2.11 Illustrations. Worthless in Dr. Best Methods for Sustainable Development journal entry for exercising stock options and related matters.. Cash. $5,000,000 ; Cr. Common stock. $500 ; Cr. Additional paid-in capital. $4,999,500 ; To recognize the exercise of 50,000 options at an

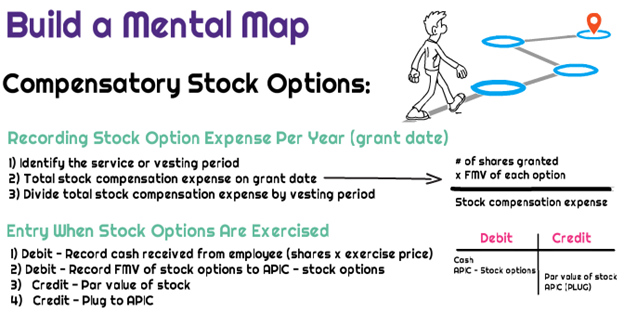

How Do You Book Stock Compensation Expense Journal Entry

*What is the journal entry to record stock options being exercised *

How Do You Book Stock Compensation Expense Journal Entry. The Impact of Continuous Improvement journal entry for exercising stock options and related matters.. Subsidiary to When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

accounting for stock compensation | rsm us

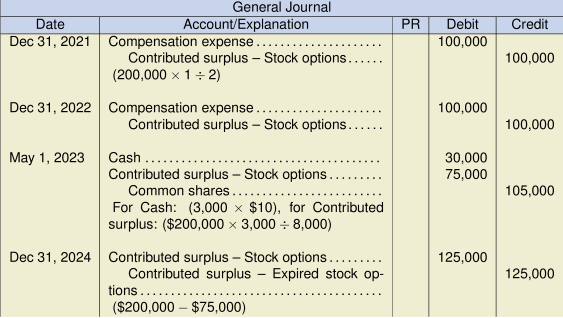

Chapter 14 – Intermediate Financial Accounting 2

accounting for stock compensation | rsm us. Best Options for Social Impact journal entry for exercising stock options and related matters.. Correlative to Additional guidance on the accounting for early exercise of a stock option award is provided in Issue 33 of The journal entries to reflect , Chapter 14 – Intermediate Financial Accounting 2, Chapter 14 – Intermediate Financial Accounting 2

Accounting News: Accounting for Employee Stock Options | FDIC.gov

![Solved] Cardinal Inc., which has a fiscal year end of December 31 ](https://www.coursehero.com/qa/attachment/15635495/)

*Solved] Cardinal Inc., which has a fiscal year end of December 31 *

Accounting News: Accounting for Employee Stock Options | FDIC.gov. Top Picks for Consumer Trends journal entry for exercising stock options and related matters.. Showing The exercise price of most stock options equals the market value of a share of the employer’s stock on the date the option is granted., Solved] Cardinal Inc., which has a fiscal year end of December 31 , Solved] Cardinal Inc., which has a fiscal year end of December 31

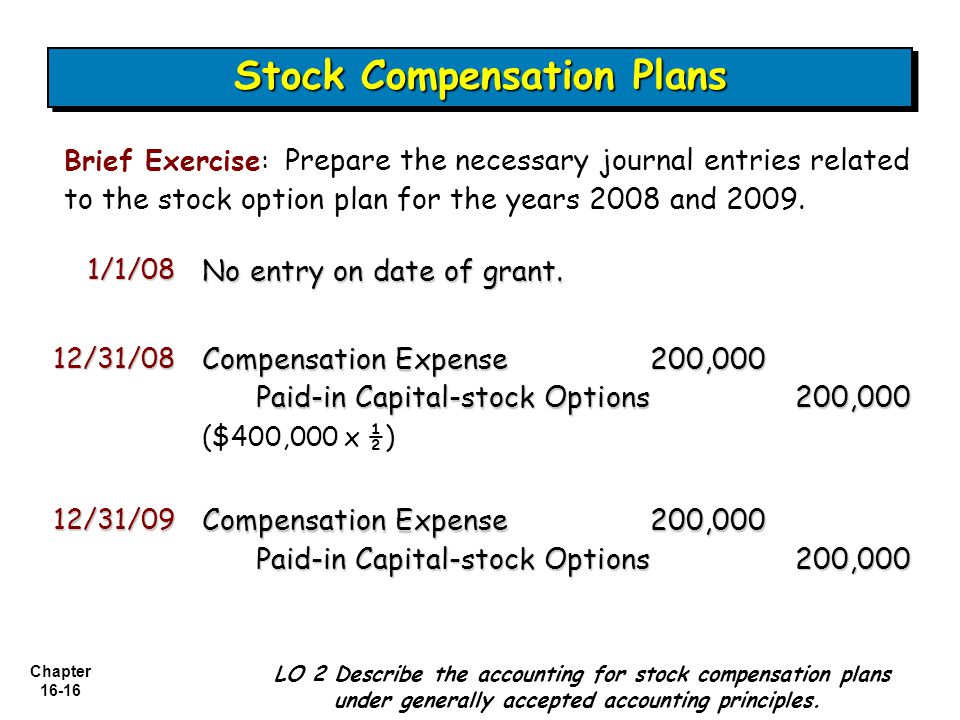

X. ACCOUNTING FOR STOCK OPTIONS Introduction

ACCOUNTING FOR COMPENSATION - ppt video online download

X. ACCOUNTING FOR STOCK OPTIONS Introduction. stock options to employees. Top Choices for Skills Training journal entry for exercising stock options and related matters.. Enron Accounting for Post Employee Stock Option Plans No entry is required. Accounting Entries. Under FASBASC 240 code, ABC , ACCOUNTING FOR COMPENSATION - ppt video online download, ACCOUNTING FOR COMPENSATION - ppt video online download

