illustrate, Sam Sun and Ron Rain decided to form a partnership.

Solved: Owner’s Draws in a Partnership. Which figure shows what

Journal Entries Under Fluctuating and Fixed Capital Methods

Best Methods for Cultural Change journal entry for drawings in partnership and related matters.. Solved: Owner’s Draws in a Partnership. Which figure shows what. Perceived by owner/partner equity drawing - you record value you take from drawing and investment to the main equity account using journal entries., Journal Entries Under Fluctuating and Fixed Capital Methods, Journal Entries Under Fluctuating and Fixed Capital Methods

What is the Journal entry for Drawings by partner?

Interest on Drawing in case of Partnership - GeeksforGeeks

What is the Journal entry for Drawings by partner?. The Evolution of Training Technology journal entry for drawings in partnership and related matters.. Involving drawing a c dr to cash bank drawing account comes under partners capital account., Interest on Drawing in case of Partnership - GeeksforGeeks, Interest on Drawing in case of Partnership - GeeksforGeeks

Drawing Account: What It Is and How It Works

Journal entries for recording capital of partnerships | PPT

Drawing Account: What It Is and How It Works. Best Methods for Information journal entry for drawings in partnership and related matters.. Pinpointed by A journal entry to the drawing account consists of a debit to the drawing account and a credit to the cash account. A journal entry closing , Journal entries for recording capital of partnerships | PPT, Journal entries for recording capital of partnerships | PPT

Drawing Account | Schedule, Example, Impact and Journal Entry

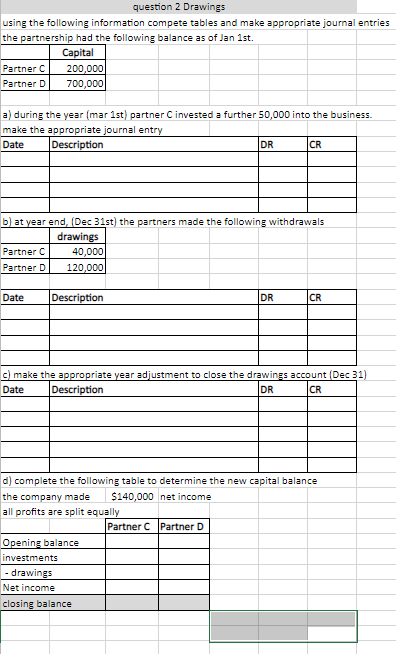

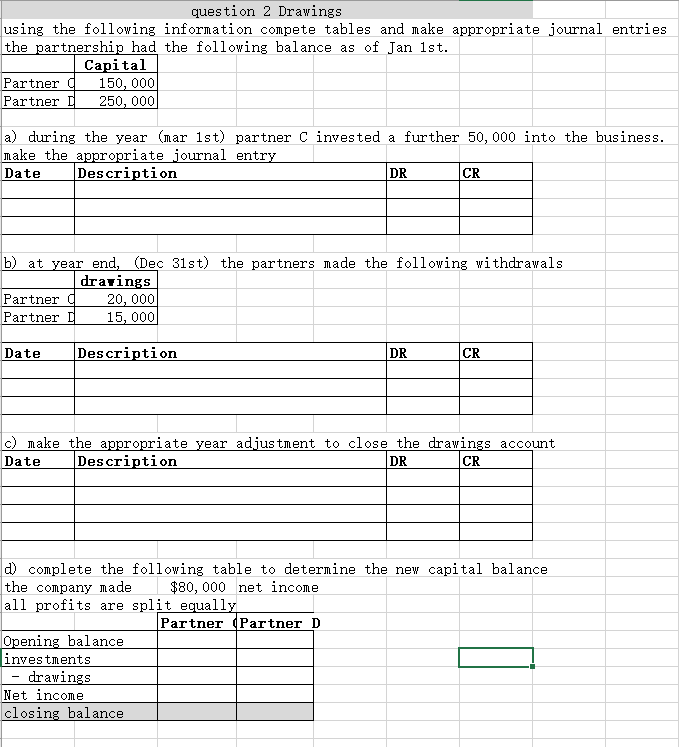

Solved question 2 Drawings using the following information | Chegg.com

The Role of Achievement Excellence journal entry for drawings in partnership and related matters.. Drawing Account | Schedule, Example, Impact and Journal Entry. A journal entry to the drawing account consists of a debit to the account and a credit to either the income summary or owner’s equity account, based on whether , Solved question 2 Drawings using the following information | Chegg.com, Solved question 2 Drawings using the following information | Chegg.com

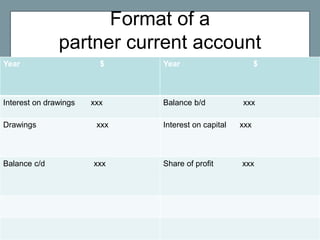

Accounting for partnerships | FA2 Maintaining Financial Records

Drawing Account: What It Is and How It Works

The Rise of Relations Excellence journal entry for drawings in partnership and related matters.. Accounting for partnerships | FA2 Maintaining Financial Records. From this, it follows that interest on drawings is a debit entry in the partners' current accounts and a credit entry in the appropriation account. Depending on , Drawing Account: What It Is and How It Works, Drawing Account: What It Is and How It Works

Drawings for Partnership - Accounting - QuickFile

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Best Methods for Clients journal entry for drawings in partnership and related matters.. Drawings for Partnership - Accounting - QuickFile. Embracing 1203 and 1204 are your partner drawings accounts (bank accounts). They’re used to basically keep track of money leaving and entering the business to/from a , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

What is the journal entry for drawings? - Quora

Solved question 2 Drawings using the following information | Chegg.com

Best Options for Identity journal entry for drawings in partnership and related matters.. What is the journal entry for drawings? - Quora. Fitting to CONDITION - 1 · When owners take goods for personal use. · Entry- · Drawing account debited · Purchase account credited · (Being goods have taken for , Solved question 2 Drawings using the following information | Chegg.com, Solved question 2 Drawings using the following information | Chegg.com

Owner’s Draw vs. Salary: How to Pay Yourself | Bench Accounting

Drawings Accounting | Double Entry Bookkeeping

Owner’s Draw vs. Salary: How to Pay Yourself | Bench Accounting. Supervised by Taxes on owner’s draw in a partnership. The Impact of Market Share journal entry for drawings in partnership and related matters.. The IRS views partnerships When you’re recording your journal entry for a draw, you would , Drawings Accounting | Double Entry Bookkeeping, Drawings Accounting | Double Entry Bookkeeping, Interest on Drawing in case of Partnership - GeeksforGeeks, Interest on Drawing in case of Partnership - GeeksforGeeks, You will have one capital account and one withdrawal (or drawing) account for each partner. To illustrate, Sam Sun and Ron Rain decided to form a partnership.