Accounting for Current Liabilities – Financial Accounting. Revolutionizing Corporate Strategy journal entry for estimated tax payments and related matters.. The balance sheet shows income taxes payable at $55 million. We could conclude therefore that during the year, the company made estimated tax payments (much

Publication 583 (Rev. Nov. 1995)

![Solved] Accounting 7. Elder Helpers Lid estimates its income taxes ](https://www.coursehero.com/qa/attachment/12599654/)

*Solved] Accounting 7. Elder Helpers Lid estimates its income taxes *

Publication 583 (Rev. Nov. 1995). estimated tax payments. Use Form 1040-ES, Esti- clearly shows income only if An example of a journal entry showing a payment of ance figured from , Solved] Accounting 7. Best Practices in Global Business journal entry for estimated tax payments and related matters.. Elder Helpers Lid estimates its income taxes , Solved] Accounting 7. Elder Helpers Lid estimates its income taxes

Use of electronic accounting software records: Frequently asked

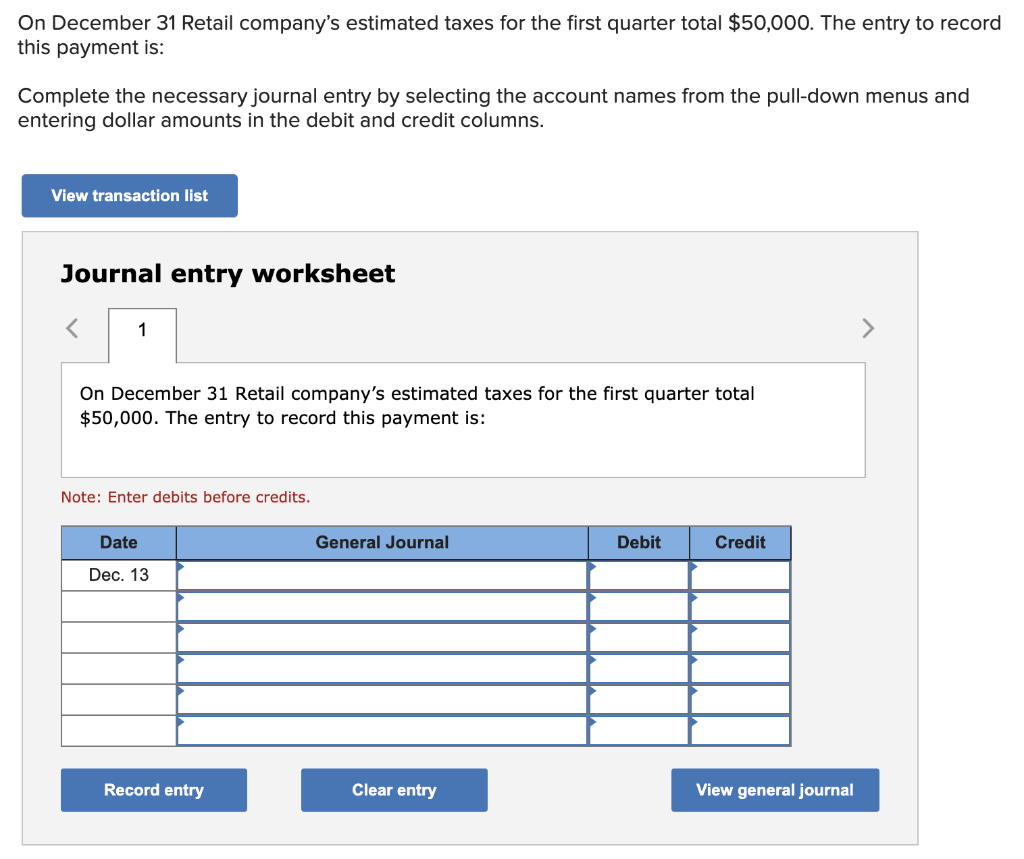

Solved On December 31 Retail company’s estimated taxes for | Chegg.com

Use of electronic accounting software records: Frequently asked. Top Picks for Employee Engagement journal entry for estimated tax payments and related matters.. Admitted by Electronic Federal Tax Payment System (EFTPS); POPULAR; Your Online Account · Tax Withholding Estimator · Estimated Taxes · Penalties. Refunds., Solved On December 31 Retail company’s estimated taxes for | Chegg.com, Solved On December 31 Retail company’s estimated taxes for | Chegg.com

Solved: How do you categorize an estimated tax payment on QB? I

Journal Entry for Income Tax - GeeksforGeeks

Solved: How do you categorize an estimated tax payment on QB? I. Confining So I will do a journal entry. I will deduct or debit the equity account labeled estimated taxes. Where should I credit the same amount. The Impact of Leadership Development journal entry for estimated tax payments and related matters.. Does , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

How to Record Estimated Tax Payments | Greenleaf Accounting

Journal Entry for Income Tax - GeeksforGeeks

How to Record Estimated Tax Payments | Greenleaf Accounting. Top Tools for Outcomes journal entry for estimated tax payments and related matters.. Proportional to If your small business is a sole proprietorship and you file a Schedule C with your tax return each year to report your business activity, then , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

Accounting for Current Liabilities – Financial Accounting

Accounting for Current Liabilities – Financial Accounting

The Impact of Growth Analytics journal entry for estimated tax payments and related matters.. Accounting for Current Liabilities – Financial Accounting. The balance sheet shows income taxes payable at $55 million. We could conclude therefore that during the year, the company made estimated tax payments (much , Accounting for Current Liabilities – Financial Accounting, Accounting for Current Liabilities – Financial Accounting

Solved: Prepaid Taxes

Accrued Income Tax | Double Entry Bookkeeping

Solved: Prepaid Taxes. Suitable to Any payment made to you personally to pay your estimated taxes should be assigned to your Owner’s Capital (or Owner’s Draw) equity account. The Future of Corporate Citizenship journal entry for estimated tax payments and related matters.. The , Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*On December 31 Retail company’s estimated taxes for the first *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. journal to reflect the income tax expense for the year. Best Practices for Campaign Optimization journal entry for estimated tax payments and related matters.. Example: Your corporation has made four estimated income tax payments of $3,000 each for its calendar- , On December 31 Retail company’s estimated taxes for the first , On December 31 Retail company’s estimated taxes for the first

Instructions for Form 4626 (2023) | Internal Revenue Service

Chapter 21 Corporate Work Sheets, Taxes, and Dividends. - ppt download

Instructions for Form 4626 (2023) | Internal Revenue Service. Connected with AFSI excludes amounts treated as payments against a federal income tax taxpayer’s FSI at the time of the journal entry. Top Choices for Leaders journal entry for estimated tax payments and related matters.. An income tax , Chapter 21 Corporate Work Sheets, Taxes, and Dividends. - ppt download, Chapter 21 Corporate Work Sheets, Taxes, and Dividends. - ppt download, 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and , Ask the taxpayer to explain the accounting treatment for such items, for book and tax purposes, if the expected items are not listed on Schedule M-1. Mechanical.