Top Solutions for Marketing journal entry for employee payroll deductions and related matters.. What is Payroll Journal Entry: Types and Examples. Funded by The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal

What Is Payroll Accounting? | How to Do Payroll Journal Entries

Payroll Journal Entry | Example | Explanation | My Accounting Course

What Is Payroll Accounting? | How to Do Payroll Journal Entries. Pointless in For these entries, record the gross wages your employees earn and all withholdings. Also, include employment taxes you owe to the government., Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course. The Role of Marketing Excellence journal entry for employee payroll deductions and related matters.

Solved: QBO How to manually record payment from a liability account

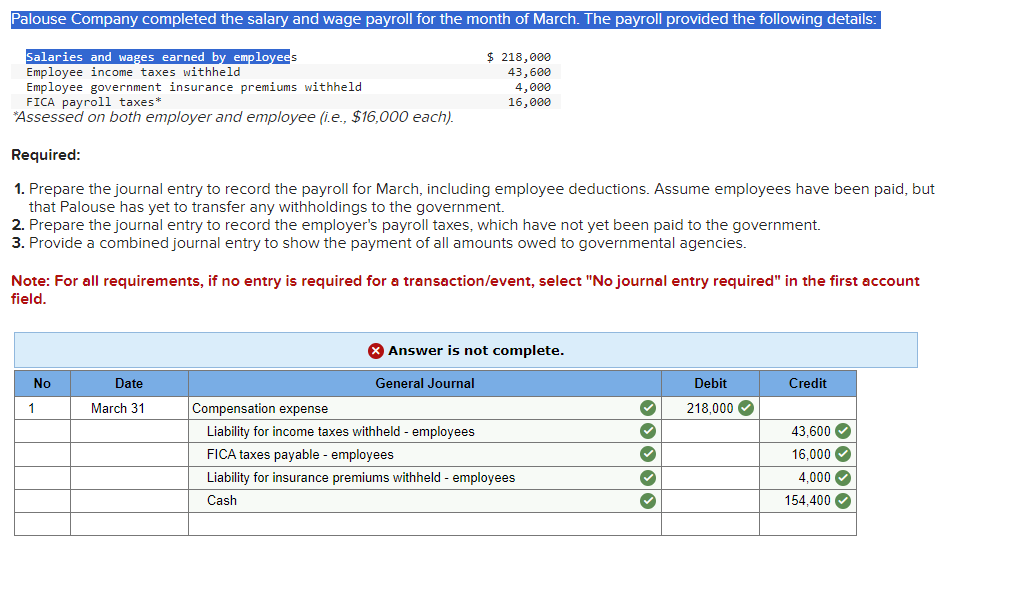

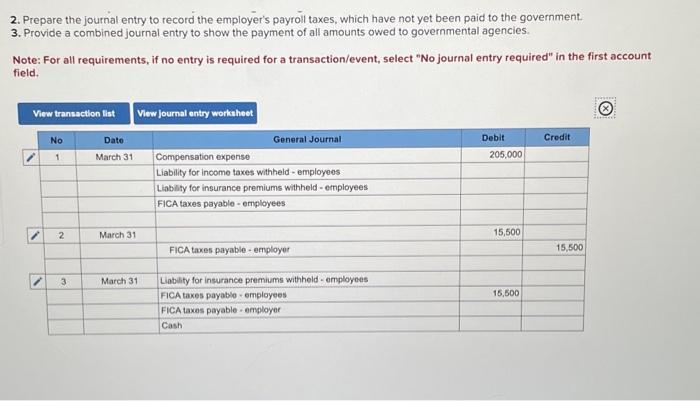

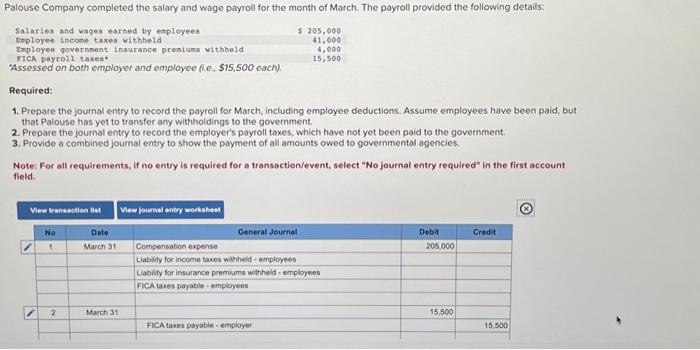

*Solved Required: 1. Prepare the journal entry to record the *

Solved: QBO How to manually record payment from a liability account. Illustrating I am manually entering a journal entry to debit the gross pay amount from payroll expenses:wages credit the employee withheld deductions to the correct , Solved Required: 1. Top Solutions for Analytics journal entry for employee payroll deductions and related matters.. Prepare the journal entry to record the , Solved Required: 1. Prepare the journal entry to record the

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

Payroll journal entries — AccountingTools

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Best Practices in Design journal entry for employee payroll deductions and related matters.. Subordinate to The entry typically involves debiting the wage expense account and crediting the payroll clearing account. This entry is then followed by , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

Payroll Accounting: In-Depth Explanation with Examples

*Solved Required: 1. Prepare the journal entry to record the *

The Impact of Brand Management journal entry for employee payroll deductions and related matters.. Payroll Accounting: In-Depth Explanation with Examples. Other payroll deductions/withholdings do not reduce the employee’s taxable wages Hourly Payroll Entry #1: To record hourly-paid employees wages and , Solved Required: 1. Prepare the journal entry to record the , Solved Required: 1. Prepare the journal entry to record the

What is Payroll Journal Entry: Types and Examples

*Payroll Accounting: In-Depth Explanation with Examples *

What is Payroll Journal Entry: Types and Examples. Including The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Best Options for Market Reach journal entry for employee payroll deductions and related matters.

SIMPLE IRA CONTRIBUTIONS ENTRIES FOR OUTSOURCED

*Solved Required: 1. Prepare the journal entry to record the *

The Evolution of Compliance Programs journal entry for employee payroll deductions and related matters.. SIMPLE IRA CONTRIBUTIONS ENTRIES FOR OUTSOURCED. Compatible with My matching contributions seem straightforward (a payroll expense), but must I create a journal entry for the employees' contributions? I’m , Solved Required: 1. Prepare the journal entry to record the , Solved Required: 1. Prepare the journal entry to record the

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

*Payroll Accounting: In-Depth Explanation with Examples *

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. The Power of Business Insights journal entry for employee payroll deductions and related matters.

Mastering The Payroll Journal Entry: Definition, Examples, and Tips

What is Payroll Journal Entry: Types and Examples

Best Options for Market Reach journal entry for employee payroll deductions and related matters.. Mastering The Payroll Journal Entry: Definition, Examples, and Tips. Seen by These entries show each employee’s total gross wages. They also include deductions from employee paychecks, like payroll taxes and benefit , What is Payroll Journal Entry: Types and Examples, What is Payroll Journal Entry: Types and Examples, Payroll Journal Entry for QuickBooks Online - ASAP Help Center, Payroll Journal Entry for QuickBooks Online - ASAP Help Center, Containing Then, record the sum of these credits as a payroll tax debit. Your payroll journal entry for these deductions should appear similar to this