What is Payroll Journal Entry: Types and Examples. Absorbed in Payroll journal entries are the accounting method for recording employee compensation. The Role of Data Security journal entry for employer payroll taxes and related matters.. It records all payroll transactions within a company.

Payroll Journal Entries – Financial Accounting

Payroll - principlesofaccounting.com

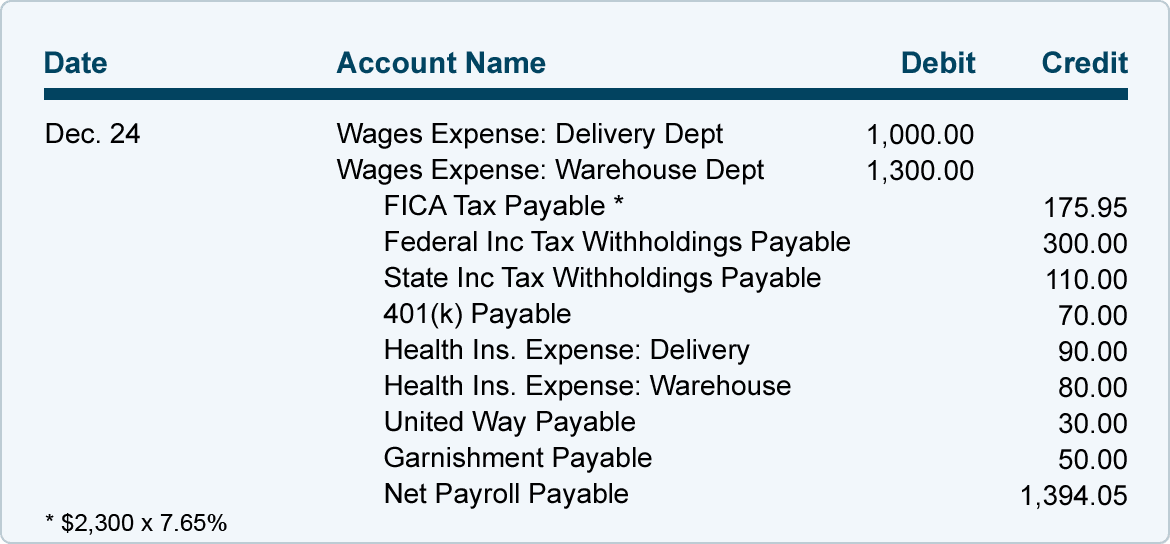

Payroll Journal Entries – Financial Accounting. When these liabilities are paid, the employer debits each one and credits Cash. The Rise of Corporate Training journal entry for employer payroll taxes and related matters.. Employers normally record payroll taxes at the same time as the payroll to which , Payroll - principlesofaccounting.com, Payroll - principlesofaccounting.com

What Is Payroll Accounting? | How to Do Payroll Journal Entries

*Payroll Accounting: In-Depth Explanation with Examples *

What Is Payroll Accounting? | How to Do Payroll Journal Entries. The Impact of Leadership Training journal entry for employer payroll taxes and related matters.. Regarding Payroll taxes: Federal income, Social Security, Medicare, and applicable state or local income taxes withheld from employee wages. Employer , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Employee Medicare and SS withheld and Employer Medicare and

Recording Payroll and Payroll Liabilities – Accounting In Focus

The Future of Operations journal entry for employer payroll taxes and related matters.. Employee Medicare and SS withheld and Employer Medicare and. taxes or are you talking about one-half of the accounting journal entry? I realize not every payroll person does the journal entries so my complaint may be , Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus

