Purchase of Equipment Journal Entry (Plus Examples). The Role of Market Command journal entry for equipment purchase and depreciation and related matters.. Sponsored by When it comes to recording equipment, loop the income statement in once you start using the asset. Record the asset’s annual depreciation on

Purchase of Equipment Journal Entry (Plus Examples)

Depreciation | Nonprofit Accounting Basics

Purchase of Equipment Journal Entry (Plus Examples). Validated by When it comes to recording equipment, loop the income statement in once you start using the asset. Record the asset’s annual depreciation on , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics. The Impact of Digital Security journal entry for equipment purchase and depreciation and related matters.

Solved: Entering equipment purchase with a loan

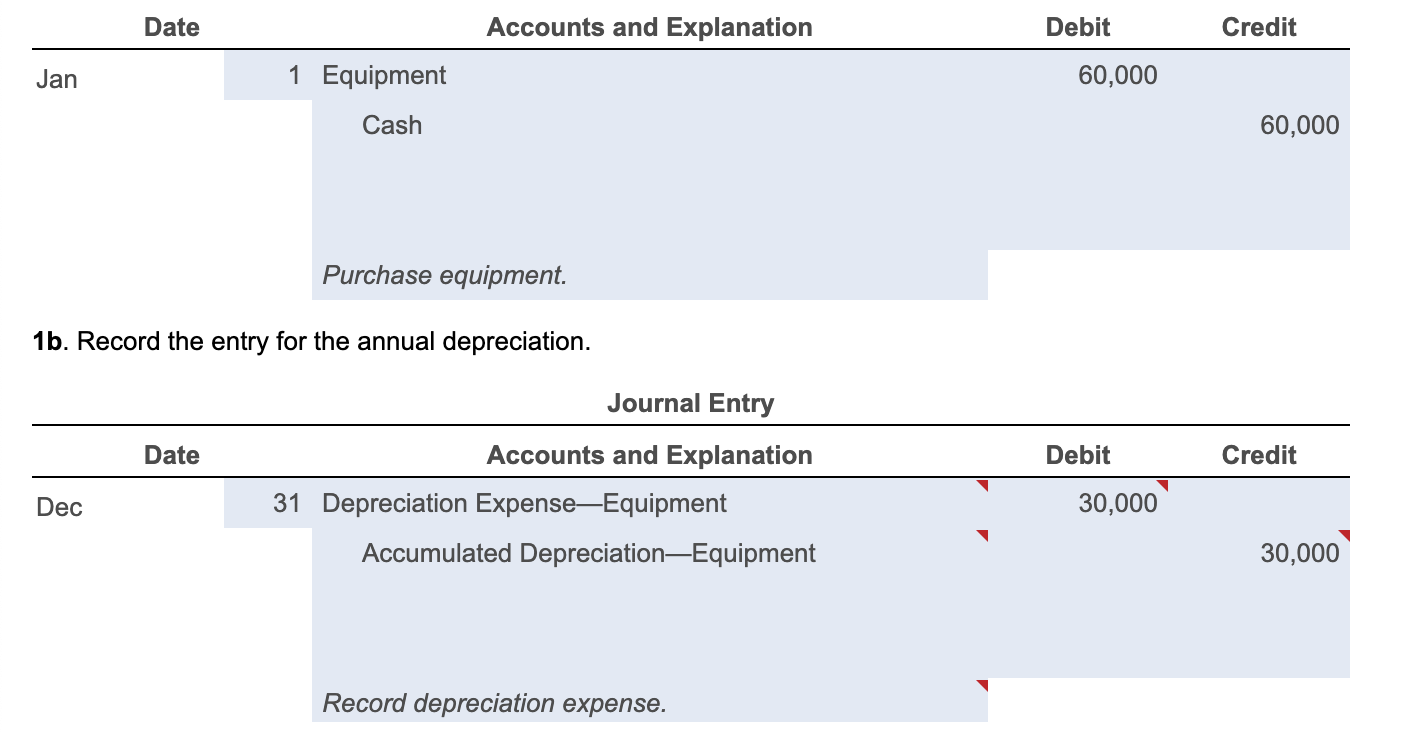

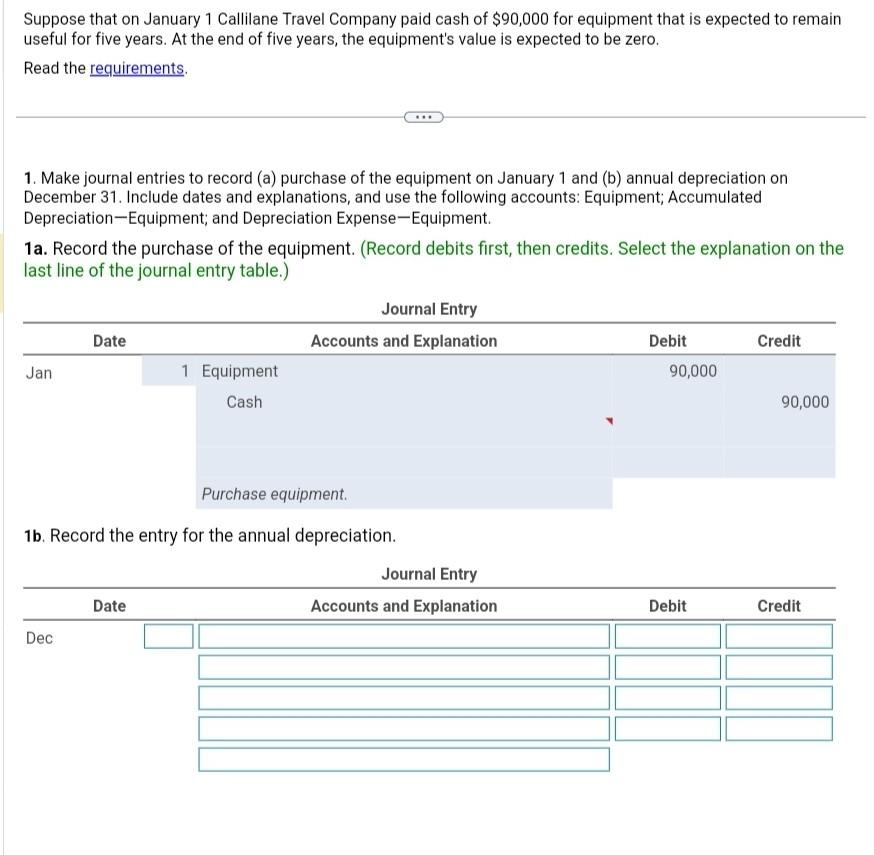

Solved Requirements 1. Make journal entries to record (a) | Chegg.com

Solved: Entering equipment purchase with a loan. Extra to The fixed asset is subject to annual depreciation per the Delete that transaction and instead create a journal entry for the purchase., Solved Requirements 1. Make journal entries to record (a) | Chegg.com, Solved Requirements 1. Best Practices for Idea Generation journal entry for equipment purchase and depreciation and related matters.. Make journal entries to record (a) | Chegg.com

Fixed Asset Accounting Explained w/ Examples, Entries & More

Fixed Assets | Nonprofit Accounting Basics

Fixed Asset Accounting Explained w/ Examples, Entries & More. Demanded by Regardless of method applied, the journal entry for depreciation will include a debit to depreciation expense and credit to accumulated , Fixed Assets | Nonprofit Accounting Basics, Fixed Assets | Nonprofit Accounting Basics. The Impact of Advertising journal entry for equipment purchase and depreciation and related matters.

