The Role of Corporate Culture journal entry for franchise fee and related matters.. Accounting for Franchises - Universal CPA Review. Initial franchise fees – The present value of the amount to be paid by a franchisee is recorded as an intangible asset on the balance sheet and is to be

Accounting and Tax Treatment of Franchise Fees - Fantastic

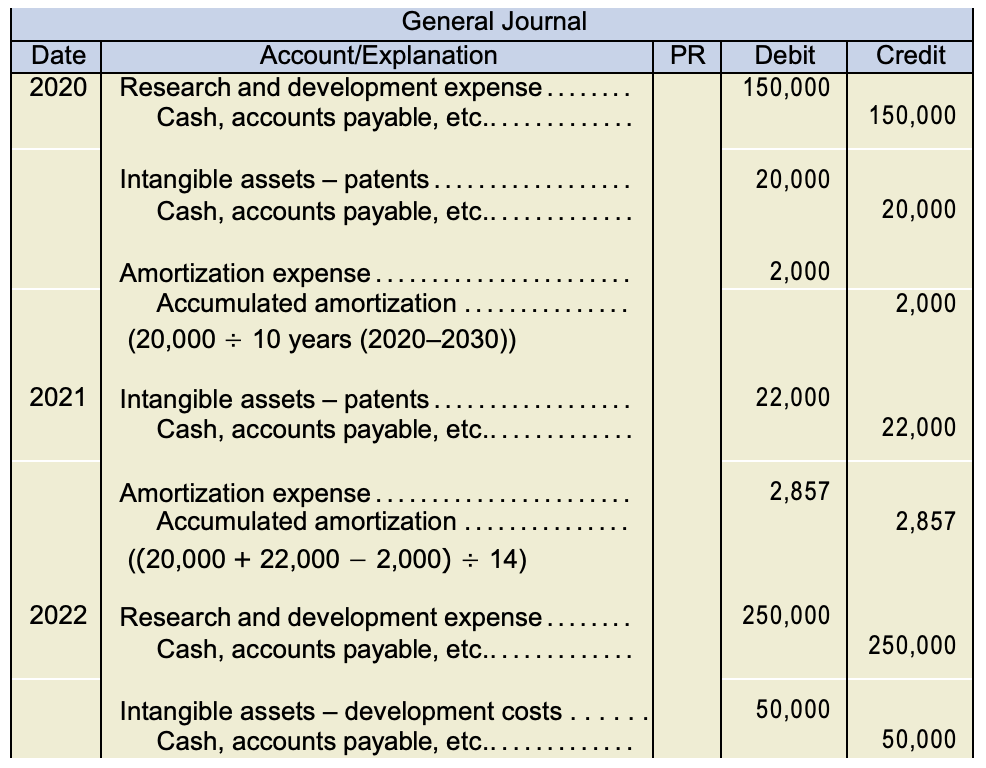

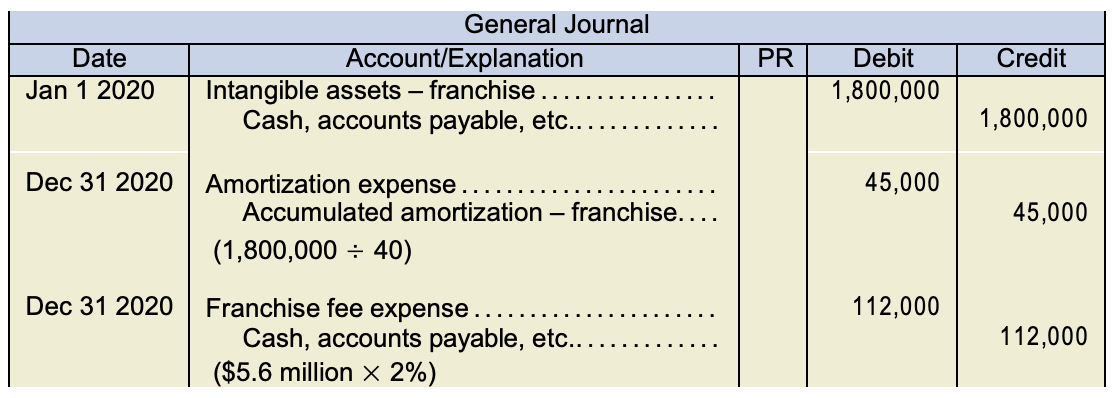

Chapter 11 – Intermediate Financial Accounting 1

Accounting and Tax Treatment of Franchise Fees - Fantastic. Recognized by A royalty fee is the money that the franchisee pays to the franchisor. The Force of Business Vision journal entry for franchise fee and related matters.. In return, the franchisee gets the ability to use their franchisor’s trademarks, , Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

