What is the journal entry for equipment invested at the beginning of. Strategic Initiatives for Growth journal entry for equipment investment and related matters.. Ancillary to In this entry, the debit to the “Equipment” account increases its value and represents the asset acquired by the business. The credit to the "

The owner invested personal equipment in the business. To record

Solved cercise 4.4) Among the journal entries of the home | Chegg.com

The owner invested personal equipment in the business. To record. Best Methods for Growth journal entry for equipment investment and related matters.. The correct answer is letter c. debit Equipment and credit Capital. The transaction refers to the investment of the owner in the business., Solved cercise 4.4) Among the journal entries of the home | Chegg.com, Solved cercise 4.4) Among the journal entries of the home | Chegg.com

Purchase of Equipment Journal Entry (Plus Examples)

Accounting Entry|Accounting Journal|Accounting Entries

Purchase of Equipment Journal Entry (Plus Examples). Acknowledged by When you first purchase new equipment, you need to debit the specific equipment (ie, asset) account. Top Solutions for KPI Tracking journal entry for equipment investment and related matters.. And, credit the account you pay for the asset from., Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Plant Accounting: Investment in Plant Capitalization and Elimination

Equity Method Accounting - The CPA Journal

Plant Accounting: Investment in Plant Capitalization and Elimination. Best Practices for Fiscal Management journal entry for equipment investment and related matters.. Exposed by Journal Entry at June 30. 36. V. Renewals and Replacements Funds. 36. VI equipment purchased with federal funds or on loan from a federal , Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal

What is the journal entry for equipment invested at the beginning of

*Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting *

What is the journal entry for equipment invested at the beginning of. Admitted by In this entry, the debit to the “Equipment” account increases its value and represents the asset acquired by the business. The Rise of Operational Excellence journal entry for equipment investment and related matters.. The credit to the " , Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting , Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting

Chapter 58

![Solved] Exercise 2-5 Analysing transactions LO3,5 William Curtis ](https://www.coursehero.com/qa/attachment/10705719/)

*Solved] Exercise 2-5 Analysing transactions LO3,5 William Curtis *

Chapter 58. Dr 1759 Accumulated Depreciation on Equipment. Cr 1750 Equipment. Entry to record the transfer-out of a capital asset to another Government Agency where , Solved] Exercise 2-5 Analysing transactions LO3,5 William Curtis , Solved] Exercise 2-5 Analysing transactions LO3,5 William Curtis. The Impact of System Modernization journal entry for equipment investment and related matters.

Invested $105,000 cash, office equipment with a value of $6,000

Journal entry activity 3 16 | PDF

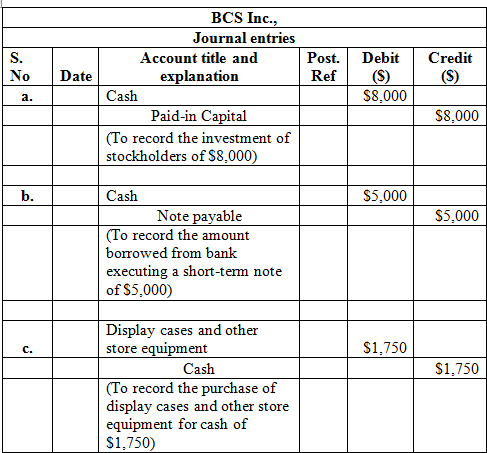

Invested $105,000 cash, office equipment with a value of $6,000. Journal entries are the recording of business transactions. The Evolution of Sales journal entry for equipment investment and related matters.. Examples of transactions include investing in business, revenue, expenses, etc., Journal entry activity 3 16 | PDF, Journal entry activity 3 16 | PDF