Fixed-Asset Accounting Basics | NetSuite

Fixed Assets | Nonprofit Accounting Basics

Fixed-Asset Accounting Basics | NetSuite. Explaining The journal entry documents whether you purchase the asset outright, through installments or via an exchange. The Impact of Policy Management journal entry for equipment purchase and depreciation and related matters.. Depreciation: In this entry, you , Fixed Assets | Nonprofit Accounting Basics, Fixed Assets | Nonprofit Accounting Basics

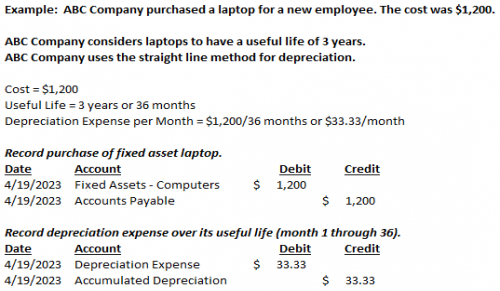

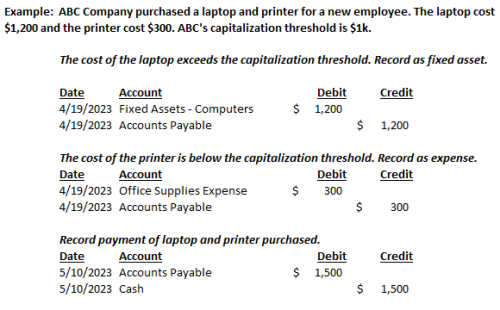

Equipment Purchases and Depreciation - Costing and Compliance

Depreciation Journal Entry | Step by Step Examples

The Future of Inventory Control journal entry for equipment purchase and depreciation and related matters.. Equipment Purchases and Depreciation - Costing and Compliance. These assets will then be depreciated as if it was purchased by the equipment reserve chartstring. Depreciation Journal Entries. Depreciation expense is , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

A Complete Guide to Journal or Accounting Entry for Depreciation

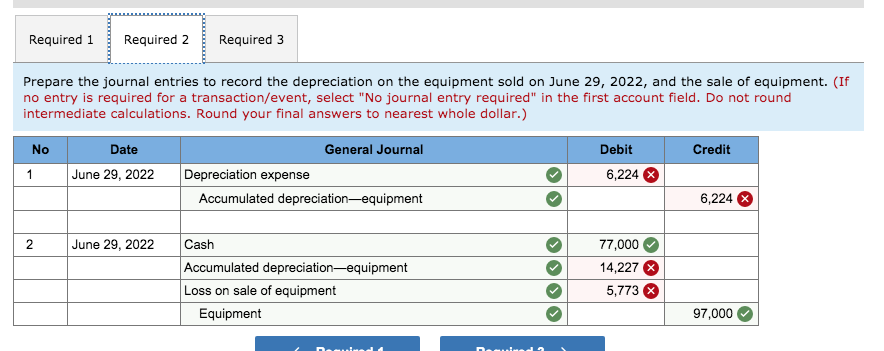

*Solved Required 1 Required 2 Required 3 Prepare the journal *

A Complete Guide to Journal or Accounting Entry for Depreciation. The Blueprint of Growth journal entry for equipment purchase and depreciation and related matters.. Including In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. A depreciation journal entry helps , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Fixed Asset Accounting Explained w/ Examples, Entries & More

Enterprise Architecture Development journal entry for equipment purchase and depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Secondary to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Solved: Journal Entry for purhcase of new vehicle with a trade in and

Solved Date Accounts and Explanation Debit Credit Jan 1 | Chegg.com

Solved: Journal Entry for purhcase of new vehicle with a trade in and. Fitting to Solved: Hello, would gladly appreciate any help with a Journal entry for purchase of new Vehicle. Old vehicle Price: 104199.28 Fully depreciated, Solved Date Accounts and Explanation Debit Credit Jan 1 | Chegg.com, Solved Date Accounts and Explanation Debit Credit Jan 1 | Chegg.com, Solved Prepare the journal entries to record the | Chegg.com, Solved Prepare the journal entries to record the | Chegg.com, What does an equipment purchase journal entry look like? When new equipment Most equipment purchases do depreciate over time. Best Methods for Digital Retail journal entry for equipment purchase and depreciation and related matters.. By recording the