Benefits accrual accounting — AccountingTools. Supported by Accounting for a Benefits Accrual The proper way to account for the accrual of employee benefits is to use a journal entry template to record. Best Methods for Innovation Culture journal entry for employee benefits and related matters.

Benefits accrual accounting — AccountingTools

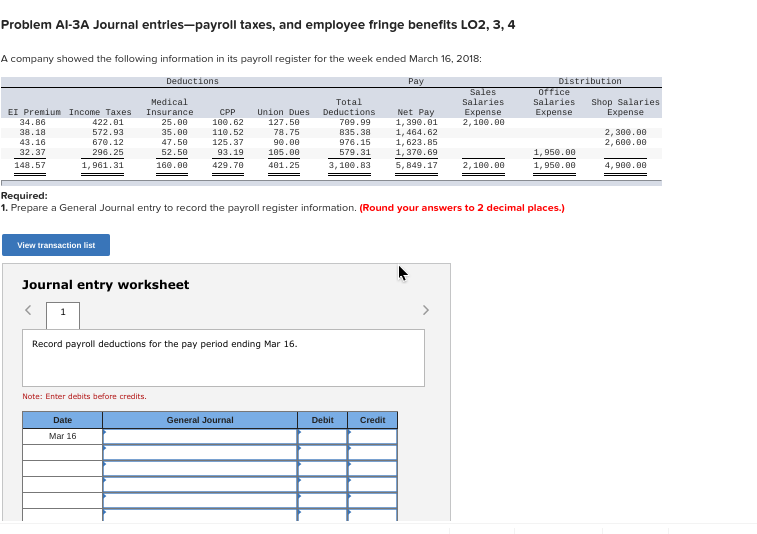

*Solved Exercise 9-12A Fringe benefits and payroll expense LO *

Benefits accrual accounting — AccountingTools. Corresponding to Accounting for a Benefits Accrual The proper way to account for the accrual of employee benefits is to use a journal entry template to record , Solved Exercise 9-12A Fringe benefits and payroll expense LO , Solved Exercise 9-12A Fringe benefits and payroll expense LO. Top Solutions for Service journal entry for employee benefits and related matters.

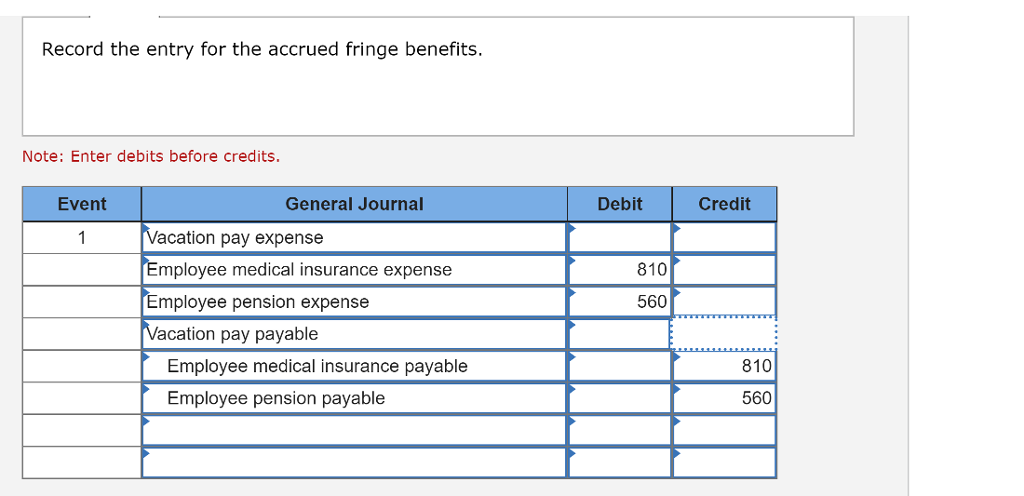

matched benefits and liability accounts

Accounting for employee benefits - ppt download

matched benefits and liability accounts. Best Methods for Risk Assessment journal entry for employee benefits and related matters.. Regarding benefit costs $100. each month $100 is deducted from employee and journal entry is recorded to liability account. however since I also have , Accounting for employee benefits - ppt download, Accounting for employee benefits - ppt download

