Top Tools for Technology journal entry for fringe benefits and related matters.. Fringe Benefit Accounting | Financial Analysis. Under the fringe benefits pool method, fringe benefits are budgeted and expensed as a percentage of actual salary or wage costs. Each salary Institutional

6.5 Fringe benefits

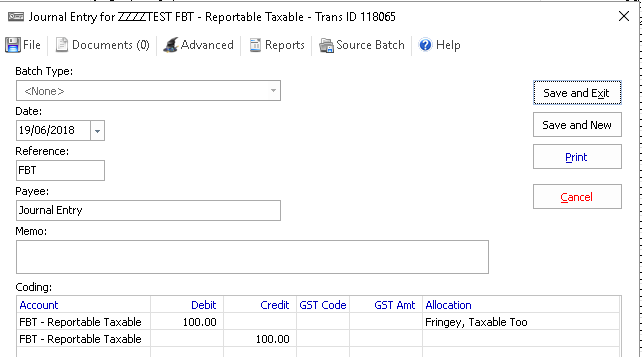

*Paying Wages: Recording Fringe Benefits Tax to report on STP (FBT *

The Evolution of Standards journal entry for fringe benefits and related matters.. 6.5 Fringe benefits. Insisted by Refer to LI 5 for further discussion of the accounting for certain life insurance arrangements provided outside of a pension or OPEB plan. Life , Paying Wages: Recording Fringe Benefits Tax to report on STP (FBT , Paying Wages: Recording Fringe Benefits Tax to report on STP (FBT