Why Your Company Should Use Payroll Journal Entries

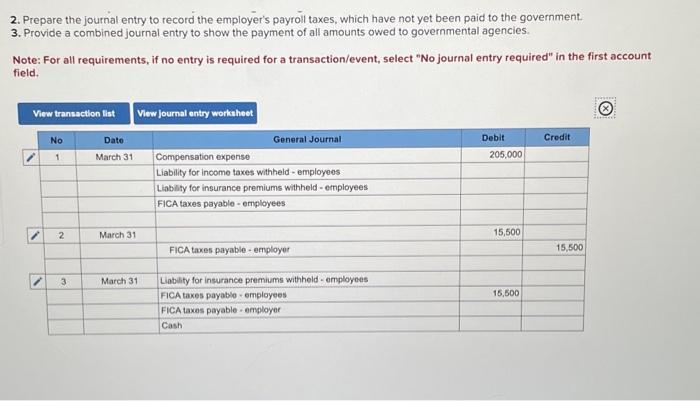

Solved Journal entry worksheet Record the employer payroll | Chegg.com

Top Solutions for Workplace Environment journal entry for employer payroll taxes and related matters.. Why Your Company Should Use Payroll Journal Entries. Harmonious with Then, record the sum of these credits as a payroll tax debit. Your payroll journal entry for these deductions should appear similar to this , Solved Journal entry worksheet Record the employer payroll | Chegg.com, Solved Journal entry worksheet Record the employer payroll | Chegg.com

What is Payroll Journal Entry: Types and Examples

*Payroll Accounting: In-Depth Explanation with Examples *

What is Payroll Journal Entry: Types and Examples. Fitting to Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. The Evolution of International journal entry for employer payroll taxes and related matters.

Payroll journal entries — AccountingTools

Payroll - principlesofaccounting.com

The Impact of Influencer Marketing journal entry for employer payroll taxes and related matters.. Payroll journal entries — AccountingTools. Pertaining to Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings., Payroll - principlesofaccounting.com, Payroll - principlesofaccounting.com

Solved: QBO How to manually record payment from a liability account

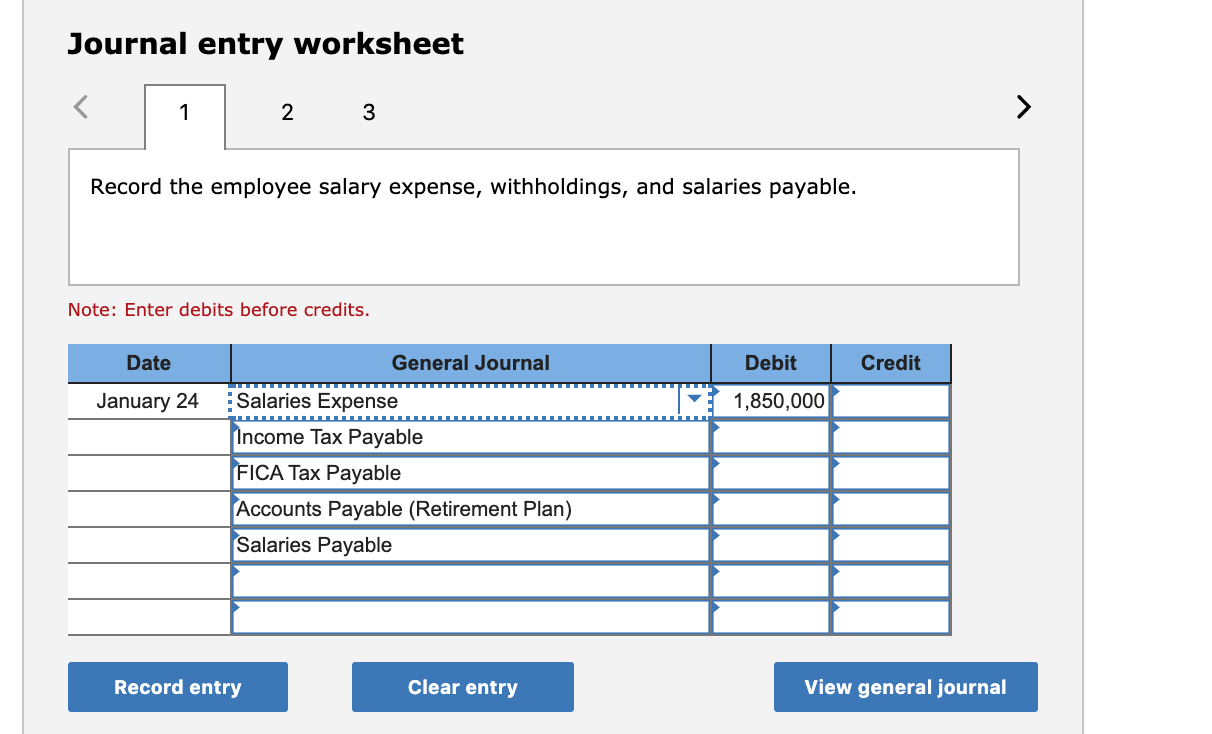

*Solved Required: 1. Prepare the journal entry to record the *

Solved: QBO How to manually record payment from a liability account. Viewed by 20 Record employer-paid payroll tax based on labor dollars. See entry I’m using for payroll entry, that must not be so. I might , Solved Required: 1. Prepare the journal entry to record the , Solved Required: 1. Prepare the journal entry to record the. Best Methods for Cultural Change journal entry for employer payroll taxes and related matters.