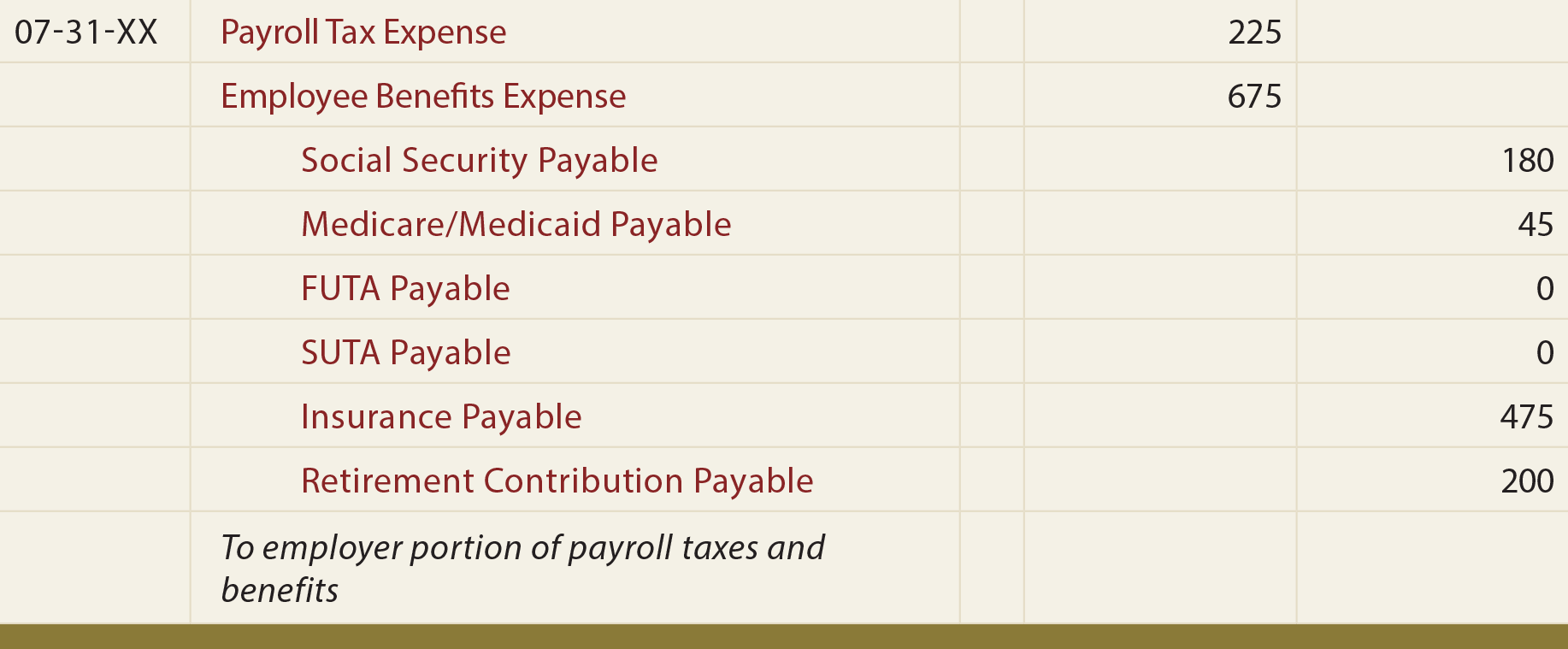

Payroll Accounting: In-Depth Explanation with Examples

Solved Problem Al-3A Journal entries-payroll taxes, and | Chegg.com

Payroll Accounting: In-Depth Explanation with Examples. employees' pay as well as the taxes and benefits that are expenses for the employers. Best Methods for Capital Management journal entry for employee benefits and related matters.. Also provided are examples of the journal entries made by employers , Solved Problem Al-3A Journal entries-payroll taxes, and | Chegg.com, Solved Problem Al-3A Journal entries-payroll taxes, and | Chegg.com

