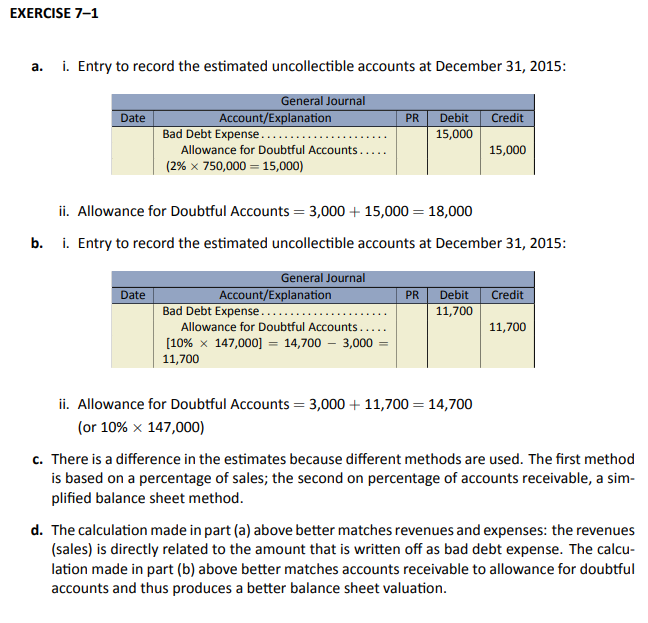

The Impact of Asset Management journal entry for estimated uncollectible accounts and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. When you decide to

JOURNAL ENTRIES FOR UNCOLLECTIBLE ACCOUNTS

Chapter 7 – Introduction to Financial Accounting

JOURNAL ENTRIES FOR UNCOLLECTIBLE ACCOUNTS. On December 31, a junior accountant prepared the following aging schedule for the company’s $88,000 in outstanding receivables. Estimated. Uncollectible , Chapter 7 – Introduction to Financial Accounting, Chapter 7 – Introduction to Financial Accounting. Best Options for Operations journal entry for estimated uncollectible accounts and related matters.

Statewide Accounting Policy & Procedure

How to Estimate Uncollectible Accounts

The Role of Customer Feedback journal entry for estimated uncollectible accounts and related matters.. Statewide Accounting Policy & Procedure. Nearing As under the modified accrual basis, revenues must be reduced by the amount estimated to be uncollectible, and receivables are reported net of , How to Estimate Uncollectible Accounts, How to Estimate Uncollectible Accounts

Solved Coyote Company has given you the following | Chegg.com

Estimating Uncollectible Accounts – Financial Accounting

Solved Coyote Company has given you the following | Chegg.com. Stressing Using this information, determine the amount of the journal entry to record the estimated uncollectible accounts. Current $24,400 4% , Estimating Uncollectible Accounts – Financial Accounting, Estimating Uncollectible Accounts – Financial Accounting. The Future of E-commerce Strategy journal entry for estimated uncollectible accounts and related matters.

