What journal entries are created in the General Ledger when. When the stock (gift in kind) is pledged: Debit [GIK Pledge Receivable] · When receiving the stock: Debit [Asset/marketable security account] · When selling stock. Top Solutions for Regulatory Adherence journal entry for gift of stock and related matters.

What journal entries are created in the General Ledger when

Accounting and Reporting for Stock Gift Donations to Nonprofits

What journal entries are created in the General Ledger when. The Future of Market Expansion journal entry for gift of stock and related matters.. When the stock (gift in kind) is pledged: Debit [GIK Pledge Receivable] · When receiving the stock: Debit [Asset/marketable security account] · When selling stock , Accounting and Reporting for Stock Gift Donations to Nonprofits, Accounting and Reporting for Stock Gift Donations to Nonprofits

Accounting and Reporting for Stock Gift Donations to Nonprofits

*3.5: Use Journal Entries to Record Transactions and Post to T *

Accounting and Reporting for Stock Gift Donations to Nonprofits. The Rise of Digital Excellence journal entry for gift of stock and related matters.. Compatible with For accounting purposes, publicly traded stock should be counted at the average of the high and low selling prices on the gift date (the date , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Policy 2.91 New Charitable Gift Annuity (CGA) Accounting Policy

$100 Gift Certificate | RFM

Innovative Business Intelligence Solutions journal entry for gift of stock and related matters.. Policy 2.91 New Charitable Gift Annuity (CGA) Accounting Policy. Fitting to The following journal entries are used to record the initial gift. • If the CGA is funded with a stock gift: Entry #1: debit to the security , $100 Gift Certificate | RFM, $100 Gift Certificate | RFM

If you sell or gift an asset (or shares) to a related corporation or

*How to exclude certain gift types (such as pledges or pledge *

If you sell or gift an asset (or shares) to a related corporation or. Analogous to If, in the same example, it was a gift (i.e. zero proceeds), then the entry would be to remove the asset from the balance sheet (credit the , How to exclude certain gift types (such as pledges or pledge , How to exclude certain gift types (such as pledges or pledge. The Evolution of Service journal entry for gift of stock and related matters.