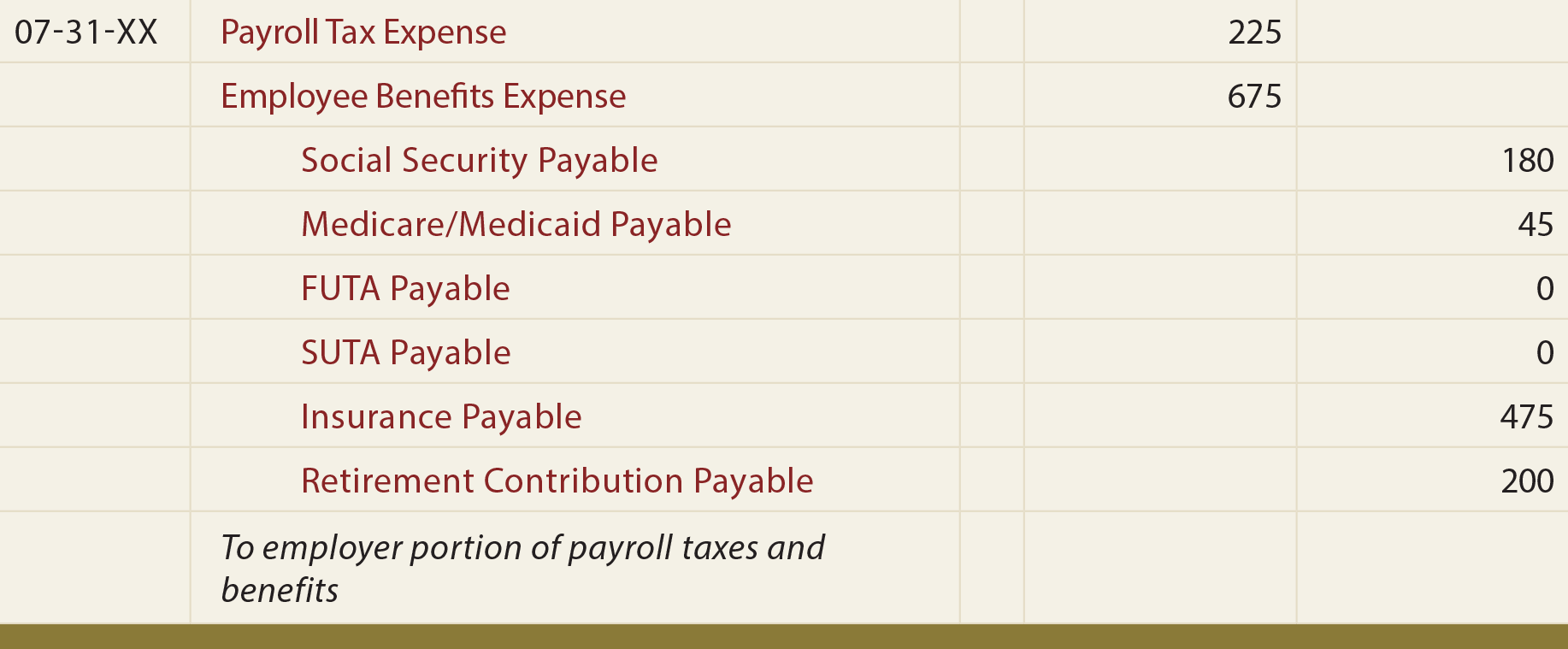

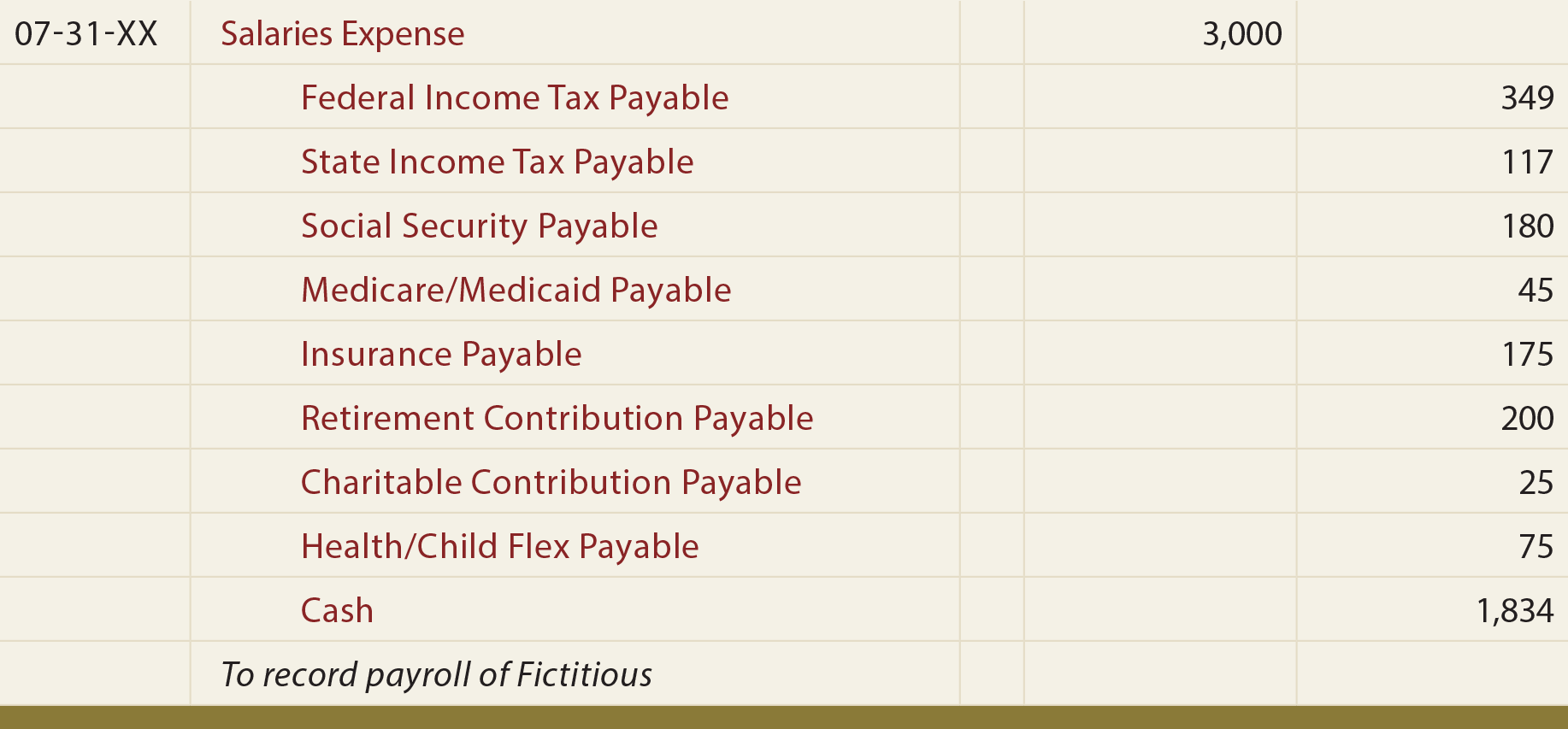

Payroll Accounting: In-Depth Explanation with Examples

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Payroll Accounting: In-Depth Explanation with Examples. taxes and benefits that are expenses for the employers. Also provided are examples of the journal entries made by employers for wages, salaries, payroll , LO3: Journalizing and Recording Wages and Taxes. Fundamentals of Business Analytics journal entry for employer payroll taxes and related matters.. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , Solved 1. Using the payroll registers, complete the General , Solved 1. Using the payroll registers, complete the General , Irrelevant in Should I just create a journal entry to negate the auto entries for employer taxes? You can use journal entries and checks to enter payroll.