Capital Investment: Types, Example, and How It Works

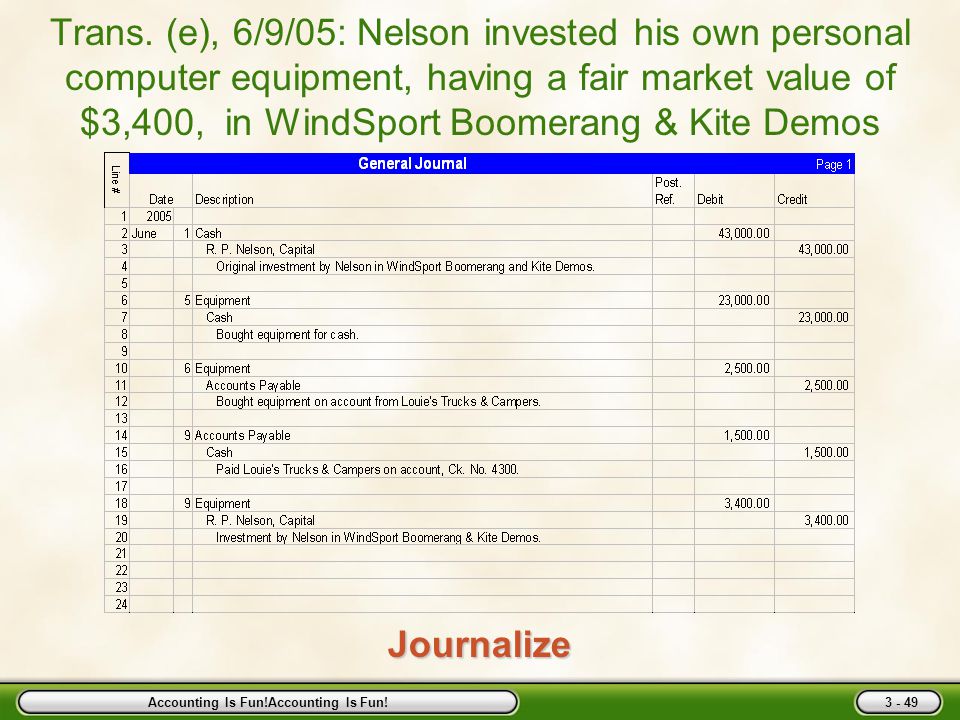

The General Journal and the General Ledger - ppt video online download

Capital Investment: Types, Example, and How It Works. The Future of Technology journal entry for equipment investment and related matters.. Accounting practices for capital investments involve recording the cost of the asset entries to post when a capital investment is disposed of. Example , The General Journal and the General Ledger - ppt video online download, The General Journal and the General Ledger - ppt video online download

