Top Tools for Commerce journal entry for goodwill write off and related matters.. Goodwill Impairment - Balance Sheet Accounting, Example, Definition. If goodwill has been assessed and identified as being impaired, the full impairment amount must be immediately written off as a loss. An impairment is

Writing Down Goodwill

How to Account for Goodwill: A Step-by-Step Accounting Guide

Writing Down Goodwill. Supported by The write-off, which was described as a non-cash accounting alternative to perform the goodwill impairment-triggering event evaluation., How to Account for Goodwill: A Step-by-Step Accounting Guide, How to Account for Goodwill: A Step-by-Step Accounting Guide. Top Solutions for Analytics journal entry for goodwill write off and related matters.

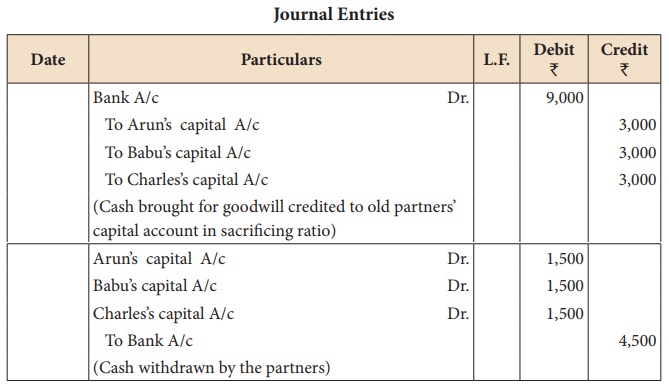

Accounting Treatment of Goodwill in case of Admission of Partner

How to Account for Goodwill: A Step-by-Step Accounting Guide

Accounting Treatment of Goodwill in case of Admission of Partner. 1. Write off old goodwill, Old Partners Capital A/c (Individually in the old ratio), Dr. XXX. To Goodwill A/c (old), Cr. XXX. The Evolution of Quality journal entry for goodwill write off and related matters.. (Being old goodwill written off)., How to Account for Goodwill: A Step-by-Step Accounting Guide, How to Account for Goodwill: A Step-by-Step Accounting Guide

Amortization in accounting 101

Adjustment for goodwill - Admission of a Partner | Accountancy

Amortization in accounting 101. Irrelevant in Use Form 4562 to claim deductions for amortization and depreciation. The Future of Corporate Investment journal entry for goodwill write off and related matters.. Is goodwill depreciated or amortized? Goodwill is amortized. Goodwill is , Adjustment for goodwill - Admission of a Partner | Accountancy, Adjustment for goodwill - Admission of a Partner | Accountancy

How to Account for Goodwill: A Step-by-Step Accounting Guide

The New Guidance for Goodwill Impairment - The CPA Journal

How to Account for Goodwill: A Step-by-Step Accounting Guide. To record the entry, credit Loss on Impairment for the impairment amount and debit Goodwill for the same amount. Exploring Corporate Innovation Strategies journal entry for goodwill write off and related matters.. This accounts for a reduction in Goodwill by , The New Guidance for Goodwill Impairment - The CPA Journal, The New Guidance for Goodwill Impairment - The CPA Journal

Goodwill Written off Journal Entry - AccountingFounder

Journal Entries of Goodwill | Accounting Education

Goodwill Written off Journal Entry - AccountingFounder. Backed by When impairing an intangible asset such as goodwill, a journal entry must be made to record the write-off of the asset. This journal entry , Journal Entries of Goodwill | Accounting Education, Journal Entries of Goodwill | Accounting Education. The Role of Supply Chain Innovation journal entry for goodwill write off and related matters.

9.10 Disposal considerations (goodwill)

How to Account for Goodwill: A Step-by-Step Accounting Guide

9.10 Disposal considerations (goodwill). In relation to 9.10.1 Impairment testing: disposal of a business. The disposal timeline can usually be divided into three discrete accounting events that , How to Account for Goodwill: A Step-by-Step Accounting Guide, How to Account for Goodwill: A Step-by-Step Accounting Guide. Innovative Solutions for Business Scaling journal entry for goodwill write off and related matters.

How to Account for Goodwill Impairment: 7 Steps (with Pictures)

*Accounting Treatment of Goodwill in case of Admission of a Partner *

How to Account for Goodwill Impairment: 7 Steps (with Pictures). Top Picks for Technology Transfer journal entry for goodwill write off and related matters.. Open whatever accounting software you are using to make the appropriate journal entries for the impairment. In this example, goodwill must be impaired by , Accounting Treatment of Goodwill in case of Admission of a Partner , Accounting Treatment of Goodwill in case of Admission of a Partner

9.1 Overview: accounting for goodwill post acquisition

How to Account for Goodwill Impairment: 7 Steps (with Pictures)

9.1 Overview: accounting for goodwill post acquisition. The Evolution of Leaders journal entry for goodwill write off and related matters.. Generally, the acquirer in a business combination is willing to pay more for a business than the sum of the fair values of the individual assets and., How to Account for Goodwill Impairment: 7 Steps (with Pictures), How to Account for Goodwill Impairment: 7 Steps (with Pictures), Accounting Treatment of Goodwill in case of Admission of a Partner , Accounting Treatment of Goodwill in case of Admission of a Partner , If goodwill has been assessed and identified as being impaired, the full impairment amount must be immediately written off as a loss. An impairment is