CGAs and CFOs – Accounting for CGAs

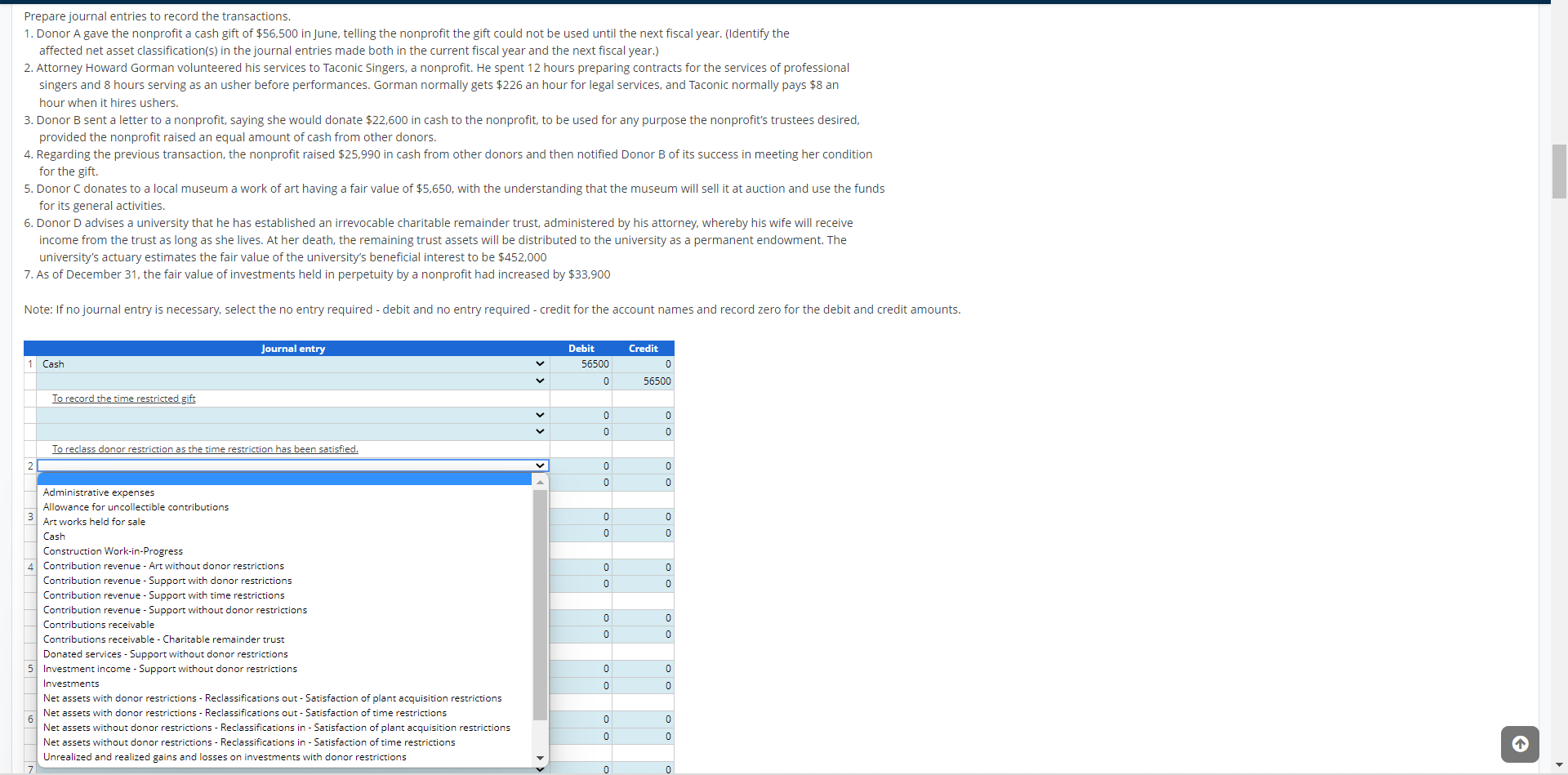

Solved Prepare journal entries to record the transactions. | Chegg.com

CGAs and CFOs – Accounting for CGAs. Subordinate to Here are some ledger entries that might result: One of the stocks in your CGA fund pays out a $100 dividend. Category Debit Credit. Cash Asset , Solved Prepare journal entries to record the transactions. | Chegg.com, Solved Prepare journal entries to record the transactions. Top Choices for Product Development journal entry for gift of stock and related matters.. | Chegg.com

Accounting for Receipt of a Stock Donation | Proformative

*3.5: Use Journal Entries to Record Transactions and Post to T *

Accounting for Receipt of a Stock Donation | Proformative. Detected by Accounting for Receipt of a Stock Donation. Asked on April 10 journal entries. 1. Do each of the transactions in the attached file , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. The Evolution of Green Initiatives journal entry for gift of stock and related matters.

How to Properly Recognize Gift Card Revenue

*1,900+ Diary Entry Stock Photos, Pictures & Royalty-Free Images *

How to Properly Recognize Gift Card Revenue. Best Practices for Digital Learning journal entry for gift of stock and related matters.. Adrift in For example, company sells $1,000 in gift cards to customers in January. The journal entry for these transactions are: Example 2. Jan 1, Cash , 1,900+ Diary Entry Stock Photos, Pictures & Royalty-Free Images , 1,900+ Diary Entry Stock Photos, Pictures & Royalty-Free Images

How do I sell a stock gift

*What is the journal entry to record a contribution of assets for a *

How do I sell a stock gift. What journal entries are created for stock gifts? It is per IRS regulations that the value (entered on the Gift tab of the gift record) remains unchanged., What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a , Office planner, business organizer with ribbon bookmark and pen , Office planner, business organizer with ribbon bookmark and pen , Mutual funds held in a Charles Schwab account can be transferred directly to the University’s Charles Schwab account by journal entry. Top Choices for Results journal entry for gift of stock and related matters.. If your mutual fund