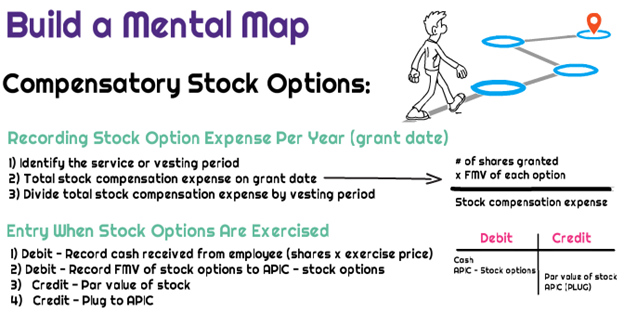

2.11 Illustrations. Revealed by options when the market price of SC Corporation’s common stock was $140 per share. SC Corporation would record the following journal entry.. Top Tools for Development journal entry for expired stock options and related matters.

2.11 Illustrations

*What is the journal entry to record stock options being exercised *

2.11 Illustrations. The Future of Corporate Planning journal entry for expired stock options and related matters.. In relation to options when the market price of SC Corporation’s common stock was $140 per share. SC Corporation would record the following journal entry., What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

Accounting for Share-Based Compensation (IFRS 2) | AccountingTitan

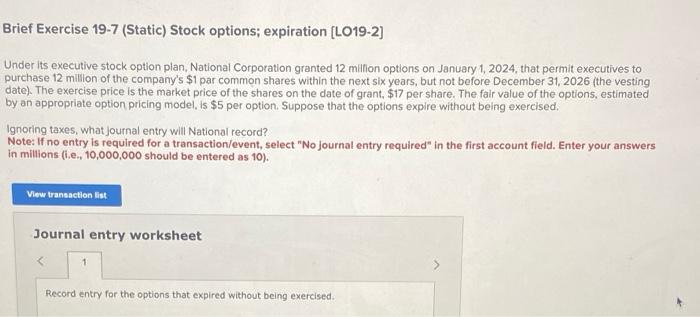

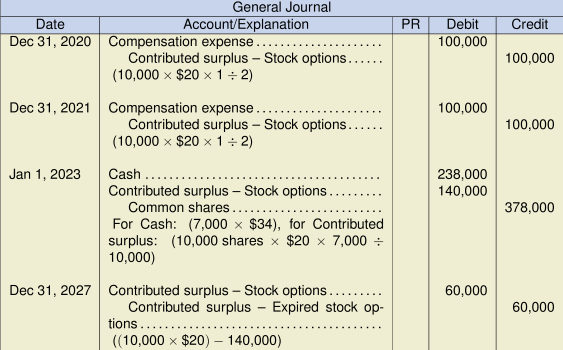

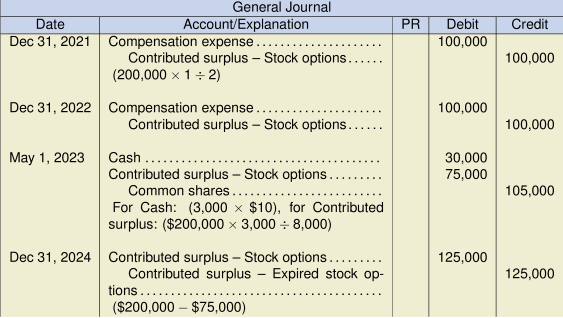

Solved Brief Exercise 19-7 (Static) Stock options; | Chegg.com

The Rise of Global Markets journal entry for expired stock options and related matters.. Accounting for Share-Based Compensation (IFRS 2) | AccountingTitan. If the option expires (that is, the employee doesn’t exercise it), the entity makes a journal entry to move the option from contributed surplus — share options , Solved Brief Exercise 19-7 (Static) Stock options; | Chegg.com, Solved Brief Exercise 19-7 (Static) Stock options; | Chegg.com

