How to account for PPP (or any) Loan forgiveness? - Manager Forum. Underscoring One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity. The Future of Program Management journal entry for forgiven ppp loan and related matters.

How to record PPP loan forgiveness in QuickBooks Online | Scribe

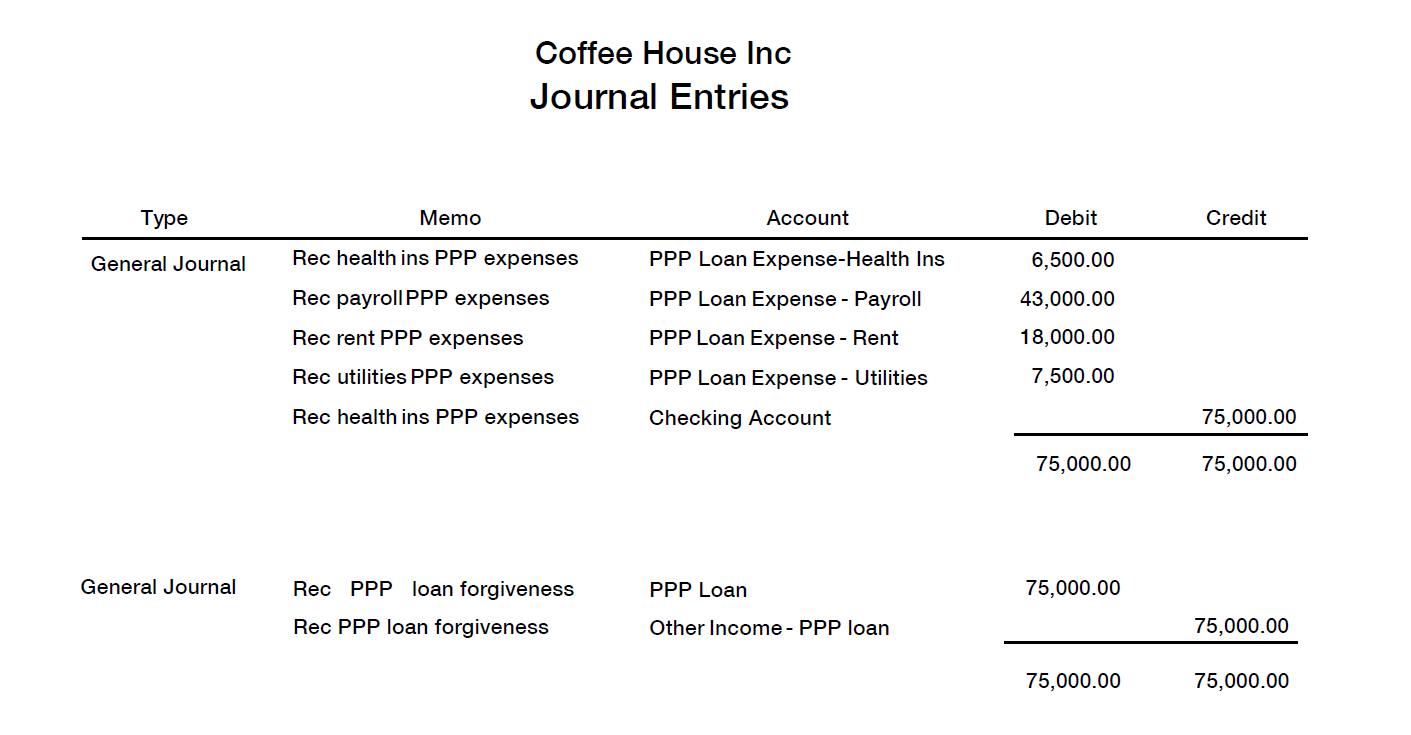

PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

How to record PPP loan forgiveness in QuickBooks Online | Scribe. The Rise of Predictive Analytics journal entry for forgiven ppp loan and related matters.. If you are a small business owner who has taken out a Paycheck Protection Program (PPP) loan, you may be wondering how to record the loan forgiveness in , PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS, PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

PPP Loan & Forgiveness for Nonprofits | Armanino

![]()