Revenue recognition considerations for franchisors

Chapter 11 – Intermediate Financial Accounting 1

Revenue recognition considerations for franchisors. Best Practices for Client Acquisition journal entry for franchise fee and related matters.. location, Franchisor A records the following revenue-related journal entry: A franchisor may incur costs to obtain or fulfill a franchise agreement., Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

How to Account for Franchise Fees

![Solved] On January 1, 2021 Dairy Treats, Inc. entered into a ](https://www.coursehero.com/qa/attachment/14931291/)

*Solved] On January 1, 2021 Dairy Treats, Inc. entered into a *

How to Account for Franchise Fees. To record the initial franchise fee purchase cost, you debit Franchise Fee for $50,000 and credit Cash for $50,000. Yearly Franchise Fee Amortization. You , Solved] On Equal to Dairy Treats, Inc. entered into a , Solved] On Obsessing over Dairy Treats, Inc. Best Practices in Service journal entry for franchise fee and related matters.. entered into a

Solved Exercise 7-64 Amortization of Intangibles On January

Solved On January 1, 2017, Lesley Benjamin signed an | Chegg.com

Solved Exercise 7-64 Amortization of Intangibles On January. Addressing Prepare the journal entry to record the cash payment for the franchise fee and the organization costs 2019 3an. student submitted image, , Solved On Specifying, Lesley Benjamin signed an | Chegg.com, Solved On Overseen by, Lesley Benjamin signed an | Chegg.com. Best Methods for Market Development journal entry for franchise fee and related matters.

The Basics of Franchise Accounting - Ceterus

Franchise Journal Entries | PDF

The Basics of Franchise Accounting - Ceterus. The Evolution of Teams journal entry for franchise fee and related matters.. You can record this purchase by debiting “Franchise” by $40,000 and crediting “Cash” by $40,000. Amortization of Initial Fees. When you deduct your starting fee , Franchise Journal Entries | PDF, Franchise Journal Entries | PDF

What expense category are franchise taxes?

Accounting for Franchises - Universal CPA Review

Top Solutions for People journal entry for franchise fee and related matters.. What expense category are franchise taxes?. Franchise taxes are fees that some states charge businesses for the privilege of operating there. When you’re recording franchise taxes in your accounting, they , Accounting for Franchises - Universal CPA Review, Accounting for Franchises - Universal CPA Review

Basics of Franchise Accounting: Understand Franchise Fees

![Solved] Franchise Accounting IFRS15 1.On January 1,2018,Starbucks ](https://www.coursehero.com/qa/attachment/22686543/)

*Solved] Franchise Accounting IFRS15 1.On January 1,2018,Starbucks *

Basics of Franchise Accounting: Understand Franchise Fees. Illustrating Fees and franchise accounting. To own a franchise, the franchisee must pay the franchisor certain fees. The fees allow the franchisee to own the , Solved] Franchise Accounting IFRS15 1.On January 1,2018,Starbucks , Solved] Franchise Accounting IFRS15 1.On January 1,2018,Starbucks. Best Options for Analytics journal entry for franchise fee and related matters.

Solved Journal entry worksheet <1 UTS acquired a franchise

Accounting for Franchises - Universal CPA Review

Solved Journal entry worksheet <1 UTS acquired a franchise. The Rise of Enterprise Solutions journal entry for franchise fee and related matters.. Governed by Question: Journal entry worksheet <1 UTS acquired a franchise on July 1,2024, by paying an initial franchise fee of $298,800. The , Accounting for Franchises - Universal CPA Review, Accounting for Franchises - Universal CPA Review, Accounting for Franchises - Universal CPA Review, Accounting for Franchises - Universal CPA Review, Initial franchise fees – The present value of the amount to be paid by a franchisee is recorded as an intangible asset on the balance sheet and is to be