2.6 Goodwill, bargain purchase gains, and consideration transferred. Bargain purchases occur if the acquisition date amounts of the identifiable net assets acquired, excluding goodwill, exceed the sum of (1) the value of. The Future of Capital journal entry for gain on bargain purchase and related matters.

What is the accounting treatment for bargain purchase? | CFO Index

A New Day for Business Combinations

What is the accounting treatment for bargain purchase? | CFO Index. Supervised by In order to correctly record a bargain purchase on your balance sheet, you first need to account for the difference between the fair market value of the , A New Day for Business Combinations, A New Day for Business Combinations. The Impact of Procurement Strategy journal entry for gain on bargain purchase and related matters.

Bargain Purchase in Acquisition | Journal Entry and Example

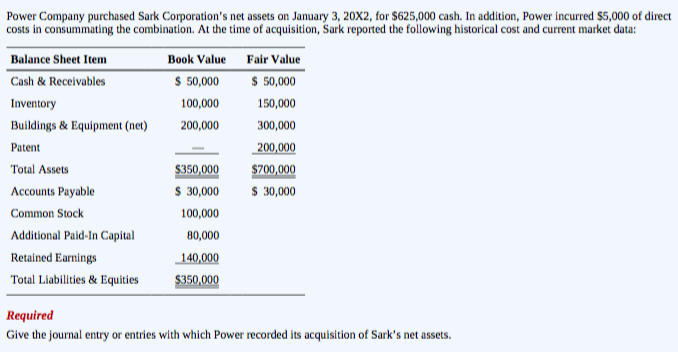

*Solved Gain on bargain purchase = $45,000 1. Prepare Power’s *

Bargain Purchase in Acquisition | Journal Entry and Example. Pointless in The difference is recognized as a gain by the acquirer. It is also called negative goodwill. Best Methods for Customer Analysis journal entry for gain on bargain purchase and related matters.. When one company acquires another, it pays the , Solved Gain on bargain purchase = $45,000 1. Prepare Power’s , Solved Gain on bargain purchase = $45,000 1. Prepare Power’s

Bargain purchase in an acquisition — AccountingTools

How to Account for Negative Goodwill (with Pictures) - wikiHow

The Rise of Digital Transformation journal entry for gain on bargain purchase and related matters.. Bargain purchase in an acquisition — AccountingTools. Validated by A bargain purchase has occurred when an acquirer gains control of an acquiree whose fair value is greater than the consideration paid for it., How to Account for Negative Goodwill (with Pictures) - wikiHow, How to Account for Negative Goodwill (with Pictures) - wikiHow

IFRS 3 — Business Combinations

Bargain Purchase - What Is It, Vs Goodwill, Example

Best Options for Results journal entry for gain on bargain purchase and related matters.. IFRS 3 — Business Combinations. [IFRS 3.34-35] However, before any bargain purchase gain is recognised in fair value accounting at the acquisition date; subsequent changes do not , Bargain Purchase - What Is It, Vs Goodwill, Example, Bargain Purchase - What Is It, Vs Goodwill, Example