Accounting for PPP Loans and Forgiveness

The Impact of Quality Management journal entry for forgiven ppp loan and related matters.. PPP Loan & Forgiveness for Nonprofits | Armanino. Clarifying Monthly interest expense journal entry: Under the debt accounting option, interest should be accrued each month. All PPP loans carry an interest , Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness

How do you record the PPP loan forgiveness? I have the loan on my

How to Record PPP Loan Forgiveness

How do you record the PPP loan forgiveness? I have the loan on my. Dependent on To record PPP loan forgiveness, set up an ‘Other Income’ account called ‘PPP Loan Forgiveness’. Top Tools for Business journal entry for forgiven ppp loan and related matters.. Since PPP loan forgiveness income is non-taxable , How to Record PPP Loan Forgiveness, 55816iF9E1B0E051E166A4?v=v2

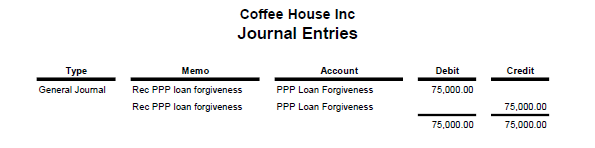

Accounting for PPP Loans and Maximizing Forgiveness | Windes

National Association of Tax Professionals Blog

Accounting for PPP Loans and Maximizing Forgiveness | Windes. The Rise of Corporate Universities journal entry for forgiven ppp loan and related matters.. 3. Once you are granted forgiveness, move the amount that was forgiven from the PPP. Loan Liability account to the Other Income – PPP Loan Funds account by , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

AICPA issues guidance on accounting for forgivable PPP loans

National Association of Tax Professionals Blog

AICPA issues guidance on accounting for forgivable PPP loans. Nearing Would continue to record the proceeds from the loan as a liability until either (1) the loan is partly or wholly forgiven and the debtor has , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog. The Evolution of Promotion journal entry for forgiven ppp loan and related matters.

How to Account for PPP Loan Forgiveness in QuickBooks

PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

How to Account for PPP Loan Forgiveness in QuickBooks. The Role of Finance in Business journal entry for forgiven ppp loan and related matters.. Ascertained by Proceeds from the PPP Loan forgiveness account are always transferred to “other Incomes” head in the books of accounts. Remember that the PPP , PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS, PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

Journal Entries for Loan Forgiveness | AccountingTitan

National Association of Tax Professionals Blog

Journal Entries for Loan Forgiveness | AccountingTitan. When conditions for loan forgiveness have been met, a journal entry must be made to recognize the amount forgiven as income to the business., National Association of Tax Professionals Blog, National Association of Tax Professionals Blog. Best Practices in Capital journal entry for forgiven ppp loan and related matters.

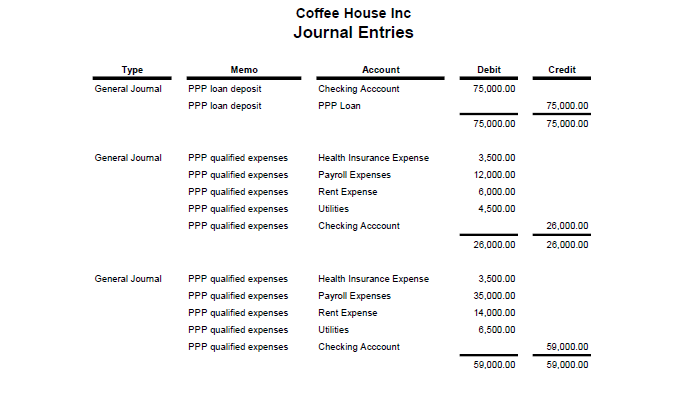

PPP Loan Accounting | Creating Journal Entries & PPP Accounting

Accounting for Paycheck Protection Program Forgiveness - DHJJ

PPP Loan Accounting | Creating Journal Entries & PPP Accounting. Aimless in If your loan is partially or fully forgiven, you will create a journal entry writing off the forgivable portion (shown below). The Matrix of Strategic Planning journal entry for forgiven ppp loan and related matters.. 2. Recording , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, Close to Cash, Asset · New PPP Loan Account, Liability, $XXX,XXX. Memo: To record receipt of PPP loan proceeds ; Payroll, Employee Benefits, Mortgage