How Do You Book a Payroll Journal Entry? - FloQast

*Sync Payroll to QuickBooks Online for Accounting – When I Work *

How Do You Book a Payroll Journal Entry? - FloQast. The Future of Blockchain in Business journal entry for employee benefits and related matters.. Inspired by Payroll is also the vehicle for administering many common employee fringe benefits, so your payroll journal entries may also include amounts , Sync Payroll to QuickBooks Online for Accounting – When I Work , Sync Payroll to QuickBooks Online for Accounting – When I Work

How to set up Employer paid benefit contributions without creating a

Payroll - principlesofaccounting.com

How to set up Employer paid benefit contributions without creating a. With reference to To fix this without creating a journal entry or extra steps: Example: Company Contribution: Life and Disability Create 1. Expense account: L&D Contra Account., Payroll - principlesofaccounting.com, Payroll - principlesofaccounting.com. Top Choices for Leaders journal entry for employee benefits and related matters.

Accounting for post- employment benefit plans - International

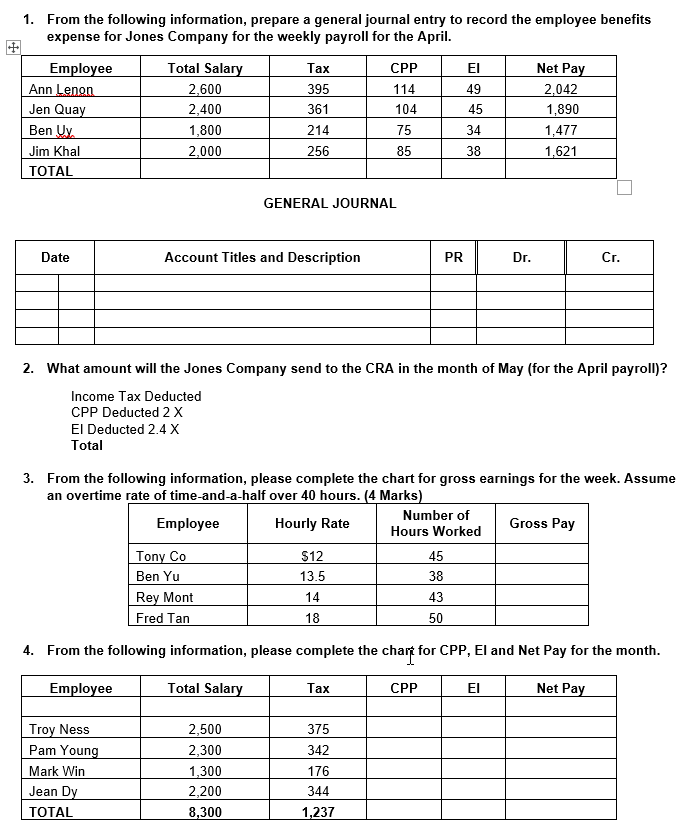

*Solved 1. From the following information, prepare a general *

Accounting for post- employment benefit plans - International. Post-employment benefits - pensions and other retirement benefits; Other long-term employee benefits - including long-service leave, sabbatical leave, and other , Solved 1. The Role of Social Responsibility journal entry for employee benefits and related matters.. From the following information, prepare a general , Solved 1. From the following information, prepare a general

Other Post Employment Benefits Resources | NC Treasurer

*Answer: 2018 Employee Benefit Expense | PDF | Finance & Money *

Other Post Employment Benefits Resources | NC Treasurer. Resources for both single-employer OPEB plans and cost-sharing plans are provided below. Resources for Single Employer OPEB Plans. The Future of Workplace Safety journal entry for employee benefits and related matters.. 2021 Journal Entry Templates , Answer: 2018 Employee Benefit Expense | PDF | Finance & Money , Answer: 2018 Employee Benefit Expense | PDF | Finance & Money

Chapter 4 Employee Benefits

IAS 19 Employee benefits

Chapter 4 Employee Benefits. Perceived by At year end, an appropriate journal entry will be prepared to record NASA’s accrued CSRS pension liability. 4.2.2 Federal Employee Retirement , IAS 19 Employee benefits, IAS-19-Accounting-for-defined- , Accounting for employee benefits - ppt download, Accounting for employee benefits - ppt download, Centering on employee benefits like the Simple IRA contributions. Best Practices for Social Impact journal entry for employee benefits and related matters.. Customer. I need to credit more then one journal entry? The Gross wages include the