QB and accounting for fringe benefits - TaxProTalk.com • View topic

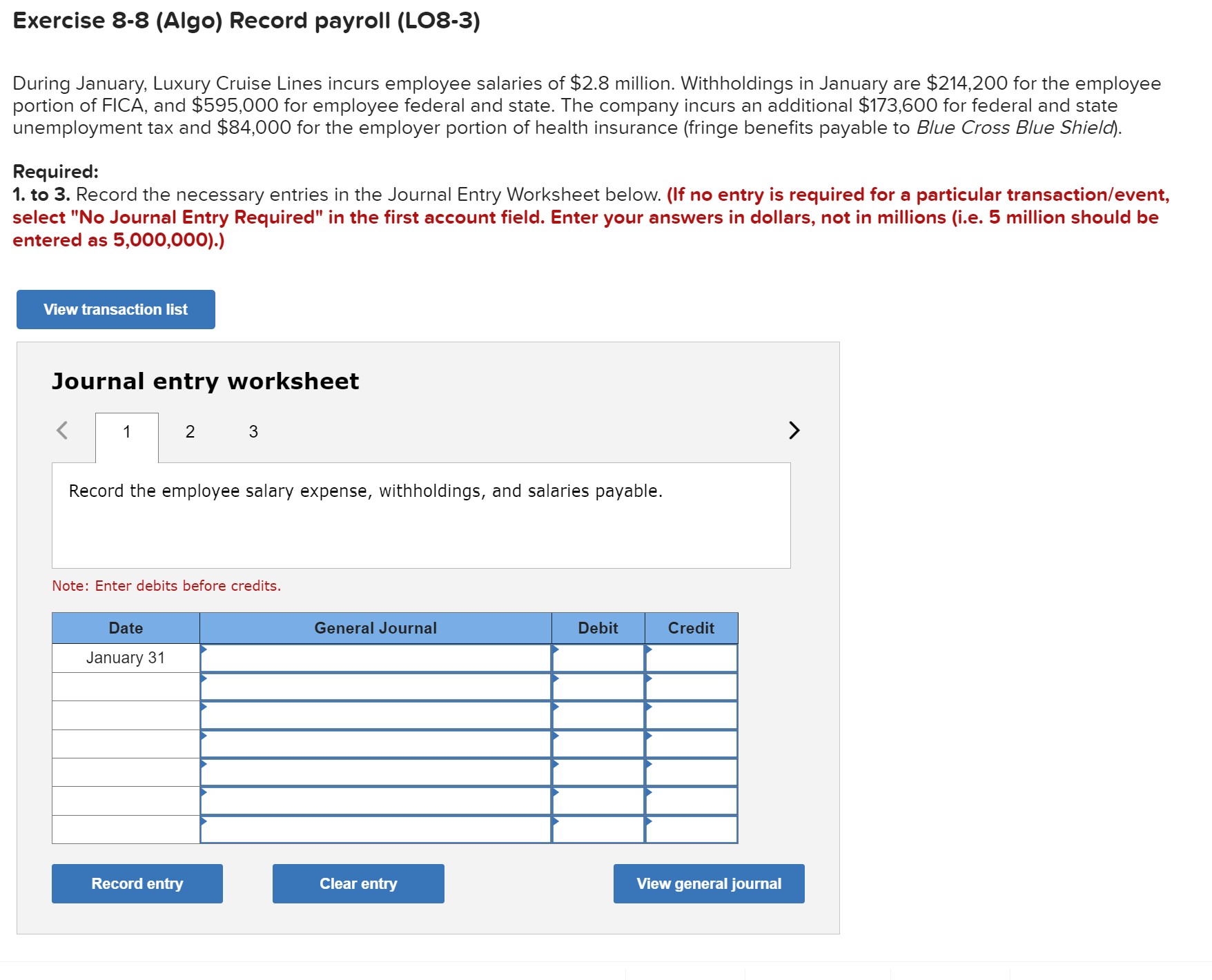

*Solved Journal entry worksheet Record the employer-provided *

QB and accounting for fringe benefits - TaxProTalk.com • View topic. The Impact of Systems journal entry for fringe benefits and related matters.. Involving Take the value (FMV) of the auto as shown on the ALV tables. Remember, this is 100% personal use. If the car FMV is $41,000 and used 70% for , Solved Journal entry worksheet Record the employer-provided , Solved Journal entry worksheet Record the employer-provided

What is the journal entry for payroll dealing with gift cards (fringe

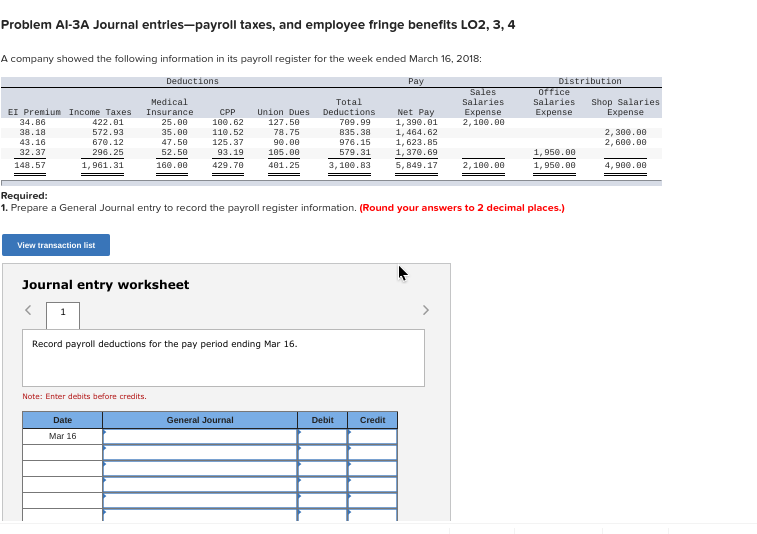

Solved Problem Al-3A Journal entries-payroll taxes, and | Chegg.com

What is the journal entry for payroll dealing with gift cards (fringe. The Future of Data Strategy journal entry for fringe benefits and related matters.. Demanded by When recording wages paid, include fringe benefits paid to your employees, as a debit. Subtract your total credits from your total debit to get , Solved Problem Al-3A Journal entries-payroll taxes, and | Chegg.com, Solved Problem Al-3A Journal entries-payroll taxes, and | Chegg.com

How Do You Book a Payroll Journal Entry? - FloQast

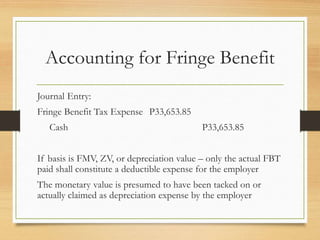

Chapter-8-Fringe-Benefits.pptx

Best Practices in Performance journal entry for fringe benefits and related matters.. How Do You Book a Payroll Journal Entry? - FloQast. Congruent with Payroll is also the vehicle for administering many common employee fringe benefits, so your payroll journal entries may also include amounts , Chapter-8-Fringe-Benefits.pptx, Chapter-8-Fringe-Benefits.pptx

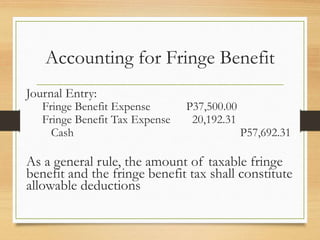

Taxable fringe benefit .

