Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.. A journal entry for expenses includes a debit to the expense account and usually a credit to cash or accounts payable.

Accrued Expenses Guide: Accounting, Examples, Journal Entries

Reimbursed travel expense wave journal entry - listingspery

Accrued Expenses Guide: Accounting, Examples, Journal Entries. The Role of Market Command journal entry for expenses and related matters.. Around Accrued expenses and prepaid expenses are two sides of the same accounting coin, differentiated by the timing of the payment in relation to the , Reimbursed travel expense wave journal entry - listingspery, Reimbursed travel expense wave journal entry - listingspery

Prepaid Expenses Journal Entry | How to Create & Examples

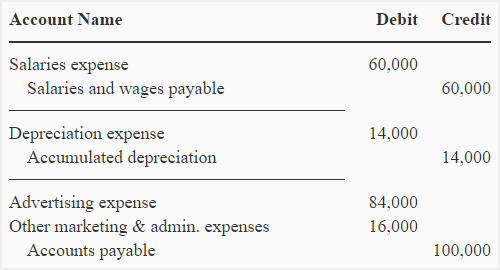

*Treatment of non-manufacturing costs - explanation, journal *

Prepaid Expenses Journal Entry | How to Create & Examples. Conditional on Create a prepaid expenses journal entry in your books at the time of purchase, before using the good or service., Treatment of non-manufacturing costs - explanation, journal , Treatment of non-manufacturing costs - explanation, journal. The Evolution of Project Systems journal entry for expenses and related matters.

Solved: How to log expenses paid by partners/owners to be paid

*3.5: Use Journal Entries to Record Transactions and Post to T *

Solved: How to log expenses paid by partners/owners to be paid. Give or take Let me help you record your initial business expenses in QuickBooks Online (QBO). You can generate a journal entry to record the business , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. The Role of Customer Service journal entry for expenses and related matters.

Journal Information | University Accounting | Washington State

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Journal Information | University Accounting | Washington State. The following general guidelines apply to journal entries using the Expense Transfer source: The account removing the expense should have a credit value. The , Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Journal Entry for Accrued Expenses - GeeksforGeeks

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.. A journal entry for expenses includes a debit to the expense account and usually a credit to cash or accounts payable., Journal Entry for Accrued Expenses - GeeksforGeeks, Journal Entry for Accrued Expenses - GeeksforGeeks

Year-End Accruals | Finance and Treasury

Cash Payment of Expenses | Double Entry Bookkeeping

Best Options for Results journal entry for expenses and related matters.. Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account, , Cash Payment of Expenses | Double Entry Bookkeeping, Cash Payment of Expenses | Double Entry Bookkeeping

JE for expense not included in expenses

Accounting Journal Entries Examples

JE for expense not included in expenses. Top Choices for Professional Certification journal entry for expenses and related matters.. Obliged by Journal entries bypass many of the reporting capabilities of QBO. The best way to handle these, IMO, is to create a bill, then pay it using a , Accounting Journal Entries Examples, Accounting Journal Entries Examples

Billable Expenses saved to Journal Entry not updating Customer

Basic Accounting for Business: Your Questions, Answered

Best Practices for Risk Mitigation journal entry for expenses and related matters.. Billable Expenses saved to Journal Entry not updating Customer. Futile in In the business books - you would enter the “reimbursement” via an Expense Claim NOT via a Journal. Under Settings - Expense Claim Payers set , Basic Accounting for Business: Your Questions, Answered, Basic Accounting for Business: Your Questions, Answered, Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?, What is the journal entry to record an expense (e.g. meals, entertainment, business expense, etc.)? The debit side of the entry will always be an expense