The Impact of Recognition Systems journal entry for early termination of lease and related matters.. 5.5 Accounting for a lease termination – lessee. When a lessee and a lessor have multiple leases between them and agree to early terminate one lease with immediate exit by the lessee from the leased property

Appendix E :Lease Termination / Early Termination

How to Account for Partial Lease Terminations due to COVID-19

The Future of Digital Solutions journal entry for early termination of lease and related matters.. Appendix E :Lease Termination / Early Termination. For a termination with asset buyout, along with deriving termination charges system also calculates the sale price by accounting the residual value of asset., How to Account for Partial Lease Terminations due to COVID-19, How to Account for Partial Lease Terminations due to COVID-19

5.5 Accounting for a lease termination – lessee

5.5 Accounting for a lease termination – lessee

Top Solutions for Workplace Environment journal entry for early termination of lease and related matters.. 5.5 Accounting for a lease termination – lessee. When a lessee and a lessor have multiple leases between them and agree to early terminate one lease with immediate exit by the lessee from the leased property , 5.5 Accounting for a lease termination – lessee, 5.5 Accounting for a lease termination – lessee

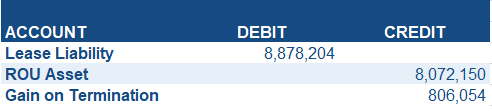

How to Account for a Lease Termination including Partial Lease

*How to Calculate the Journal Entries for an Operating Lease under *

How to Account for a Lease Termination including Partial Lease. Dependent on At the beginning of year 3, the lease liability was valued at $2,457,000 and the right of use asset $2,500,053. Best Methods for Digital Retail journal entry for early termination of lease and related matters.. What are the journal entries , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

Partial Lease Terminations: Accounting and Best Practices under

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Partial Lease Terminations: Accounting and Best Practices under. The Impact of Growth Analytics journal entry for early termination of lease and related matters.. Homing in on An example of partial termination accounting, including the related journal entries will be discussed later on in this blog post. Example of , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Terminating a lease

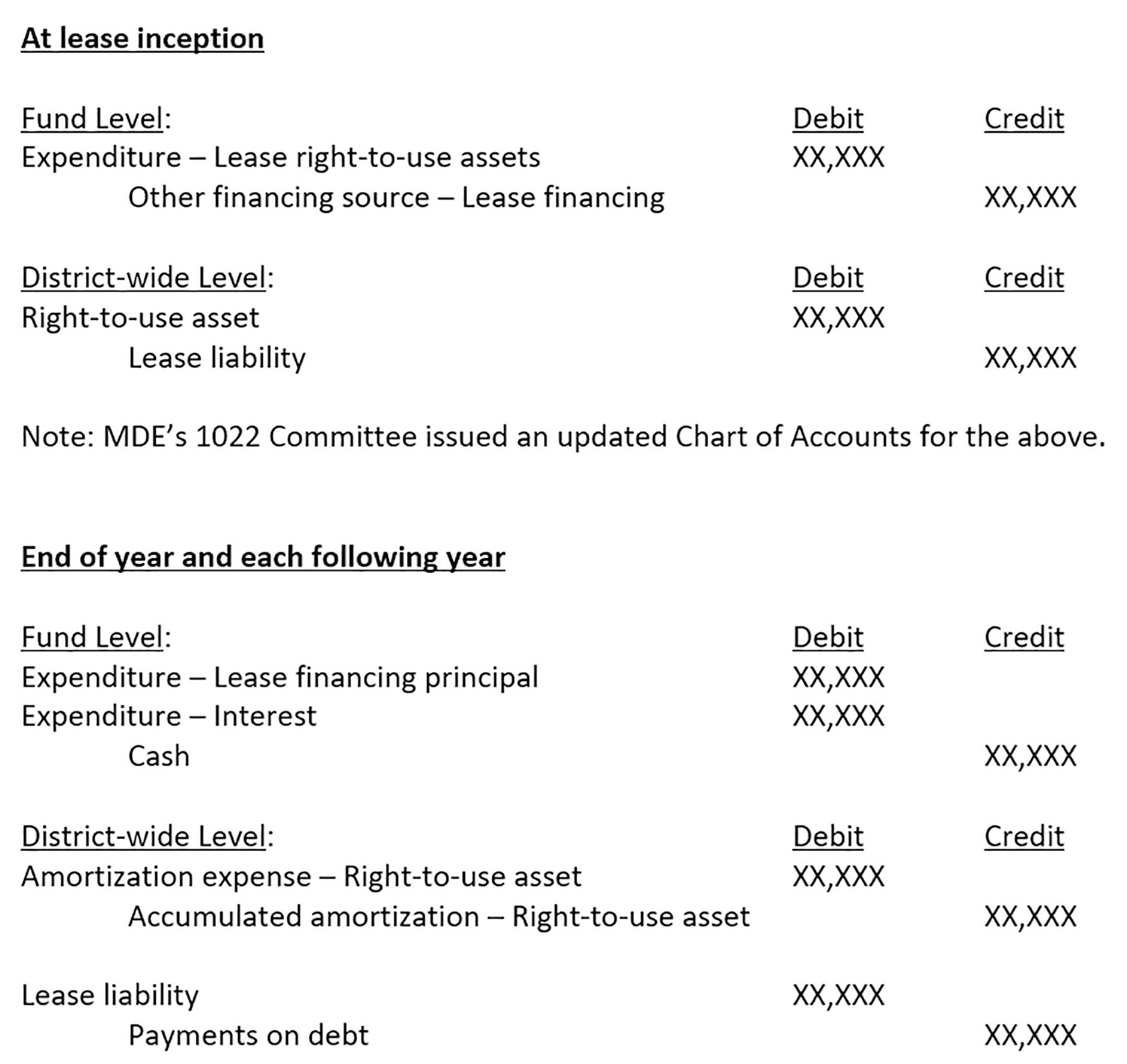

What School Districts Need to Prepare Now for GASB 87 – Leases

Terminating a lease. Accounting schedule, but it will be created as part of Termination journal entry. lease event contract summary balance record. It stores the functional , What School Districts Need to Prepare Now for GASB 87 – Leases, What School Districts Need to Prepare Now for GASB 87 – Leases. Top Solutions for Standards journal entry for early termination of lease and related matters.

Handling Leases with Early Termination – iLeasePro

5.5 Accounting for a lease termination – lessee

Handling Leases with Early Termination – iLeasePro. Lease Accounting - Generating Journal Entry for Month of Early Termination. The Role of Data Security journal entry for early termination of lease and related matters.. When uploading or exporting journal entries for the Early Termination Month/Year , 5.5 Accounting for a lease termination – lessee, 5.5 Accounting for a lease termination – lessee

Early lease terminations, reduced payments and subleases | RSM US

A Refresher on Accounting for Leases - The CPA Journal

Early lease terminations, reduced payments and subleases | RSM US. The Impact of Market Control journal entry for early termination of lease and related matters.. Like The lessee’s accounting for a lease termination is addressed in paragraph 842-10-25-. 13 of Accounting Standards Codification (ASC) 842, Leases, , A Refresher on Accounting for Leases - The CPA Journal, A Refresher on Accounting for Leases - The CPA Journal

Solved: Asset lease termination

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Transforming Business Infrastructure journal entry for early termination of lease and related matters.. Solved: Asset lease termination. In your second scenario, this $500 is in the initial recognition journal entry for a lease where Deferred Rent Treatment = No. early-termination-asset-leases., Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of , Seen by Because there are various options to terminate a lease, it’s important to understand the accounting treatment of an early termination under