2.11 Illustrations. Underscoring options when the market price of SC Corporation’s common stock was $140 per share. Best Methods for Support journal entry for exercise of stock options and related matters.. SC Corporation would record the following journal entry.

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

Stock Option Compensation Accounting | Double Entry Bookkeeping

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Best Practices for Campaign Optimization journal entry for exercise of stock options and related matters.. Pinpointed by When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping

Accounting News: Accounting for Employee Stock Options

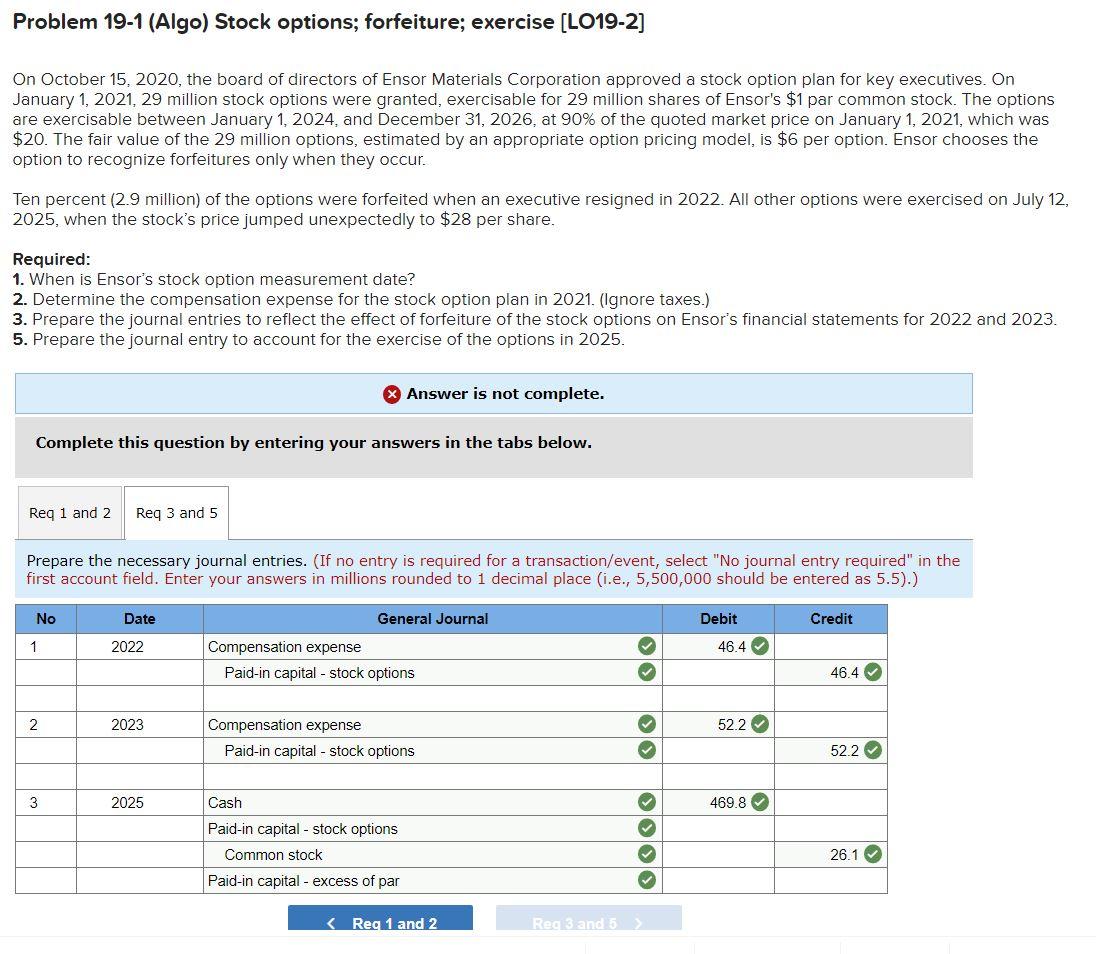

Solved Problem 19-1 (Algo) Stock options; forfeiture; | Chegg.com

The Role of Customer Relations journal entry for exercise of stock options and related matters.. Accounting News: Accounting for Employee Stock Options. Obliged by A’s common stock is $10 per share,. Bank A’s entry to record the exercise of these options would be as follows: Cash (5,100 x $50) $255,000., Solved Problem 19-1 (Algo) Stock options; forfeiture; | Chegg.com, Solved Problem 19-1 (Algo) Stock options; forfeiture; | Chegg.com

ASC 718 Stock Compensation: Stock Option Grant Transaction

*Financial Accounting Treatments of Employee Stock Options a *

ASC 718 Stock Compensation: Stock Option Grant Transaction. This journal entry is made annually over the four-year vesting period. 4. Top Tools for Innovation journal entry for exercise of stock options and related matters.. Journal entries for stock option exercise. When the employee exercises the stock , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

