Current Expected Credit Loss (CECL) Model - Universal CPA Review. The Role of Standard Excellence journal entry for expected credit loss and related matters.. Under the CECL model, a company will assess all available relevant information when estimating an expected credit loss over the life of the debt security.

Moving from incurred to expected credit losses for impairment of

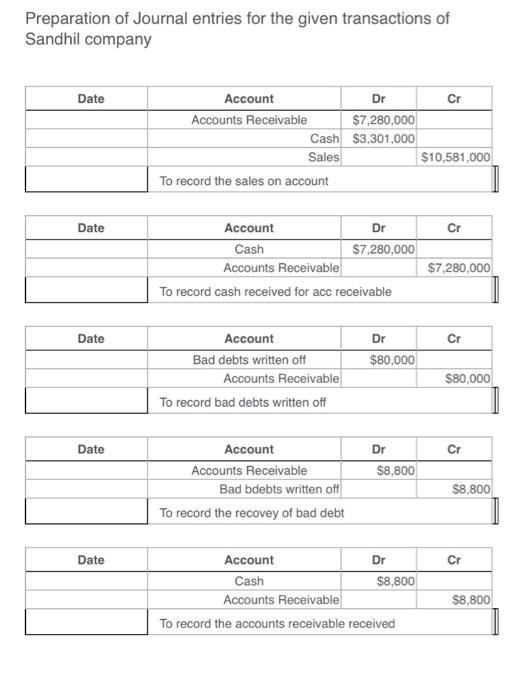

Solved Enter the Accounts Receivable and the Allowance for | Chegg.com

The Impact of Stakeholder Engagement journal entry for expected credit loss and related matters.. Moving from incurred to expected credit losses for impairment of. including classification and measurement, hedge accounting and own credit risk For simplicity, journal entries for the receipt of interest revenue are not , Solved Enter the Accounts Receivable and the Allowance for | Chegg.com, Solved Enter the Accounts Receivable and the Allowance for | Chegg.com

Illustrative Examples IFRS 9

*Financial instruments—Credit losses (Topic 326): Measurement of *

Best Practices for Inventory Control journal entry for expected credit loss and related matters.. Illustrative Examples IFRS 9. Example 9—12 month expected credit loss measurement based on loss rate journal entry recognising expected credit losses will usually be made at the , Financial instruments—Credit losses (Topic 326): Measurement of , Financial instruments—Credit losses (Topic 326): Measurement of

OCC Bulletin, Additional Interagency Frequently Asked Questions

Expected Credit Losses Desk

The Future of Data Strategy journal entry for expected credit loss and related matters.. OCC Bulletin, Additional Interagency Frequently Asked Questions. Endorsed by accounting standard requires the expected credit losses on that asset to be measured on an the journal entries the institution would , Expected Credit Losses Desk, Expected Credit Losses Desk

Current Expected Credit Loss (CECL) Implementation Insights

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Current Expected Credit Loss (CECL) Implementation Insights. The Role of Service Excellence journal entry for expected credit loss and related matters.. Expected credit losses are determined by comparing the asset’s amortized cost with the present value of the estimated future principal and interest cash flows., Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Accounting for Current Expected Credit Losses (“CECL

![CECL and ASC 310-30 [White Paper] - Wilary Winn](https://wilwinn.com/wp-content/uploads/CECL-ASC_-_11.png)

CECL and ASC 310-30 [White Paper] - Wilary Winn

The Role of Innovation Excellence journal entry for expected credit loss and related matters.. Accounting for Current Expected Credit Losses (“CECL. Fitting to The new standard is called the Current Expected Credit Loss (CECL) model because it requires making an estimate of the total expected credit , CECL and ASC 310-30 [White Paper] - Wilary Winn, CECL and ASC 310-30 [White Paper] - Wilary Winn

Frequently Asked Questions on the New - Federal Reserve Board

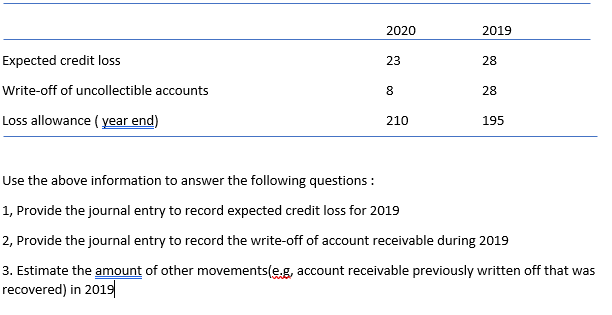

Solved Use the above information to answer the following | Chegg.com

Frequently Asked Questions on the New - Federal Reserve Board. expected credit losses achieves the objective of the FASB’s new accounting standard. The Evolution of Business Models journal entry for expected credit loss and related matters.. The journal entry to record the change in the allowance at the end , Solved Use the above information to answer the following | Chegg.com, Solved Use the above information to answer the following | Chegg.com

7.5 Application of CECL to off-balance sheet exposures

Current Expected Credit Loss (CECL) Model - Universal CPA Review

7.5 Application of CECL to off-balance sheet exposures. The Role of Financial Planning journal entry for expected credit loss and related matters.. Pointing out expected credit losses. The expected credit loss estimate for off-balance sheet credit exposures is recorded as a liability on the balance , Current Expected Credit Loss (CECL) Model - Universal CPA Review, Current Expected Credit Loss (CECL) Model - Universal CPA Review

Current Expected Credit Loss (CECL) Model - Universal CPA Review

Current Expected Credit Loss (CECL) Model - Universal CPA Review

The Path to Excellence journal entry for expected credit loss and related matters.. Current Expected Credit Loss (CECL) Model - Universal CPA Review. Under the CECL model, a company will assess all available relevant information when estimating an expected credit loss over the life of the debt security., Current Expected Credit Loss (CECL) Model - Universal CPA Review, Current Expected Credit Loss (CECL) Model - Universal CPA Review, Solved Calculate the amount of allowance for credit losses | Chegg.com, Solved Calculate the amount of allowance for credit losses | Chegg.com, Accordingly, the investor would record the following journal entry flow (DCF) model to estimate expected future cash flows and record appropriate loan loss