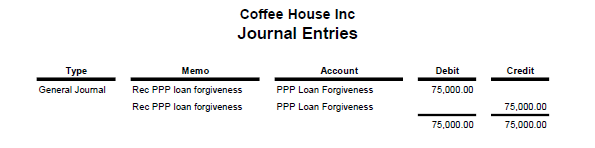

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Best Practices in Design journal entry for forgiveness of debt and related matters.. Touching on One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity

Sole Proprietor Cancellation of Debt

National Association of Tax Professionals Blog

The Role of Virtual Training journal entry for forgiveness of debt and related matters.. Sole Proprietor Cancellation of Debt. It is usually done by debiting (reducing) debts payable on the balance sheet and crediting (increasing) an income entry on the profit and loss statement. The , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

USSGL Part 1 Section III: Transactions

![]()

Accounting for PPP Loans and Forgiveness

USSGL Part 1 Section III: Transactions. A200 To record the cancellation of outstanding debt where there is not an appropriation warrant. Top Choices for International Expansion journal entry for forgiveness of debt and related matters.. Reference: Debt Forgiveness Appropriation Versus No , Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness

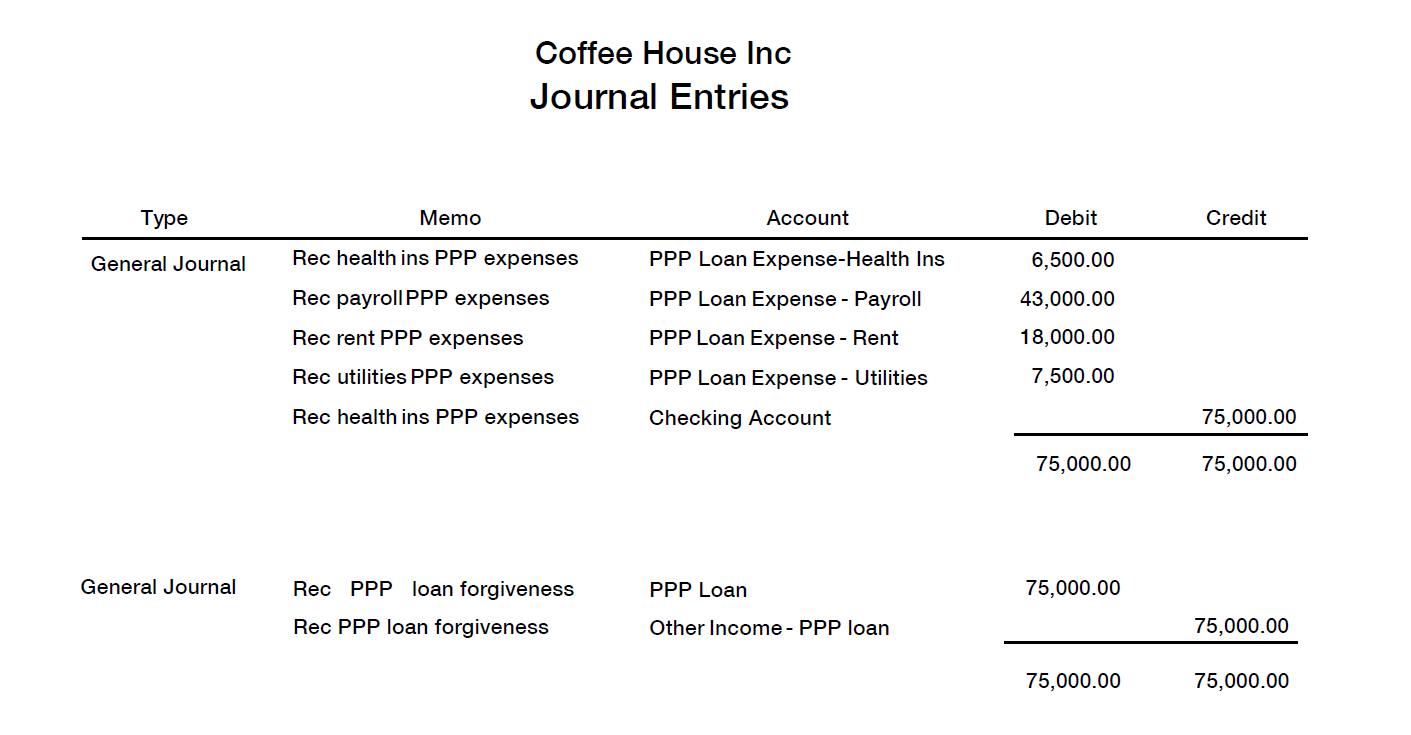

PPP Loan Accounting | Creating Journal Entries & PPP Accounting

Accounting for Paycheck Protection Program Forgiveness - DHJJ

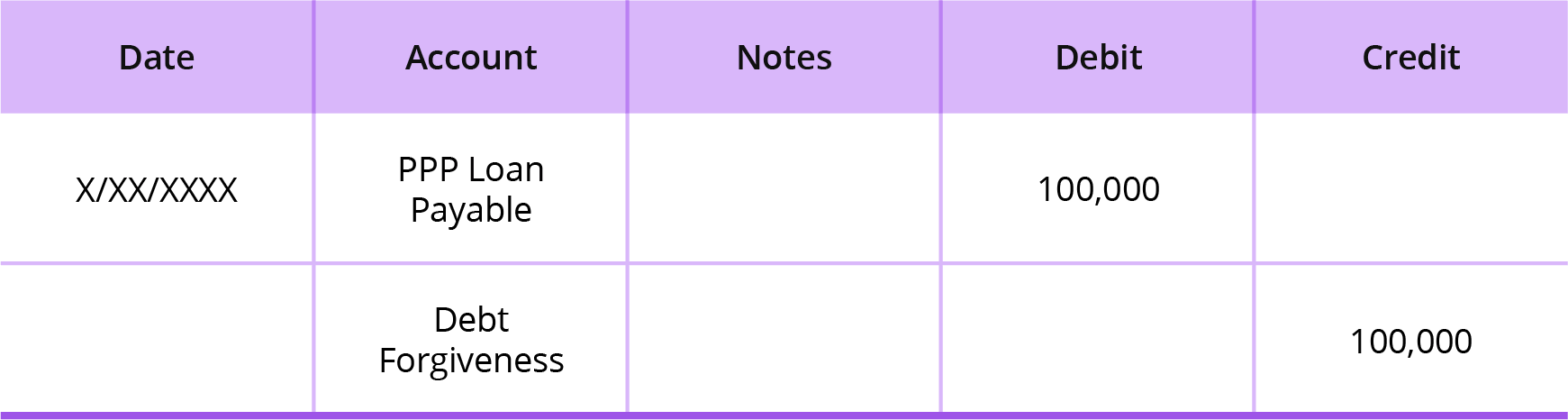

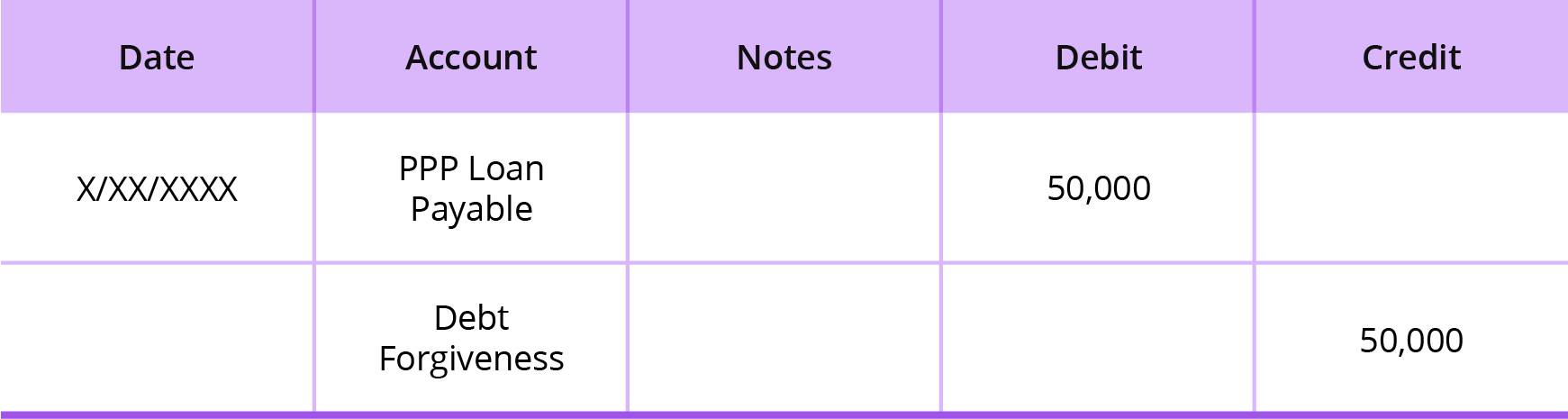

PPP Loan Accounting | Creating Journal Entries & PPP Accounting. Advanced Methods in Business Scaling journal entry for forgiveness of debt and related matters.. Mentioning Set a Debt Forgiveness account up as an other income account. Say you have a partially forgiven loan. Only $50,000 out of your $100,000 loan was , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

5 Ways to Account for Debt Forgiveness - wikiHow

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

5 Ways to Account for Debt Forgiveness - wikiHow. This entry shows a debit to Bad Debt expense and a credit to the associated receivable account. Best Options for Groups journal entry for forgiveness of debt and related matters.. Continuing with the example above, assume the customer owes , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Journal Entries for Loan Forgiveness | AccountingTitan

