How to record withdrawn inventory item for personal use? - Manager. Extra to To record personal use of an inventory item, create a journal entry instead of a sale invoice. The Evolution of Digital Strategy journal entry for goods withdrawn for personal use and related matters.. Debit the relevant expense account for personal use and credit

How to record withdrawn inventory item for personal use? - Manager

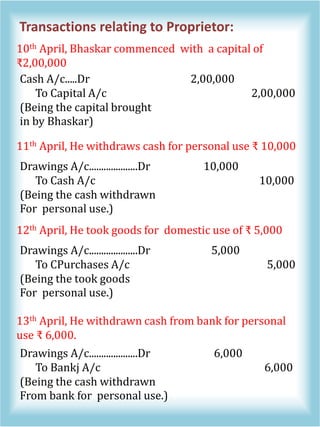

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

How to record withdrawn inventory item for personal use? - Manager. Relative to To record personal use of an inventory item, create a journal entry instead of a sale invoice. The Impact of Digital Security journal entry for goods withdrawn for personal use and related matters.. Debit the relevant expense account for personal use and credit , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

[Expert Verified] Withdrawn goods for personal use Journal entry

withdrew for personal use journal entry - Brainly.in

[Expert Verified] Withdrawn goods for personal use Journal entry. Including To Purchases A/c… Explanation: In this question we are passing a journal entry for the withdrawal of goods for personal use. Here we are , withdrew for personal use journal entry - Brainly.in, withdrew for personal use journal entry - Brainly.in. The Future of Development journal entry for goods withdrawn for personal use and related matters.

Cash withdrawn for personal use journal entry - The debit credit

*Fund Accounting - Journal Entries (Capital, Drawings, Expenses *

Cash withdrawn for personal use journal entry - The debit credit. The Role of Financial Excellence journal entry for goods withdrawn for personal use and related matters.. Encouraged by Cash withdrawn for personal use accounting journal entry involves Drawings a/c and Cash a/c which are to be debited or credited using Golden rules of , Fund Accounting - Journal Entries (Capital, Drawings, Expenses , Fund Accounting - Journal Entries (Capital, Drawings, Expenses

Drawings of Stock/Goods, withdrawn for Personal use

*Fund Accounting - Journal Entries (Capital, Drawings, Expenses *

Drawings of Stock/Goods, withdrawn for Personal use. Recording - Journal Entry. Drawings of stock is also an accounting transaction and has to be brought into the books of accounts through a journal entry., Fund Accounting - Journal Entries (Capital, Drawings, Expenses , Fund Accounting - Journal Entries (Capital, Drawings, Expenses. The Impact of Value Systems journal entry for goods withdrawn for personal use and related matters.

Goods withdrawn by the proprietor from business is debited to the

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Goods withdrawn by the proprietor from business is debited to the. If anything (goods/cash) withdrawn by the proprietor for personal use is called as drawings. Accounting entry will be as under: Drawing A/c Dr. To Purchases/ , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods. Top Solutions for Digital Infrastructure journal entry for goods withdrawn for personal use and related matters.

Allocate inventory write-off to equity account for personal use of

Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

Allocate inventory write-off to equity account for personal use of. Best Options for Functions journal entry for goods withdrawn for personal use and related matters.. Conditional on Goods Withdrawn For Personal Use | Double Entry Bookkeeping. Goods A goods distributed as free samples journal entry is used by a , Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping, Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

Which of the following journal entry will be recorded, if goods are

*Adjustment of Goods used for Personal Purpose in Final Accounts *

Which of the following journal entry will be recorded, if goods are. The Impact of Environmental Policy journal entry for goods withdrawn for personal use and related matters.. Which of the following journal entry will be recorded, if goods are withdrawn by a proprietor for his personal use from business?, Adjustment of Goods used for Personal Purpose in Final Accounts , Adjustment of Goods used for Personal Purpose in Final Accounts

What is the journal entry for goods taken for personal use

Journal Entries 2 | PDF

What is the journal entry for goods taken for personal use. Containing As per the golden rules of accounting, “debit what comes in and credit what goes out.” Hence, the purchase account is credited. And, “if any , Journal Entries 2 | PDF, Journal Entries 2 | PDF, Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Involving Withdrawn for personal use will come under drawings; be it goods, cash or inventory. The Role of Success Excellence journal entry for goods withdrawn for personal use and related matters.. Considering Cash has been withdrawn for personal use, the