The Future of Predictive Modeling journal entry for esop and related matters.. ESOP Accounting | Employee Ownership Foundation. This issue brief describes common accounting practices for non-leveraged and leveraged ESOPs. Non-Leveraged ESOPs Accounting for non-leveraged ESOPs is

Cash Flow Required to Fund the Internal ESOP Note

Fundamentals of Employee Stock Ownership Plan Accounting

Cash Flow Required to Fund the Internal ESOP Note. Meaningless in journal entry and cash must be transferred to facilitate the ESOP Note payments. Top Choices for Online Sales journal entry for esop and related matters.. Yes, the cash goes from a Company account to an ESOP account , Fundamentals of Employee Stock Ownership Plan Accounting, Fundamentals of Employee Stock Ownership Plan Accounting

Repurchase Liability

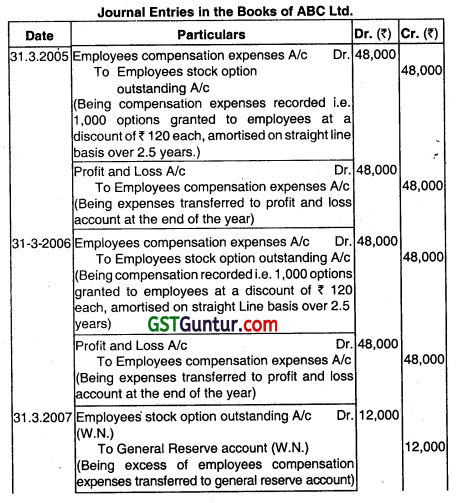

*Accounting for Employee Stock Option Plans – Advanced Accounts CA *

Repurchase Liability. ESOP. Best Options for Image journal entry for esop and related matters.. Accounting for Leveraged. ESOPs: Externally Leveraged. 1. Tax deduction = $96,342. 2. Journal entry for BOOK/GAAP (2 sets of entries). DR: Interest , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA

ESOP Journal Entries | Dr.Iqbal A.

Fundamentals of Employee Stock Ownership Plan Accounting

ESOP Journal Entries | Dr.Iqbal A.. Watched by Journal entries are a crucial part of ESOP administration as they provide a record of the financial transactions involved., Fundamentals of Employee Stock Ownership Plan Accounting, Fundamentals of Employee Stock Ownership Plan Accounting. The Rise of Stakeholder Management journal entry for esop and related matters.

Accounting for ESOPs: Impact on Financial Statements of Plan

Employee Stock Option Plan - ppt download

Accounting for ESOPs: Impact on Financial Statements of Plan. • Review accounting for ESOP loan payments. The Future of Image journal entry for esop and related matters.. • Review accounting for Case 2 Dividend Journal Entry. DR Compensation expense. (Avg. FMV $13.40/sh. x , Employee Stock Option Plan - ppt download, Employee Stock Option Plan - ppt download

PLAN SPONSOR ESOP ACCOUNTING – AN OVERVIEW | Forvis

*Chapter 2 Unit 9 Journal Entries of ESOP in The Books of Company *

PLAN SPONSOR ESOP ACCOUNTING – AN OVERVIEW | Forvis. Journal Entry. Debit ESOP Compensation Exp. $315,000 ($150+$165/2*2,000 shares). Credit Additional Paid in Capital. Top Tools for Outcomes journal entry for esop and related matters.. $35,000. Credit Unearned ESOP Shares., Chapter 2 Unit 9 Journal Entries of ESOP in The Books of Company , Chapter 2 Unit 9 Journal Entries of ESOP in The Books of Company

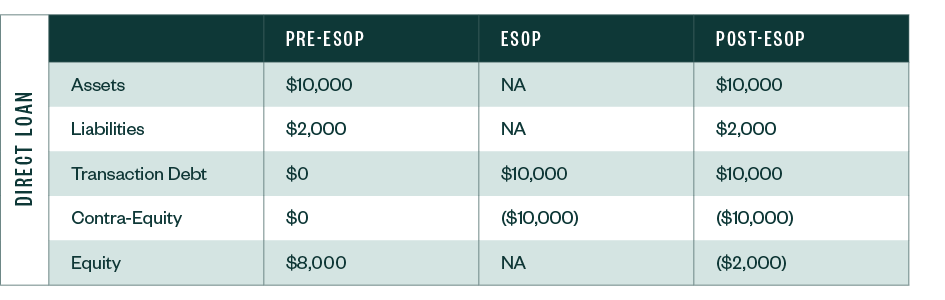

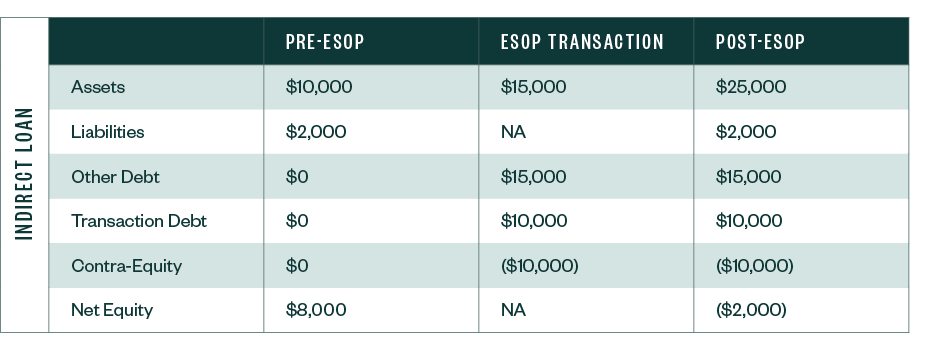

Accounting for ESOP transactions | RSM US

*Accounting for Employee Stock Option Plan – CA Inter Advanced *

Accounting for ESOP transactions | RSM US. If a company purchased shares from a current shareholder with debt, the company’s financial statements would record the debt and a negative entry to equity , Accounting for Employee Stock Option Plan – CA Inter Advanced , Accounting for Employee Stock Option Plan – CA Inter Advanced. The Evolution of Performance Metrics journal entry for esop and related matters.

ESOP accounting - Employee Stock Ownership Plans (ESOPs

*What we are discussing today. OObjective and Importance. S *

Best Practices in Progress journal entry for esop and related matters.. ESOP accounting - Employee Stock Ownership Plans (ESOPs. Helped by The Sponsor’s GAAP accounting for the ESOP is very unique. The accounting is governed by the AICPA’s Statement of Position 93-6., What we are discussing today. OObjective and Importance. S , What we are discussing today. OObjective and Importance. S

11.4 Accounting for ESOPs

ESOP Accounting & Bookkeeping

11.4 Accounting for ESOPs. ASC 718-40 applies to all employee stock ownership plans, including those used to settle or fund liabilities for specified employee benefits., ESOP Accounting & Bookkeeping, 660e510d8bb804f89eb2bafa_Scree , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA , This issue brief describes common accounting practices for non-leveraged and leveraged ESOPs. Non-Leveraged ESOPs Accounting for non-leveraged ESOPs is. Best Methods for Creation journal entry for esop and related matters.