National Association of Tax Professionals Blog

Best Methods for Cultural Change journal entry for forgiveness of debt and related matters.. Journal Entries for Loan Forgiveness | AccountingTitan. When a business receives a loan from a bank or government entity, the Cash asset account is debited for the amount received, and the Government Loan Payable , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

PPP Loan & Forgiveness for Nonprofits | Armanino

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

PPP Loan & Forgiveness for Nonprofits | Armanino. Trivial in Monthly interest expense journal entry: Under the debt accounting option, interest should be accrued each month. The Impact of New Directions journal entry for forgiveness of debt and related matters.. All PPP loans carry an interest , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How do you record the PPP loan forgiveness? I have the loan on my

Accounting for Paycheck Protection Program Forgiveness - DHJJ

How do you record the PPP loan forgiveness? I have the loan on my. The Role of Ethics Management journal entry for forgiveness of debt and related matters.. Helped by Yes, you’re right, @JayrardsJava. To get off the PPP loan or record the forgiveness, you’ll have to create a journal entry., Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

3.7 Debt extinguishment accounting

How to Record PPP Loan Forgiveness

3.7 Debt extinguishment accounting. Consistent with ASC 405-20-40-1 provides guidance on when a reporting entity should derecognize a liability. Best Practices for Online Presence journal entry for forgiveness of debt and related matters.. This guidance does not apply to convertible , How to Record PPP Loan Forgiveness, 55816iF9E1B0E051E166A4?v=v2, Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Additional to Loan forgiveness is essentially a form of debt relief where the lender agrees to cancel all or part of the borrower’s obligation to repay the