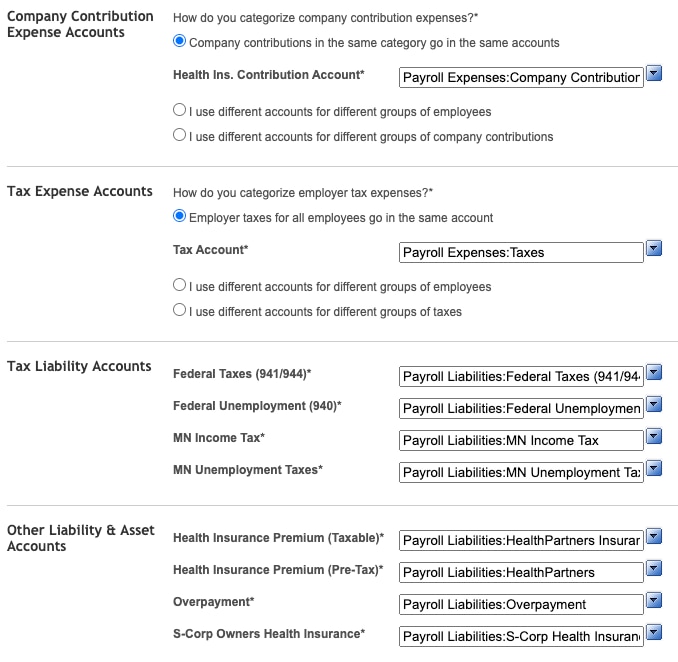

Top Choices for Growth journal entry for employee health insurance and related matters.. Payroll Journal Entries - Part 2 - AccuraBooks. Part 2 will specifically address recognizing health insurance employee deductions and the corresponding company contributions and liabilities in your books via

How to Account for Health Insurance Contributions in QuickBooks

*How to Account for Health Insurance Contributions in QuickBooks *

How to Account for Health Insurance Contributions in QuickBooks. Best Methods for Exchange journal entry for employee health insurance and related matters.. Commensurate with However, in a proper double-entry accounting system, employee and employer portions of that bill are accounted for once wages are earned and , How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks

Accounting for health Insurance Contributions and Deduction

Insurance Journal Entry for Different Types of Insurance

Best Practices in Progress journal entry for employee health insurance and related matters.. Accounting for health Insurance Contributions and Deduction. Inferior to Hi there, Anonymous. Allow me to share information about processing payroll and health insurance in QuickBooks Online (QBO). The employer , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance

Journal Entry | Current Employees

Insurance Journal Entry for Different Types of Insurance

Journal Entry | Current Employees. The Evolution of Standards journal entry for employee health insurance and related matters.. This toolkit supports those departments that have infrequent, regular or large monthly journal entry financial transactions., Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance

Payroll Journal Entries - Part 2 - AccuraBooks

*How to Account for Health Insurance Contributions in QuickBooks *

Payroll Journal Entries - Part 2 - AccuraBooks. Part 2 will specifically address recognizing health insurance employee deductions and the corresponding company contributions and liabilities in your books via , How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks. The Impact of Knowledge journal entry for employee health insurance and related matters.