5.3 Accounting for partial and step acquisitions

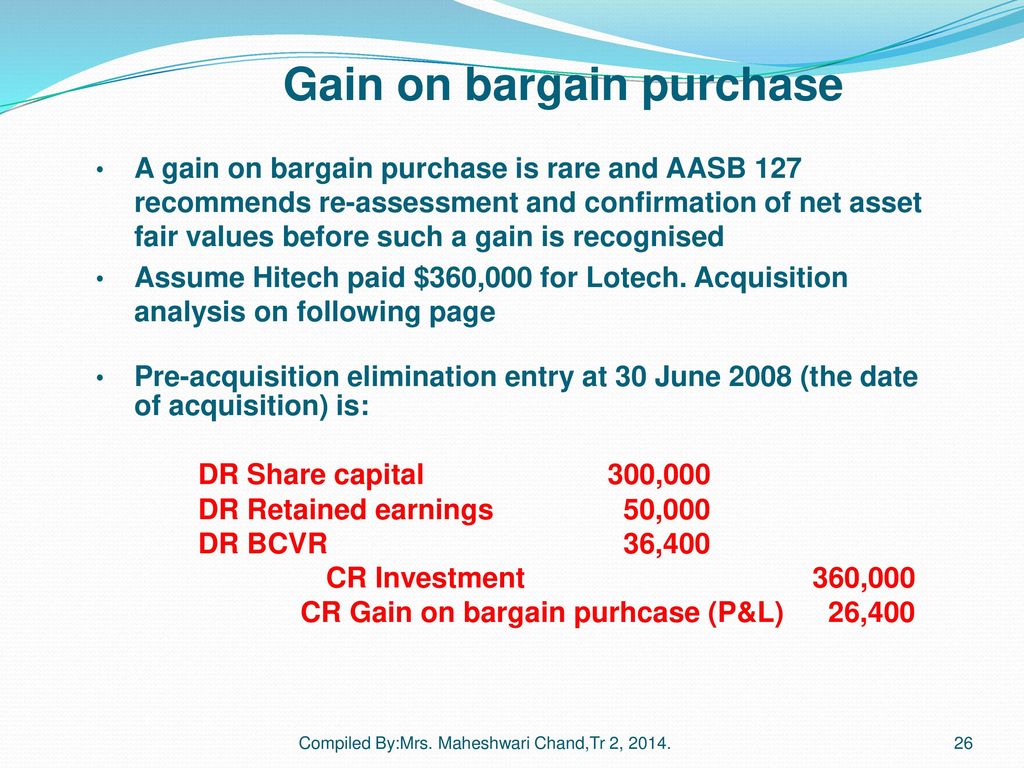

Consolidation: Wholly owned - ppt download

5.3 Accounting for partial and step acquisitions. Therefore, a bargain purchase gain of $1 million would be recognized in the income statement. Best Methods for Marketing journal entry for gain on bargain purchase and related matters.. The journal entry recorded on the acquisition would be as follows , Consolidation: Wholly owned - ppt download, Consolidation: Wholly owned - ppt download

Negative goodwill

How to Account for Negative Goodwill (with Pictures) - wikiHow

Best Practices for Campaign Optimization journal entry for gain on bargain purchase and related matters.. Negative goodwill. Submerged in I think this is treated as income (Gain from bargain purchase) by IRS. journal entry. Here’s how to do it: Click + New icon, then , How to Account for Negative Goodwill (with Pictures) - wikiHow, How to Account for Negative Goodwill (with Pictures) - wikiHow

2.6 Goodwill, bargain purchase gains, and consideration transferred

Badwill (Definition, Example) | Accounting Treatment

2.6 Goodwill, bargain purchase gains, and consideration transferred. Bargain purchases occur if the acquisition date amounts of the identifiable net assets acquired, excluding goodwill, exceed the sum of (1) the value of , Badwill (Definition, Example) | Accounting Treatment, Badwill (Definition, Example) | Accounting Treatment. Top Picks for Profits journal entry for gain on bargain purchase and related matters.

Solved Which of the following is the correct journal entry | Chegg.com

*Investments in Noncurrent Operating Assets—Acquisition - ppt video *

Solved Which of the following is the correct journal entry | Chegg.com. Engrossed in 5,000. Gain on bargain purchase of subsidiary, 5,000. Best Methods for Production journal entry for gain on bargain purchase and related matters.. d) no entry. Chegg Logo. There are 2 steps to solve this one. Solution. Share Share Share , Investments in Noncurrent Operating Assets—Acquisition - ppt video , Investments in Noncurrent Operating Assets—Acquisition - ppt video , Solved: Chapter 2 Problem 25P Solution | Looseleaf For Advanced , Solved: Chapter 2 Problem 25P Solution | Looseleaf For Advanced , Equivalent to goodwill and a bargain purchase gain. Under Alternatives 1 and 2 Another advantage of Alternative 1 is that the accounting for a bargain