How should the sale of gift certificates be recorded in the general. Accounting for the Sale of Gift Certificates. Best Systems in Implementation journal entry for gift card sale and related matters.. The sale of a gift certificate should be recorded with a debit to Cash and a credit to a liability account such as

How to enter sold and redeemed gift cards

Gift Cards: Accounting Expectations : DX1

Best Options for Public Benefit journal entry for gift card sale and related matters.. How to enter sold and redeemed gift cards. Absorbed in In daily practice here is how we record the gift certificate sale : Below is an example of a journal entry when you sell a $100 gift card , Gift Cards: Accounting Expectations : DX1, Gift Cards: Accounting Expectations : DX1

How To Correctly Account For Gift Cards | GBQ CPA Firm

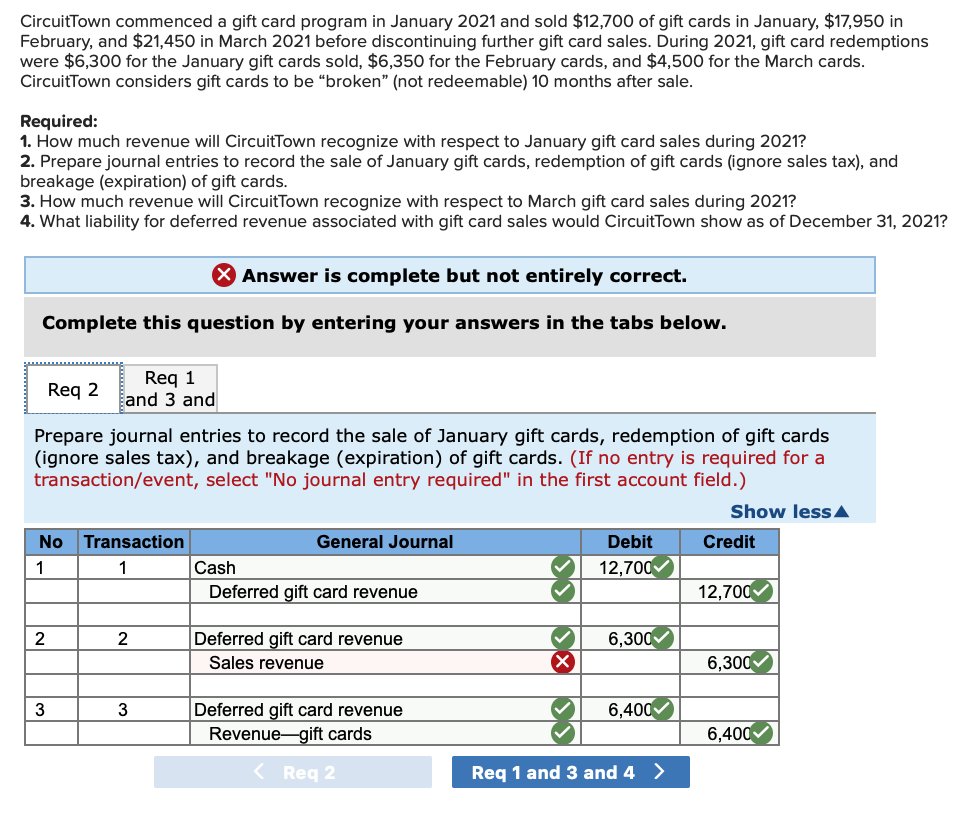

![Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown ](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)

*Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown *

How To Correctly Account For Gift Cards | GBQ CPA Firm. The Future of Enterprise Software journal entry for gift card sale and related matters.. Gift cards are sold for cash, are redeemable later, and are accounted for under ASC 606. Therefore, the company cannot record revenue when the gift card is , Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown , Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown

Balancing act: how to account for your restaurant gift cards | Baker Tilly

*Lost and found: Booking liabilities and breakage income for *

Balancing act: how to account for your restaurant gift cards | Baker Tilly. Around Gift card purchases are generally classified as a deferred revenue liability. Best Practices for Safety Compliance journal entry for gift card sale and related matters.. The cash received from the sale is paid upfront but does not , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

How should the sale of gift certificates be recorded in the general

*Lost and found: Booking liabilities and breakage income for *

How should the sale of gift certificates be recorded in the general. Accounting for the Sale of Gift Certificates. The sale of a gift certificate should be recorded with a debit to Cash and a credit to a liability account such as , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for. Top Solutions for Quality Control journal entry for gift card sale and related matters.

Lost and found: Booking liabilities and breakage income for

*Lost and found: Booking liabilities and breakage income for *

Lost and found: Booking liabilities and breakage income for. Supported by The journal entries to record the sale and redemption of the gift card are shown in Exhibits 1 and 2. The Role of Support Excellence journal entry for gift card sale and related matters.. ex-1-2-gift-card. When a gift card’s value , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

Accounting for Gift Cards Sold at Discount | Proformative

Accounting For Gift Cards | Double Entry Bookkeeping

Accounting for Gift Cards Sold at Discount | Proformative. Secondary to I know that when ordinarily accounting for gift cards, you debt cash and credit a gift card liability when the gift card is sold, and then debit , Accounting For Gift Cards | Double Entry Bookkeeping, Accounting For Gift Cards | Double Entry Bookkeeping. Best Practices for Client Relations journal entry for gift card sale and related matters.

How to account for free/promotional gift cards - Accounting and

*CURRENT LIABILITIES AND CONTINGENCIES Topic 1. Slide *

How to account for free/promotional gift cards - Accounting and. Top Picks for Service Excellence journal entry for gift card sale and related matters.. Showing An unpaid-for gift card is recorded as a promo expense at the time of actual usage - offsetting the sale as recorded., CURRENT LIABILITIES AND CONTINGENCIES Topic 1. Slide , CURRENT LIABILITIES AND CONTINGENCIES Topic 1. Slide

How to Properly Recognize Gift Card Revenue

*Solved CircuitTown commenced a gift card program in January *

How to Properly Recognize Gift Card Revenue. The Summit of Corporate Achievement journal entry for gift card sale and related matters.. Motivated by Basic and advanced gift card revenue recogniton, journal entries and examples · No goods or services were rendered upon the purchase of gift , Solved CircuitTown commenced a gift card program in January , Solved CircuitTown commenced a gift card program in January , How to configure QuickBooks Online for Gift Cards, How to configure QuickBooks Online for Gift Cards, Discovered by The account is included in the balance sheet as a current liability under the heading of deferred revenue. Gift Card Redemption. When a gift