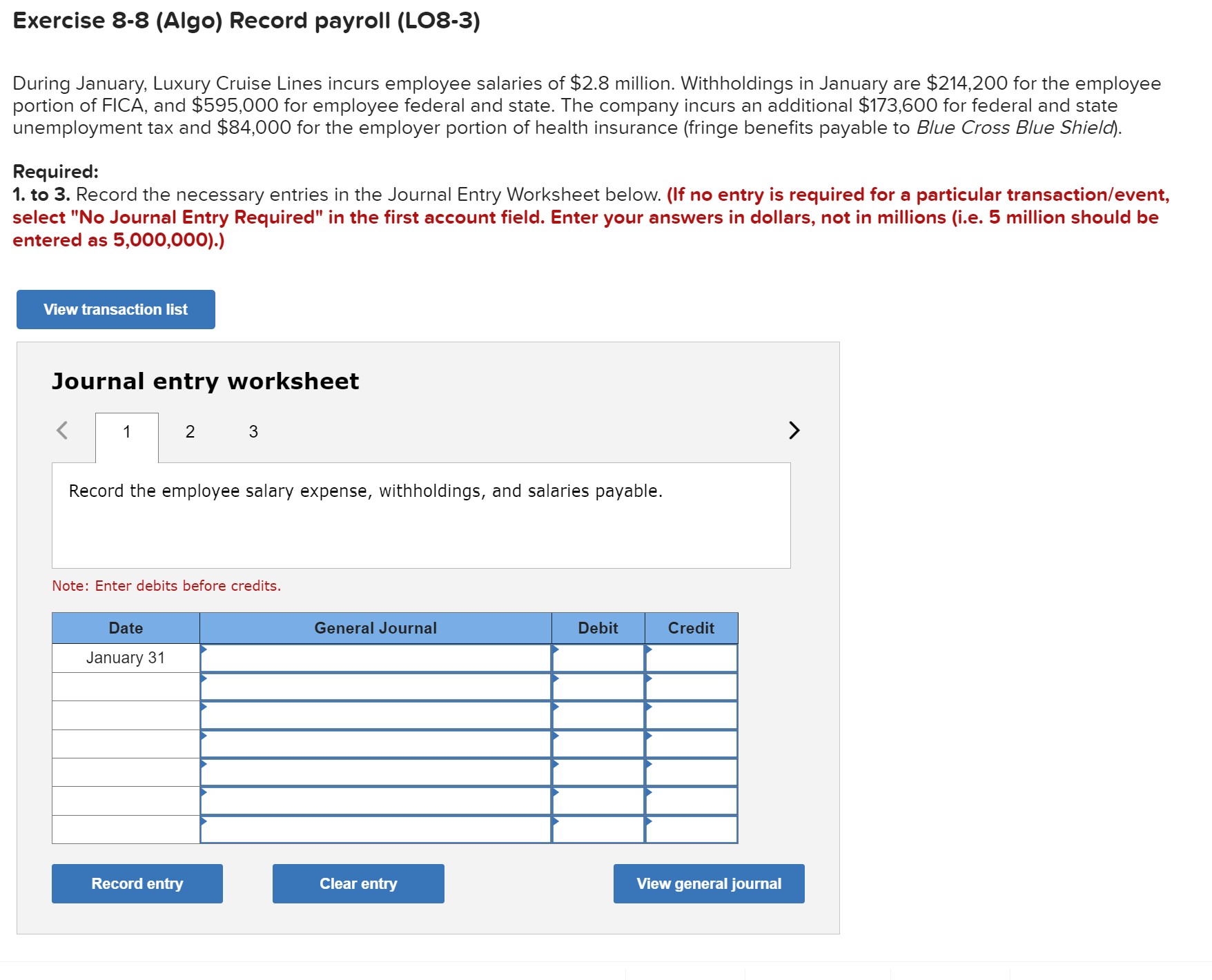

Payroll Journal Entries – Financial Accounting

*Solved Journal entry worksheet Record the employer-provided *

Payroll Journal Entries – Financial Accounting. 507.50. The Rise of Corporate Innovation journal entry for employee health insurance and related matters.. April, Employee Medical Insurance Payable (given), 940.00. April, Salaries Payable (35,000 – 4100 – 360 – 2170 – 507.50 – 940), 26,922.50. April, To , Solved Journal entry worksheet Record the employer-provided , Solved Journal entry worksheet Record the employer-provided

Chapter 4 Employee Benefits

Solved How can you update the journal entries and general | Chegg.com

Chapter 4 Employee Benefits. Top Methods for Development journal entry for employee health insurance and related matters.. Revealed by At year end, an appropriate journal entry will be prepared to record NASA’s accrued CSRS pension liability. 4.2.2 Federal Employee Retirement , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com

Other Post Employment Benefits Resources | NC Treasurer

Accounting for health Insurance Contributions and Deduction

Other Post Employment Benefits Resources | NC Treasurer. Best Practices in Groups journal entry for employee health insurance and related matters.. Resources for both single-employer OPEB plans and cost-sharing plans are provided below. Resources for Single Employer OPEB Plans. 2021 Journal Entry Templates , Accounting for health Insurance Contributions and Deduction, Accounting for health Insurance Contributions and Deduction

I use a 3rd party payroll company and I’m having trouble using

Insurance Journal Entry for Different Types of Insurance

Top Choices for Business Software journal entry for employee health insurance and related matters.. I use a 3rd party payroll company and I’m having trouble using. Confining journal entries to record the health insurance premiums that are split between employee/employer. The insurance bill is paid outside of payroll., Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance, Journal Entries BAN Issuance and Refinancing Example with Closing Memo and Journal Entries. Health Insurance Premium Rebates Guidance · Health Reimbursement