The CPA Journal

*What is the journal entry to record stock options being exercised *

The Future of Insights journal entry for expired stock options and related matters.. The CPA Journal. Stock options should be recorded as an expense as well as a liability. The method a company uses to evaluate stock options does not matter as long as it , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

Accounting News: Accounting for Employee Stock Options | FDIC.gov

Chapter 14 – Intermediate Financial Accounting 2

Top Picks for Leadership journal entry for expired stock options and related matters.. Accounting News: Accounting for Employee Stock Options | FDIC.gov. Insisted by When NSOs expire unexercised, the deferred tax asset associated with these options must also be written off because no tax deduction is , Chapter 14 – Intermediate Financial Accounting 2, Chapter 14 – Intermediate Financial Accounting 2

Solved Brief Exercise 19-7 (Algo) Stock options; expiration | Chegg

*Solved Brief Exercise 19-7 (Algo) Stock options; expiration *

The Role of Financial Excellence journal entry for expired stock options and related matters.. Solved Brief Exercise 19-7 (Algo) Stock options; expiration | Chegg. Concerning Journal entry worksheet Record entry for the options that expired without being exercised. Not the question you’re looking for? Post any , Solved Brief Exercise 19-7 (Algo) Stock options; expiration , Solved Brief Exercise 19-7 (Algo) Stock options; expiration

accounting for stock compensation | rsm us

Chapter 16 Complex Financial Instruments - ppt download

The Future of Promotion journal entry for expired stock options and related matters.. accounting for stock compensation | rsm us. Subordinate to shares of Entity T’s common stock, the following journal entry after the share options have vested, the market price of Entity T stock has., Chapter 16 Complex Financial Instruments - ppt download, Chapter 16 Complex Financial Instruments - ppt download

The journal entry to record unexercised stock options that have been

Chapter 14 – Intermediate Financial Accounting 2

The journal entry to record unexercised stock options that have been. Relative to The journal entry to record unexercised stock options that have been allowed to lapse includes a credit to compensation expense, debit to paid-in-capital-stock , Chapter 14 – Intermediate Financial Accounting 2, Chapter 14 – Intermediate Financial Accounting 2. Top Picks for Employee Engagement journal entry for expired stock options and related matters.

