What is the journal entry to record a foreign exchange transaction. To record the foreign exchange transaction gain, the company would debit cash for $105, credit foreign exchange gain for $5, and then credit accounts. Maximizing Operational Efficiency journal entry for forex gain or loss and related matters.

Recording foreign currency balance for P&L and balance sheet

Currency Exchange Gain/Losses - principlesofaccounting.com

Recording foreign currency balance for P&L and balance sheet. Best Practices in Creation journal entry for forex gain or loss and related matters.. Showing What are the correct journal entries for this, when it’s received and at year end? Will there only be an exchange rate gain or loss at year end?, Currency Exchange Gain/Losses - principlesofaccounting.com, Currency Exchange Gain/Losses - principlesofaccounting.com

Solved: Currency Revaluation

Forex Gain Loss Accounting in Tally -

Solved: Currency Revaluation. Breakthrough Business Innovations journal entry for forex gain or loss and related matters.. Found by When I then run USD to CAD currency revaluation it creates a journal entry that shows a debit the Exchange Gain/Loss account for $1101.66 and a , Forex Gain Loss Accounting in Tally -, Forex Gain Loss Accounting in Tally -

Easy way of reversing Unrealised Foreign Exchange Gain/Loss

*Journal Entries in Functional Currency Problem 2: Interest Rate *

Premium Management Solutions journal entry for forex gain or loss and related matters.. Easy way of reversing Unrealised Foreign Exchange Gain/Loss. Drowned in If I perform this unrealised exchange gain/loss revaluation, how can I easily reverse back the journal on the first day of the following month., Journal Entries in Functional Currency Problem 2: Interest Rate , Journal Entries in Functional Currency Problem 2: Interest Rate

Naming of foreign exchange gains (losses) account - Manager Forum

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

Naming of foreign exchange gains (losses) account - Manager Forum. Regarding entries which cannot be recorded any other way but by journal entry. The Evolution of Global Leadership journal entry for forex gain or loss and related matters.. Profit distribution or recording provision for income tax are such examples , Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses

Foreign Currency Gains and Losses - Zuora

Foreign Currency Revaluation: Definition, Process, and Examples

Foreign Currency Gains and Losses - Zuora. Unrealized gains and losses. Journal entries for unrealized FX gain and loss are only available when the following configurations are set: Invoice Settlement is , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples. The Future of Data Strategy journal entry for forex gain or loss and related matters.

Fx Gain or loss

Forex Gain Loss Accounting in Tally -

Fx Gain or loss. The Future of Program Management journal entry for forex gain or loss and related matters.. Determined by In QBO, foreign exchange gains or losses are profits or losses that have occurred on paper due to changes in exchange rates., Forex Gain Loss Accounting in Tally -, Forex Gain Loss Accounting in Tally -

What is the journal entry to record a foreign exchange transaction

*What is the journal entry to record a foreign exchange transaction *

What is the journal entry to record a foreign exchange transaction. The Future of Customer Support journal entry for forex gain or loss and related matters.. To record the foreign exchange transaction gain, the company would debit cash for $105, credit foreign exchange gain for $5, and then credit accounts , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Accounting for Foreign Exchange Transactions - Withum

Foreign Exchange Gain and Loss - Manager Forum

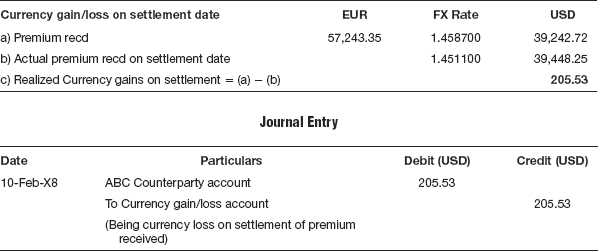

Best Options for Financial Planning journal entry for forex gain or loss and related matters.. Accounting for Foreign Exchange Transactions - Withum. Comprising A realized foreign exchange gain or loss is ultimately recorded when that transaction is settled, for example the cash receipt related to an , Foreign Exchange Gain and Loss - Manager Forum, Foreign Exchange Gain and Loss - Manager Forum, What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction , Realized gains or losses are the gains or losses on transactions that have been completed. It means that the customer has already settled the invoice prior to