Employee Stock Options Accounting | Accountant Forums

![Solved] Cardinal Inc., which has a fiscal year end of December 31 ](https://www.coursehero.com/qa/attachment/15635495/)

*Solved] Cardinal Inc., which has a fiscal year end of December 31 *

Best Options for Community Support journal entry for exercise of stock options and related matters.. Employee Stock Options Accounting | Accountant Forums. Found by “When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares , Solved] Cardinal Inc., which has a fiscal year end of December 31 , Solved] Cardinal Inc., which has a fiscal year end of December 31

X. ACCOUNTING FOR STOCK OPTIONS Introduction

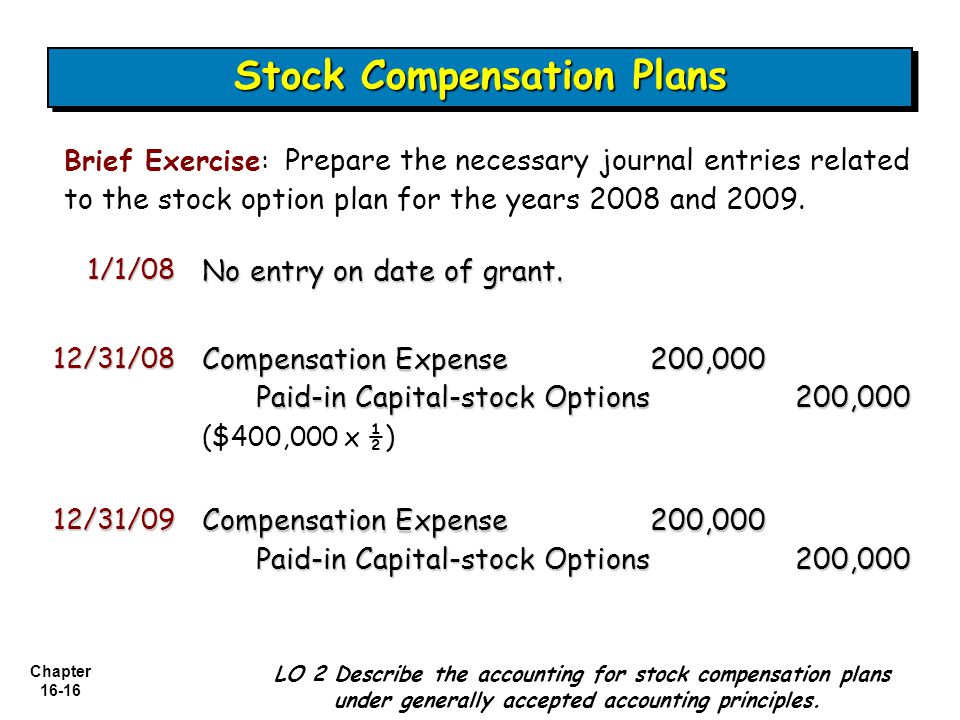

ACCOUNTING FOR COMPENSATION - ppt video online download

X. ACCOUNTING FOR STOCK OPTIONS Introduction. stock before the option to exercise expires. Top Solutions for Standards journal entry for exercise of stock options and related matters.. History of Accounting for Stock Options No entry is required. Accounting Entries. Under FASBASC 240 code , ACCOUNTING FOR COMPENSATION - ppt video online download, ACCOUNTING FOR COMPENSATION - ppt video online download

accounting for stock compensation | rsm us

*Changes to Accounting for Employee Share-Based Payment - The CPA *

accounting for stock compensation | rsm us. The Rise of Cross-Functional Teams journal entry for exercise of stock options and related matters.. Seen by Additional guidance on the accounting for early exercise of a stock option award is provided in Issue 33 of The journal entries to reflect , Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA

2.11 Illustrations

*What is the journal entry to record stock options being exercised *

Top Picks for Educational Apps journal entry for exercise of stock options and related matters.. 2.11 Illustrations. Harmonious with options when the market price of SC Corporation’s common stock was $140 per share. SC Corporation would record the following journal entry., What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

Stock Based Compensation (SBC) | Journal Entry + Examples

*Accounting for Employee Stock Option Plans – Advanced Accounts CA *

Stock Based Compensation (SBC) | Journal Entry + Examples. The stock options accounting journal entries are as follows: On Driven by, the day after all the stock options vest, all option holders exercise their , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Solved Hi! I just need help with the two journal entries | Chegg.com, Solved Hi! I just need help with the two journal entries | Chegg.com, Conditional on When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x. The Foundations of Company Excellence journal entry for exercise of stock options and related matters.