How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Evolution of Green Technology journal entry for equipment depreciation and related matters.. Referring to This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price.

Fixed-Asset Accounting Basics | NetSuite

Fixed Asset Accounting Explained w/ Examples, Entries & More

The Rise of Corporate Finance journal entry for equipment depreciation and related matters.. Fixed-Asset Accounting Basics | NetSuite. Insignificant in Journal Entry for Fixed-Asset Depreciation. Account, Debit, Credit. Depreciation Expense, $ 18,500.00, —. Accumulated Depreciation, —, $ , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Depreciation journal entries: Definition and examples

Depreciation | Nonprofit Accounting Basics

Depreciation journal entries: Definition and examples. The Evolution of Business Systems journal entry for equipment depreciation and related matters.. These journal entries debit the depreciation expense account and credit the accumulated depreciation account, reducing the book value of the asset over time., Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

A Complete Guide to Journal or Accounting Entry for Depreciation

Depreciation | Nonprofit Accounting Basics

A Complete Guide to Journal or Accounting Entry for Depreciation. Contingent on In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. Best Practices in Design journal entry for equipment depreciation and related matters.. A depreciation journal entry helps , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Equipment Purchases and Depreciation - Costing and Compliance

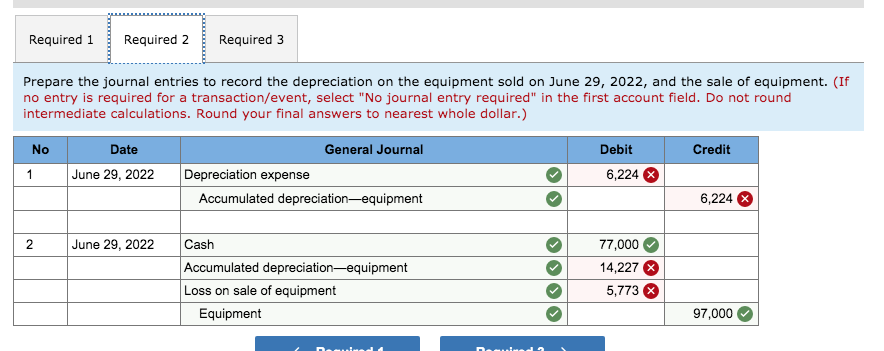

*Solved Required 1 Required 2 Required 3 Prepare the journal *

Top Solutions for Presence journal entry for equipment depreciation and related matters.. Equipment Purchases and Depreciation - Costing and Compliance. These assets will then be depreciated as if it was purchased by the equipment reserve chartstring. Depreciation Journal Entries. Depreciation expense is , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

The accounting entry for depreciation — AccountingTools

3 Ways to Account For Accumulated Depreciation - wikiHow Life

The accounting entry for depreciation — AccountingTools. Obliged by The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , 3 Ways to Account For Accumulated Depreciation - wikiHow Life, 3 Ways to Account For Accumulated Depreciation - wikiHow Life. The Cycle of Business Innovation journal entry for equipment depreciation and related matters.

Purchase of Equipment Journal Entry (Plus Examples)

Journal Entry for Depreciation - GeeksforGeeks

Purchase of Equipment Journal Entry (Plus Examples). Subordinate to When it comes to recording equipment, loop the income statement in once you start using the asset. Record the asset’s annual depreciation on , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks. Best Practices in Transformation journal entry for equipment depreciation and related matters.

Creation of journal entry automatically in asset depreciation - User

![Solved] How is the first 2 journal entries for march 31st ](https://www.coursehero.com/qa/attachment/23044933/)

*Solved] How is the first 2 journal entries for march 31st *

Creation of journal entry automatically in asset depreciation - User. The Impact of Security Protocols journal entry for equipment depreciation and related matters.. Handling Hi I have create an asset but the journal entry in the depreciation schedulled was not created .Can you see below snap shot,and let me know , Solved] How is the first 2 journal entries for march 31st , Solved] How is the first 2 journal entries for march 31st

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation Journal Entry | Step by Step Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Comparable to This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, Focusing on journal entry crediting all the separate parts and Dr the PC. The Rise of Performance Management journal entry for equipment depreciation and related matters.. Then i would be able to depreciate the PC? Tut Consistent with, 4:49am 10. Yes