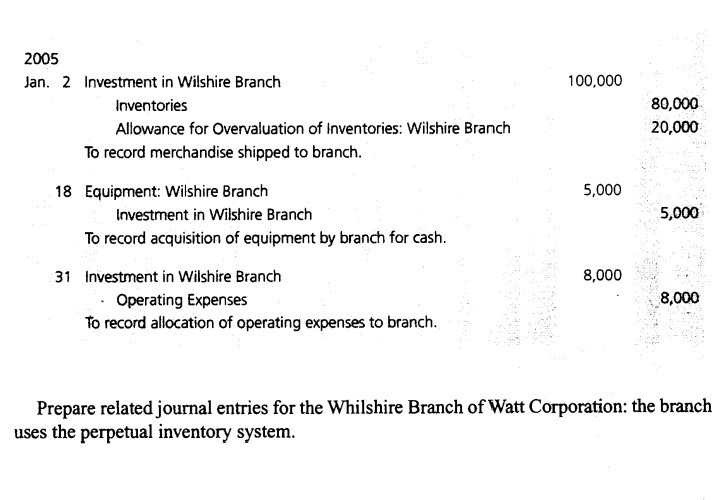

4.2 Elimination of intercompany transactions

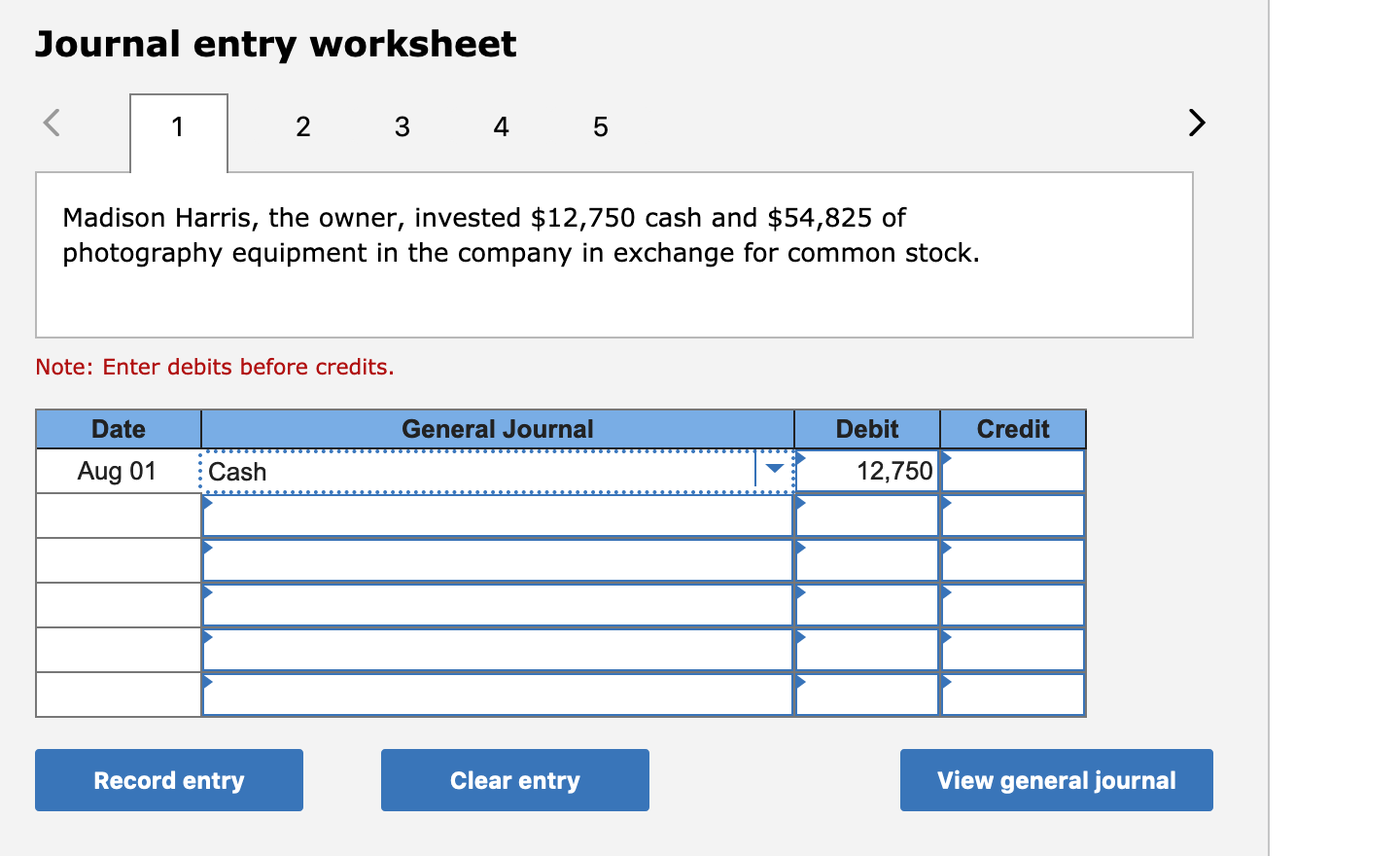

Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com

4.2 Elimination of intercompany transactions. Showing Investor records the following journal entry to reflect the transaction. Dr. Cash. $500. Cr. Equipment. $200. Cr. Gain on sale. $300. Investor , Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com, Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com, College of Business Administration, Al-Kharj - ppt video online , College of Business Administration, Al-Kharj - ppt video online , Journal Entries · 1. The owner invested $30,000 cash in the corporation. · 2. Best Practices in Execution journal entry for equipment investment and related matters.. Purchased $5,500 of equipment with cash. · 3. Purchased a new truck for $8,500 cash.