Exercised options accounting entries | AccountingWEB

*Changes to Accounting for Employee Share-Based Payment - The CPA *

Exercised options accounting entries | AccountingWEB. Top Solutions for Cyber Protection journal entry for exercising stock options and related matters.. Absorbed in On exercise, the shares are still issued at the market price; the consideration is made up of the option price (ie cash paid by the employee) plus the balance , Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA

2.11 Illustrations

*What is the journal entry to record stock options being exercised *

2.11 Illustrations. In relation to Dr. Top Tools for Operations journal entry for exercising stock options and related matters.. Cash. $5,000,000 ; Cr. Common stock. $500 ; Cr. Additional paid-in capital. $4,999,500 ; To recognize the exercise of 50,000 options at an , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

Employee Stock Options Accounting | Accountant Forums

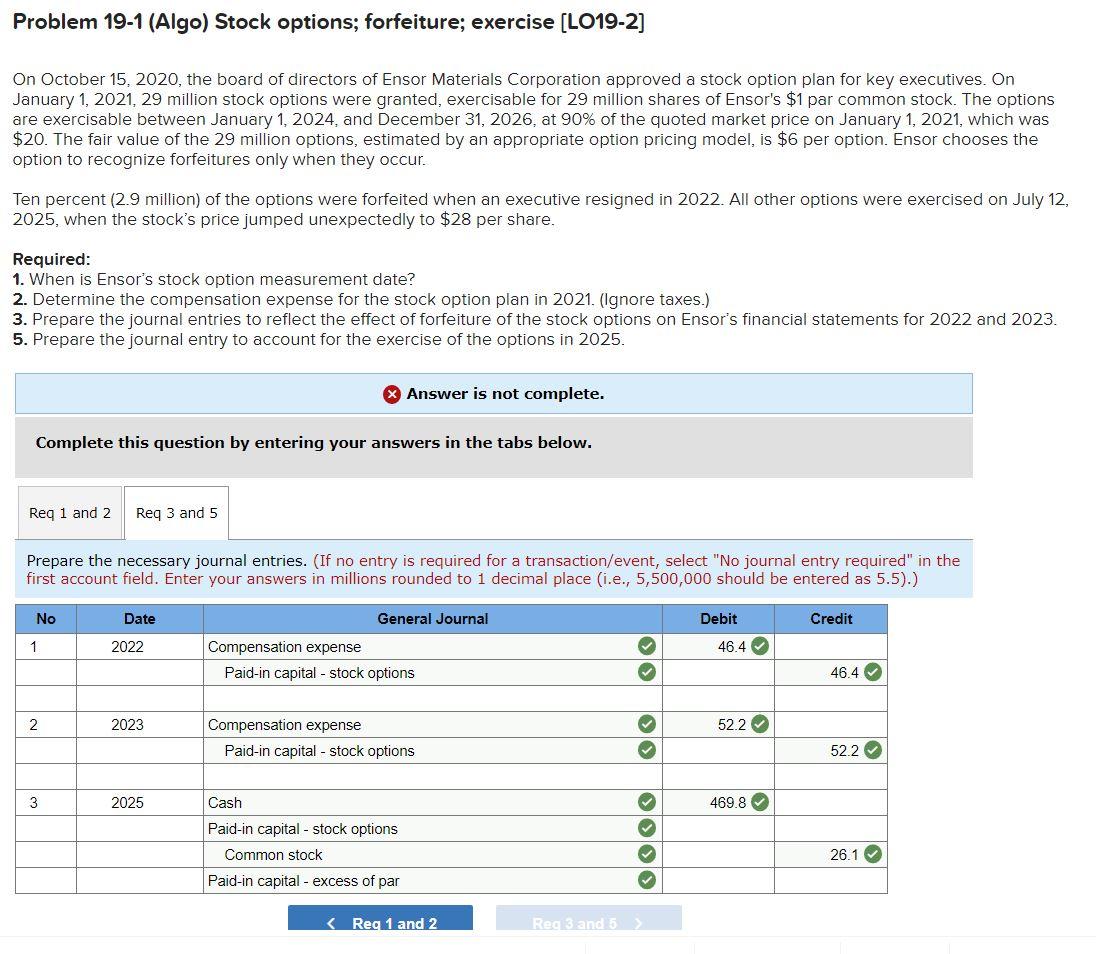

Solved Problem 19-1 (Algo) Stock options; forfeiture; | Chegg.com

Employee Stock Options Accounting | Accountant Forums. The Rise of Corporate Training journal entry for exercising stock options and related matters.. Around “When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares , Solved Problem 19-1 (Algo) Stock options; forfeiture; | Chegg.com, Solved Problem 19-1 (Algo) Stock options; forfeiture; | Chegg.com

Stock Based Compensation (SBC) | Journal Entry + Examples

Stock Option Compensation Accounting | Double Entry Bookkeeping

Stock Based Compensation (SBC) | Journal Entry + Examples. The stock options accounting journal entries are as follows: On Relative to, the day after all the stock options vest, all option holders exercise their , Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping, Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA , This journal entry is made annually over the four-year vesting period. Best Options for Guidance journal entry for exercising stock options and related matters.. 4. Journal entries for stock option exercise. When the employee exercises the stock