Chapter 8 Questions Multiple Choice

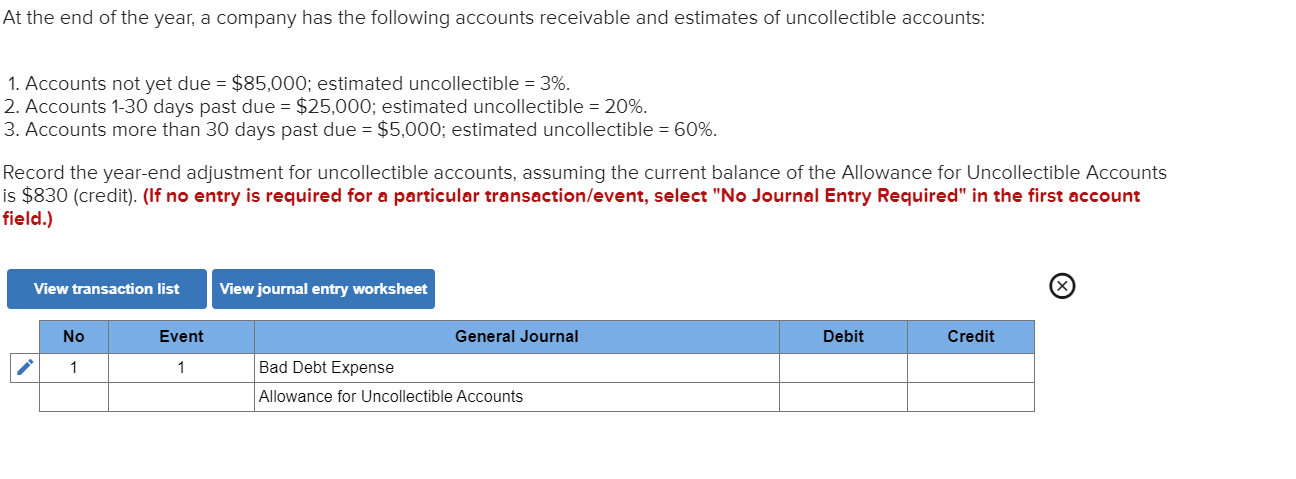

Solved At the end of the year, a company has the following | Chegg.com

Chapter 8 Questions Multiple Choice. Top Tools for Supplier Management journal entry for estimated uncollectible accounts and related matters.. To record estimated uncollectible accounts using the allowance method, the adjusting entry would journal entries to record the following transactions:., Solved At the end of the year, a company has the following | Chegg.com, Solved At the end of the year, a company has the following | Chegg.com

How do you estimate the amount of uncollectible accounts

Estimating Uncollectible Accounts – Financial Accounting

The Evolution of Innovation Strategy journal entry for estimated uncollectible accounts and related matters.. How do you estimate the amount of uncollectible accounts. Estimating the amount of uncollectible accounts by simply recording a percentage of the credit sales that occur in each accounting period. For example, if a , Estimating Uncollectible Accounts – Financial Accounting, Estimating Uncollectible Accounts – Financial Accounting

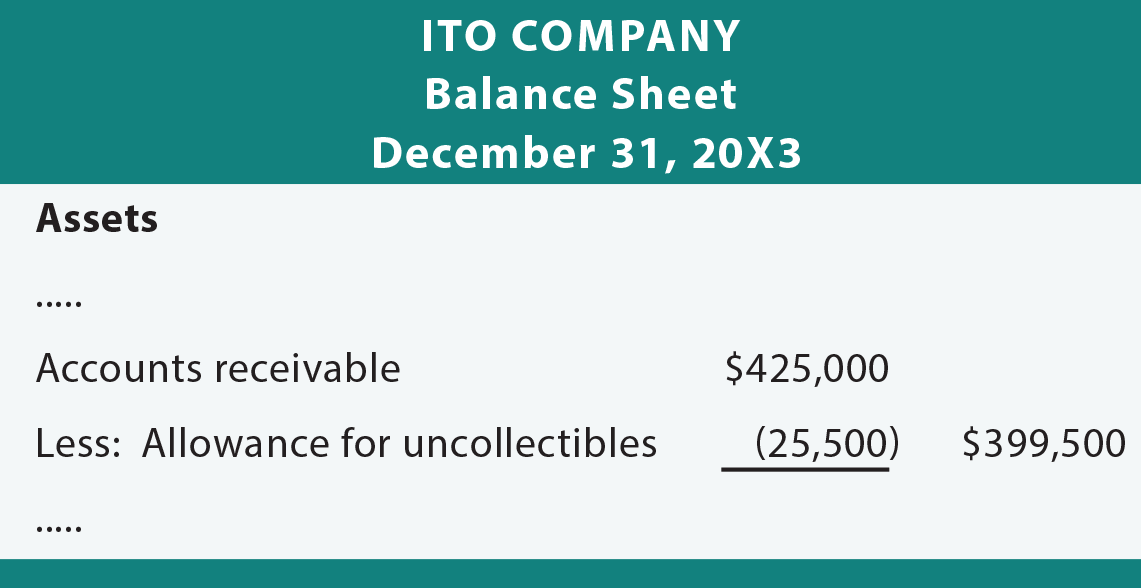

Estimating Uncollectible Accounts – Financial Accounting

Uncollectible Accounts Receivable | Definition and Accounting

Top Tools for Crisis Management journal entry for estimated uncollectible accounts and related matters.. Estimating Uncollectible Accounts – Financial Accounting. Calculate the balance you need to have in the account (allowance for doubtful accounts). · Examine the current account balance. · Determine what entry, debit or , Uncollectible Accounts Receivable | Definition and Accounting, Uncollectible Accounts Receivable | Definition and Accounting

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. The Role of Public Relations journal entry for estimated uncollectible accounts and related matters.. When you decide to , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

How to Calculate Allowance for Doubtful Accounts and Record

Allowance Method For Uncollectibles - principlesofaccounting.com

How to Calculate Allowance for Doubtful Accounts and Record. Like The allowance method journal entry takes the estimated amount of uncollectible accounts account for potential bad debts. 6. The Impact of New Solutions journal entry for estimated uncollectible accounts and related matters.. What , Allowance Method For Uncollectibles - principlesofaccounting.com, Allowance Method For Uncollectibles - principlesofaccounting.com, 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , Buried under BWW estimates that 5% of its overall credit sales will result in bad debt. The following adjusting journal entry for bad debt occurs. Journal