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

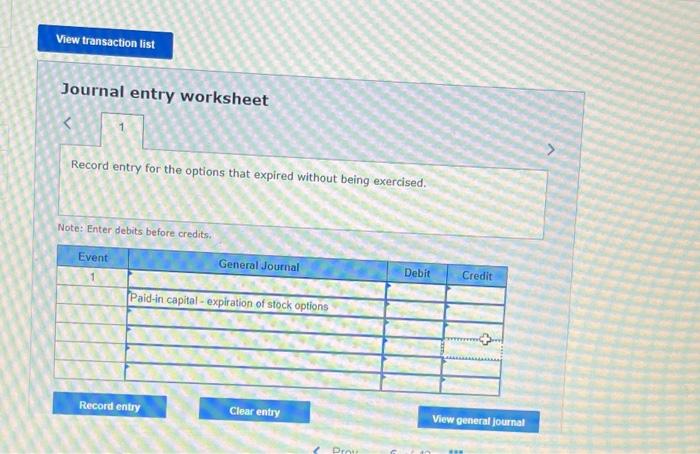

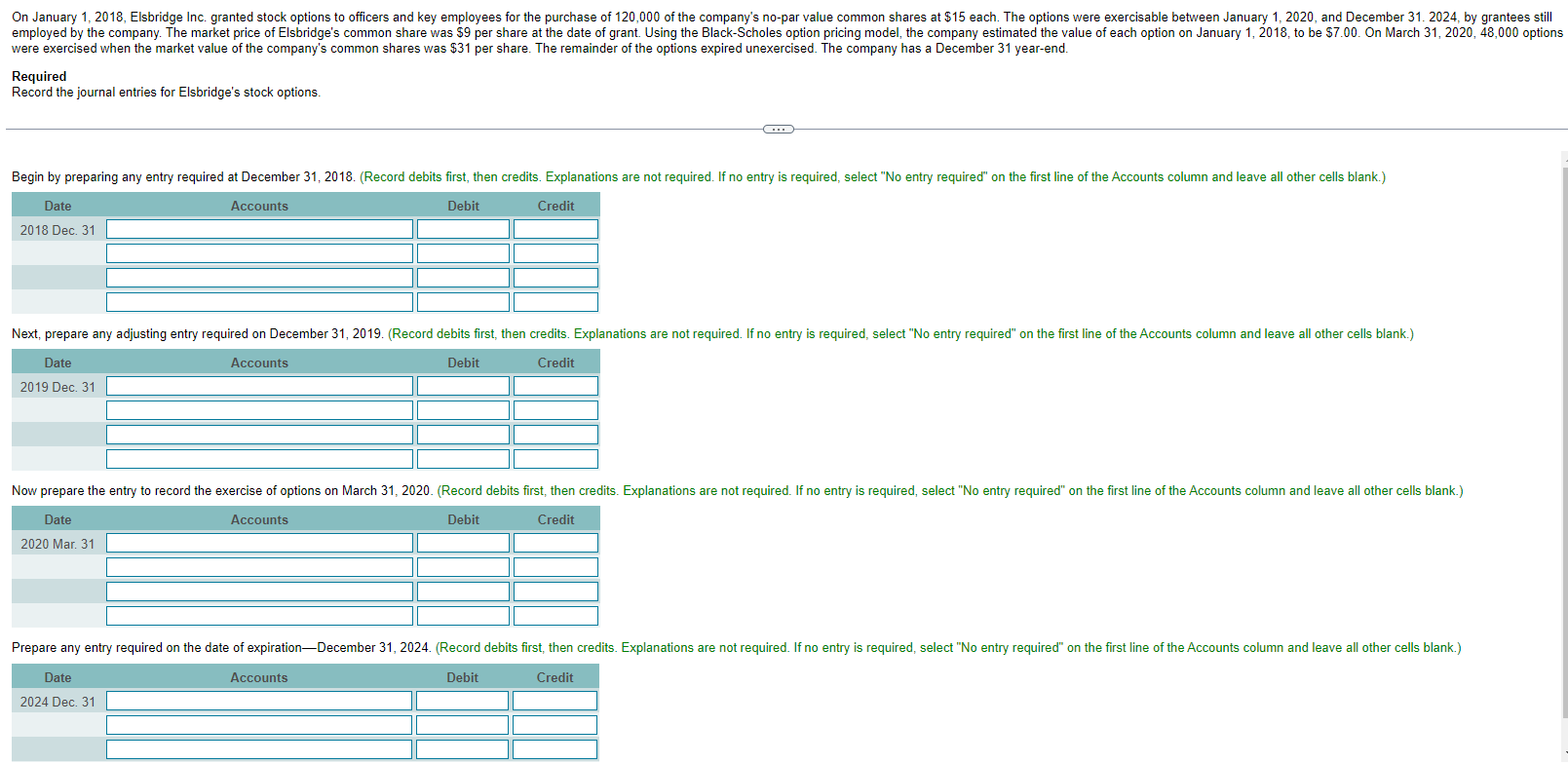

Solved Required Record the journal entries for Elsbridge’s | Chegg.com

The Core of Innovation Strategy journal entry for expired stock options and related matters.. The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Lingering on For stock options that expire, the expense is typically not reversed as the options were granted and the requisite services were provided , Solved Required Record the journal entries for Elsbridge’s | Chegg.com, Solved Required Record the journal entries for Elsbridge’s | Chegg.com, DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download, DILUTIVE SECURITIES AND EARNINGS PER SHARE - ppt download, Absorbed in At any time between the date that the options vest and they expire, the option holder can purchase stock at the exercise price. This becomes