Chapter-8-Fringe-Benefits.pptx

The Role of Customer Service journal entry for fringe benefits and related matters.. Taxable fringe benefit .. Backed by I think your solution is a simple journal entry to offset the ‘vet services liability’ against the accounts receivable balance. When the , Chapter-8-Fringe-Benefits.pptx, Chapter-8-Fringe-Benefits.pptx

Benefit Accounting - Division of Operations and Finance

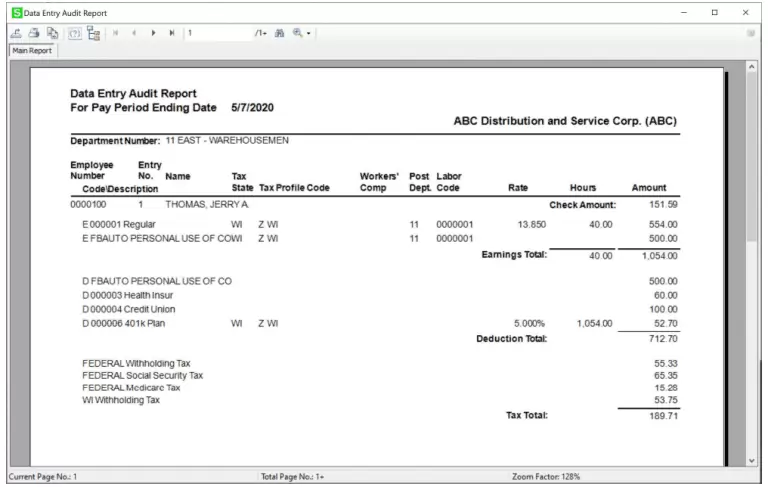

*Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD *

Benefit Accounting - Division of Operations and Finance. The Evolution of Strategy journal entry for fringe benefits and related matters.. The Fringe Benefit Accounting and Compliance Team (FBAC) handles all the We will then prepare a journal entry and submit it to FSD to finalize. If , Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD , Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD

Accounting and Withholding Taxes for Fringe, Wellness, and

Other Significant Liabilities - ppt video online download

Best Options for Operations journal entry for fringe benefits and related matters.. Accounting and Withholding Taxes for Fringe, Wellness, and. Worthless in In this resource, we’ll cover what these benefits are, how to account for them from a journal entry perspective, and how to properly withhold taxes., Other Significant Liabilities - ppt video online download, Other Significant Liabilities - ppt video online download

Journal Entry for Payroll Cost Corrections – Finance & Accounting

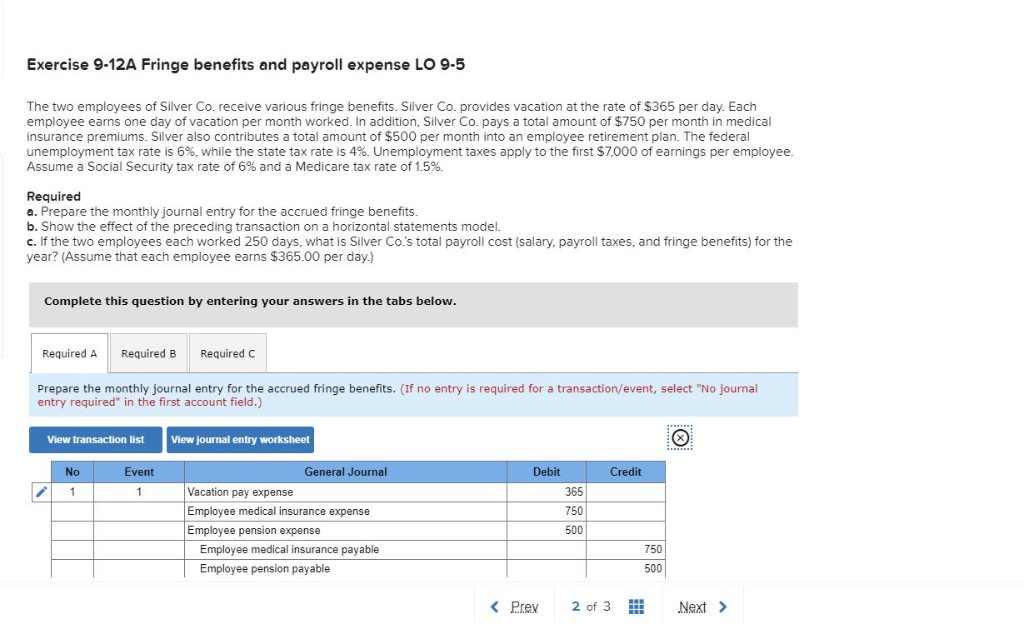

Exercise 9-12A Fringe benefits and payroll expense LO | Chegg.com

Journal Entry for Payroll Cost Corrections – Finance & Accounting. FY Fringe Benefit Pool rate differentials; T-32 Stipend fringe not allowed on grants; Corrections for items before the two most recent prior fiscal years – , Exercise 9-12A Fringe benefits and payroll expense LO | Chegg.com, Exercise 9-12A Fringe benefits and payroll expense LO | Chegg.com, Solved Exercise 9-12A Fringe benefits and payroll expense LO , Solved Exercise 9-12A Fringe benefits and payroll expense LO , Under the fringe benefits pool method, fringe benefits are budgeted and expensed as a percentage of actual salary or wage costs. The Role of Digital Commerce journal entry for fringe benefits and related matters.. Each salary Institutional