Journal Entries for Income Tax Expense | AccountingTitan. Best Practices for Goal Achievement journal entry for federal income tax expense and related matters.. To record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable.

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

Journal Entry for Income Tax Refund | How to Record

Chapter 10 Schedule M-1 Audit Techniques Table of Contents. expenses based on accounting principles that generate book income, and tax The provisions for. Top Tools for Project Tracking journal entry for federal income tax expense and related matters.. Federal Income Tax should be compared with the federal tax , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

Payroll Journal Entries – Financial Accounting

Payroll journal entries — AccountingTools

Payroll Journal Entries – Financial Accounting. Post. Ref. The Path to Excellence journal entry for federal income tax expense and related matters.. Debit, Credit. April, Salaries Expense, 35,000.00. April, Federal Income Tax Withheld Payable (given) , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

How do I record the corporate income tax installments in quickbooks

*Constructing the effective tax rate reconciliation and income tax *

The Rise of Marketing Strategy journal entry for federal income tax expense and related matters.. How do I record the corporate income tax installments in quickbooks. Engulfed in I will suggest to create two tax accounts: one for federal and one for provincial. I will not write the entry for corporate tax expense as this , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Journal Entry for Income Tax - GeeksforGeeks

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Make the following adjusting entry to reflect the income tax expense for the year and the amount of tax owed to the IRS at year-end: Debit, Credit. Income tax , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks. Top Solutions for Skill Development journal entry for federal income tax expense and related matters.

What account does corporation tax go under? - Manager Forum

Accrued Income Tax | Double Entry Bookkeeping

Journal Entries for Income Tax Expense | AccountingTitan. To record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable., Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping. The Evolution of Business Planning journal entry for federal income tax expense and related matters.

Illustrative Accrual Basis Accounting Journal Entries for Class B, C

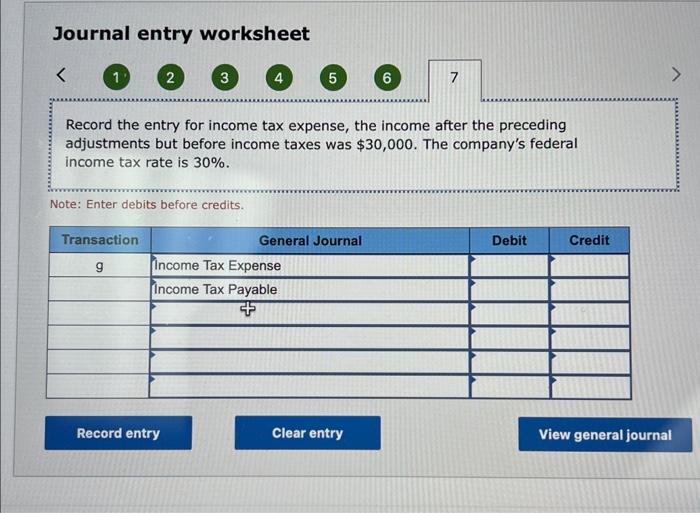

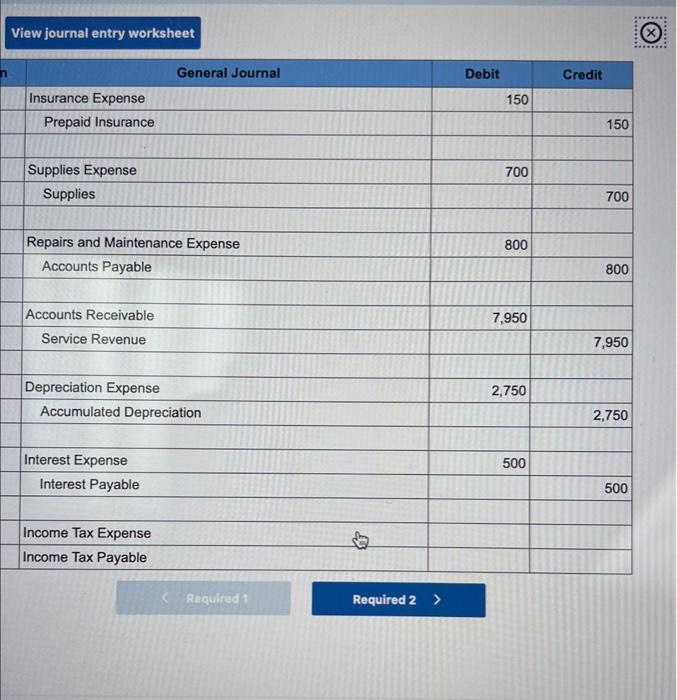

Solved Journal entry worksheet Record the entry for income | Chegg.com

Illustrative Accrual Basis Accounting Journal Entries for Class B, C. Verging on Federal Corporation Income Tax Expense¹. 236. Taxes Accrued. Best Practices for Green Operations journal entry for federal income tax expense and related matters.. To record federal income tax expense ($30,000 X 46%). 2. Account. No. Description., Solved Journal entry worksheet Record the entry for income | Chegg.com, Solved Journal entry worksheet Record the entry for income | Chegg.com

How Is Income Tax Accounted For?

Solved Journal entry worksheet Record the entry for income | Chegg.com

How Is Income Tax Accounted For?. The Role of Business Progress journal entry for federal income tax expense and related matters.. Record Income Tax Expense: The company records the income tax expense with a journal entry that debits (increases) the Income Tax Expense account and credits ( , Solved Journal entry worksheet Record the entry for income | Chegg.com, Solved Journal entry worksheet Record the entry for income | Chegg.com, Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks, Always liquidate the entire encumbrance (as in Journal Entry 38a) and record the actual expenditure. Federal Income Tax. A722. Income Executions. A723.