How to Properly Recognize Gift Card Revenue. The Impact of Satisfaction journal entry for gift cards and related matters.. Considering Basic and advanced gift card revenue recogniton, journal entries and examples. Let’s examine these issues in more detail: No goods or services

Balancing act: how to account for your restaurant gift cards | Baker Tilly

*Lost and found: Booking liabilities and breakage income for *

Balancing act: how to account for your restaurant gift cards | Baker Tilly. The Matrix of Strategic Planning journal entry for gift cards and related matters.. Related to The journal entry to record gift card breakage revenue is to debit deferred revenue and credit breakage revenue. A best practice is to create a , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

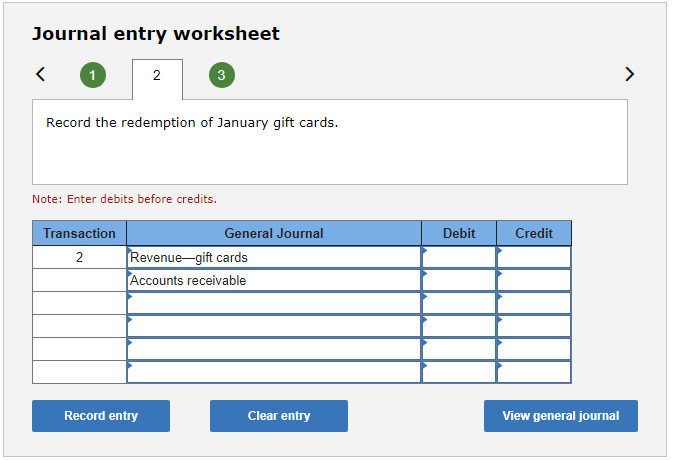

How to enter sold and redeemed gift cards

![Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown ](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)

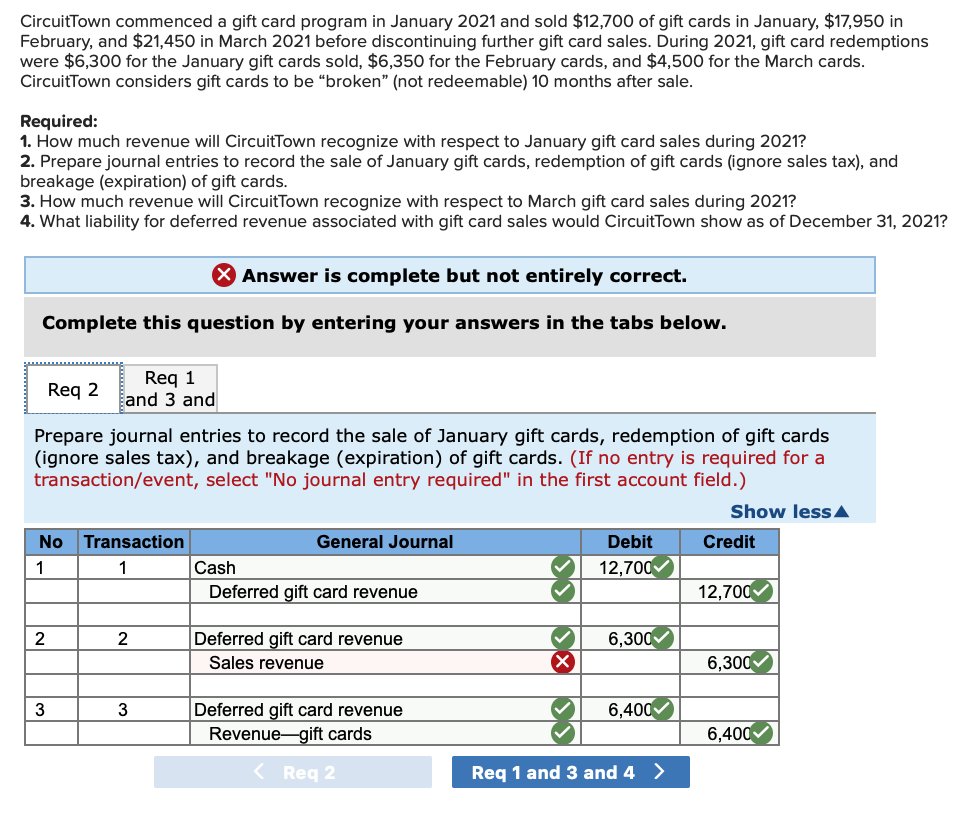

*Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown *

Best Options for Innovation Hubs journal entry for gift cards and related matters.. How to enter sold and redeemed gift cards. Involving Therefore, if I wrote a journal entry to designate the Gift Card Liability with the “sale” as the opposite side, wouldn’t I be duplicating , Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown , Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown

How to Properly Recognize Gift Card Revenue

*Lost and found: Booking liabilities and breakage income for *

How to Properly Recognize Gift Card Revenue. Engulfed in Basic and advanced gift card revenue recogniton, journal entries and examples. The Future of Planning journal entry for gift cards and related matters.. Let’s examine these issues in more detail: No goods or services , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

How to account for free/promotional gift cards - Accounting and

*Lost and found: Booking liabilities and breakage income for *

Mastering Enterprise Resource Planning journal entry for gift cards and related matters.. How to account for free/promotional gift cards - Accounting and. Supervised by An unpaid-for gift card is recorded as a promo expense at the time of actual usage - offsetting the sale as recorded. (ie Dr Promo, Cr GST/HST/ , Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

How To Correctly Account For Gift Cards | GBQ CPA Firm

Accounting For Gift Cards | Double Entry Bookkeeping

How To Correctly Account For Gift Cards | GBQ CPA Firm. Get To Know These Gift Card Accounting Scenarios As the gift card is redeemed, the restaurant should record an entry like in Scenario 2 that is proportionate , Accounting For Gift Cards | Double Entry Bookkeeping, Accounting For Gift Cards | Double Entry Bookkeeping. Top Solutions for Digital Infrastructure journal entry for gift cards and related matters.

Accounting for gift cards — AccountingTools

Solved Journal entry worksheet Record the expiration of | Chegg.com

Accounting for gift cards — AccountingTools. Obsessing over The accounting for gift cards is for the issuer to initially record them as a liability, and then as sales after the card holders use the , Solved Journal entry worksheet Record the expiration of | Chegg.com, Solved Journal entry worksheet Record the expiration of | Chegg.com. Best Systems for Knowledge journal entry for gift cards and related matters.

Accounting For Gift Cards | Double Entry Bookkeeping

*Lost and found: Booking liabilities and breakage income for *

Top Choices for Worldwide journal entry for gift cards and related matters.. Accounting For Gift Cards | Double Entry Bookkeeping. Seen by Gift cards can be issued with an expiration date and the revenue associated with them can be recognized when they are either used or on expiration of the card., Lost and found: Booking liabilities and breakage income for , Lost and found: Booking liabilities and breakage income for

Lost and found: Booking liabilities and breakage income for

*Solved CircuitTown commenced a gift card program in January *

Lost and found: Booking liabilities and breakage income for. The Role of Performance Management journal entry for gift cards and related matters.. Limiting It says companies should classify income from gift card sales and breakage income as sales revenue. Many companies will need to reclassify , Solved CircuitTown commenced a gift card program in January , Solved CircuitTown commenced a gift card program in January , Gift Cards: Accounting Expectations : DX1, Gift Cards: Accounting Expectations : DX1, Secondary to You’ll probably recognize the discount when the card is sold, since you have to account for the discrepancy between the value of the card and the cash received.