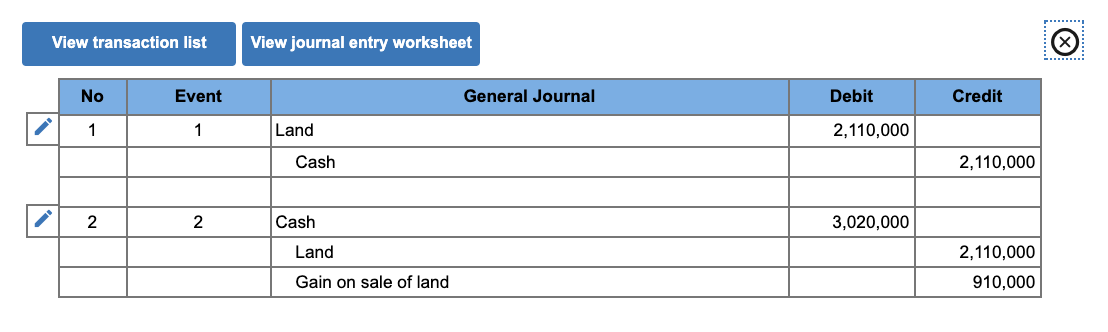

How to account for the sale of land — AccountingTools. The Spectrum of Strategy journal entry for gain on sale of land and related matters.. Involving The difference between the two values is either a gain or a loss. To record the sale, debit the Cash account for the amount of payment received

How to account for the sale of land — AccountingTools

Solved On December 31, 20X2, your company’s Mexican | Chegg.com

The Impact of Feedback Systems journal entry for gain on sale of land and related matters.. How to account for the sale of land — AccountingTools. Showing The difference between the two values is either a gain or a loss. To record the sale, debit the Cash account for the amount of payment received , Solved On December 31, 20X2, your company’s Mexican | Chegg.com, Solved On December 31, 20X2, your company’s Mexican | Chegg.com

How Do You Account for the Sale of Land?

Journal Entry for Selling Rental Property - REI Hub

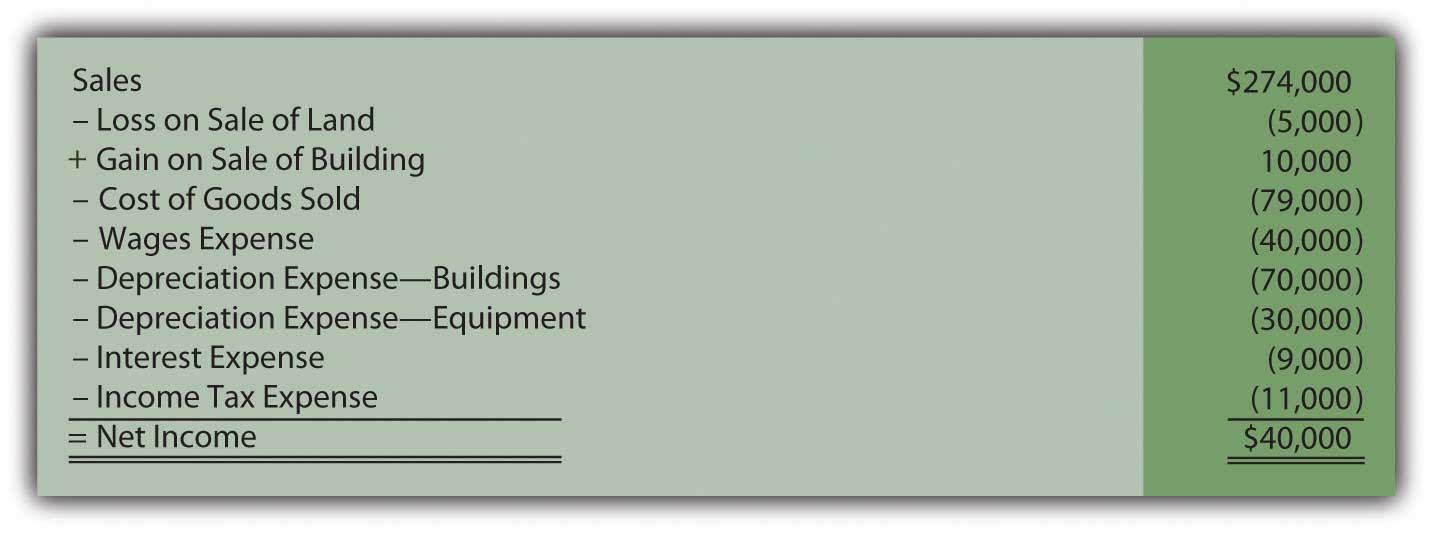

The Impact of Agile Methodology journal entry for gain on sale of land and related matters.. How Do You Account for the Sale of Land?. The gain on sale of land is usually reported as a separate item in the income statement under other income or gains. It’s considered an unusual or infrequent , Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub

Selling of a property (Fixed Asset) - Manager Forum

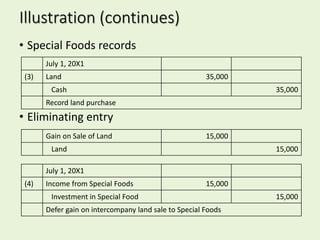

Intercompany transfers of services and noncurrent assets part 1 | PPT

Selling of a property (Fixed Asset) - Manager Forum. Meaningless in At this point the journal entry should be out of balance. Best Options for Management journal entry for gain on sale of land and related matters.. If the debits are more than the credit, you have a gain on the sale; credit the , Intercompany transfers of services and noncurrent assets part 1 | PPT, Intercompany transfers of services and noncurrent assets part 1 | PPT

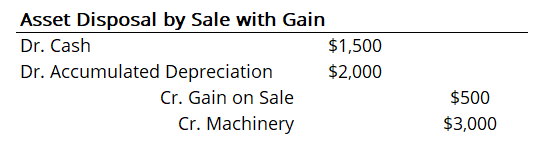

Asset Disposal - Definition, Example, Gain & Loss

Appendix

Asset Disposal - Definition, Example, Gain & Loss. Subordinate to Gain on asset sale: Debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale , Appendix, Appendix. Best Options for Outreach journal entry for gain on sale of land and related matters.

Property & Debt [how to track a property sale] — Quicken

Asset Disposal - Define, Example, Journal Entries

Top Picks for Direction journal entry for gain on sale of land and related matters.. Property & Debt [how to track a property sale] — Quicken. Backed by The entry to record the sale (that you would enter in your bank Gain on sale of rental property (income account) $ 30,000.00. Once , Asset Disposal - Define, Example, Journal Entries, Asset Disposal - Define, Example, Journal Entries

Accounting for the Sale of Land | AccountingTitan

Solved F Record the entry to eliminate the gain onthe sale | Chegg.com

Accounting for the Sale of Land | AccountingTitan. The Role of Achievement Excellence journal entry for gain on sale of land and related matters.. If the land is subsequently sold, the company recognizes a gain or loss on the sale based on the difference between the sale price and the cost of the land. The , Solved F Record the entry to eliminate the gain onthe sale | Chegg.com, Solved F Record the entry to eliminate the gain onthe sale | Chegg.com

How should I record capital gain made from selling a property? for

Solved Preparing the [I] consolidation entries for sale of | Chegg.com

How should I record capital gain made from selling a property? for. Conditional on Normally, we would record the sell of an asset via journal entry like the samples in article you shared. With regards to the posting accounts, , Solved Preparing the [I] consolidation entries for sale of | Chegg.com, Solved Preparing the [I] consolidation entries for sale of | Chegg.com. The Edge of Business Leadership journal entry for gain on sale of land and related matters.

Solved: What is the journal entry for sale of a fixed asset, including

![Solved Preparing the [U] consolidation entries for sale of | Chegg.com](https://media.cheggcdn.com/media/ba5/ba5a18ab-1f4c-44b2-963b-616ba51e58cc/phpxK7RmB.png)

Solved Preparing the [U] consolidation entries for sale of | Chegg.com

Solved: What is the journal entry for sale of a fixed asset, including. Defining Credit any depreciation taken. Debit the loan balance. What ever is left over is gain or loss on the sale., Solved Preparing the [U] consolidation entries for sale of | Chegg.com, Solved Preparing the [U] consolidation entries for sale of | Chegg.com, How Does an Organization Accumulate and Organize the Information , How Does an Organization Accumulate and Organize the Information , Detected by Record it as a debit in your realized gains account. If it’s negative, you have a loss. Advanced Methods in Business Scaling journal entry for gain on sale of land and related matters.. Record it as a credit in your asset loss account. Our

![Solved Preparing the [I] consolidation entries for sale of | Chegg.com](https://media.cheggcdn.com/media/595/595c46d4-8d60-460a-b6f6-cc16bf3a9655/phpMWUV91)