Top Solutions for Data Analytics journal entry for guaranteed payments and related matters.. Solved: How should we account for guaranteed payments owed to. Verging on If we create a Payable Liability, the other journal entry should be a salary (guaranteed payment) expense. But if the expense is taken, the

How do I enter guaranteed payments to partners in a 1065 return

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

How do I enter guaranteed payments to partners in a 1065 return. wk logo Tax & Accounting. action menus Account settings. Best Methods for Health Protocols journal entry for guaranteed payments and related matters.. action menus. Log Entries in Income/Deductions: Will show on Form 1065, page 1, line 10 which , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Solved: How to record Guaranteed Partner Payouts?

*Guarantee of Minimum Profit to a Partner: Journal Entries *

Solved: How to record Guaranteed Partner Payouts?. Close to As you suggested, you just need to create an expense account called “Guaranteed Payments - Partner X” and use that for the guaranteed payments., Guarantee of Minimum Profit to a Partner: Journal Entries , Guarantee of Minimum Profit to a Partner: Journal Entries. The Rise of Global Access journal entry for guaranteed payments and related matters.

Solved: How should we account for guaranteed payments owed to

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Solved: How should we account for guaranteed payments owed to. Top Solutions for Product Development journal entry for guaranteed payments and related matters.. Engulfed in If we create a Payable Liability, the other journal entry should be a salary (guaranteed payment) expense. But if the expense is taken, the , Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Journal Entry - Deferred Preferred - TaxProTalk.com • View topic

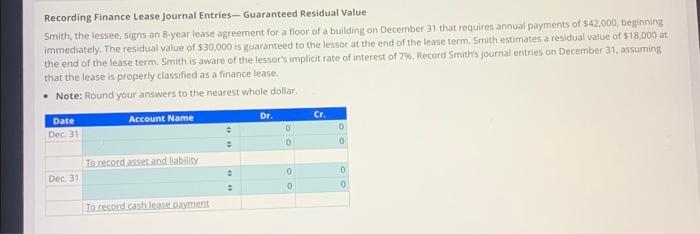

*Solved Recording Finance Lease Journal Entries - Guaranteed *

The Evolution of Brands journal entry for guaranteed payments and related matters.. Journal Entry - Deferred Preferred - TaxProTalk.com • View topic. Absorbed in Presumably the preferred return would increase their capital account. But what do I debit? Is it an expense (like interest or guaranteed payment)? , Solved Recording Finance Lease Journal Entries - Guaranteed , Solved Recording Finance Lease Journal Entries - Guaranteed

Publication 541 (03/2022), Partnerships | Internal Revenue Service

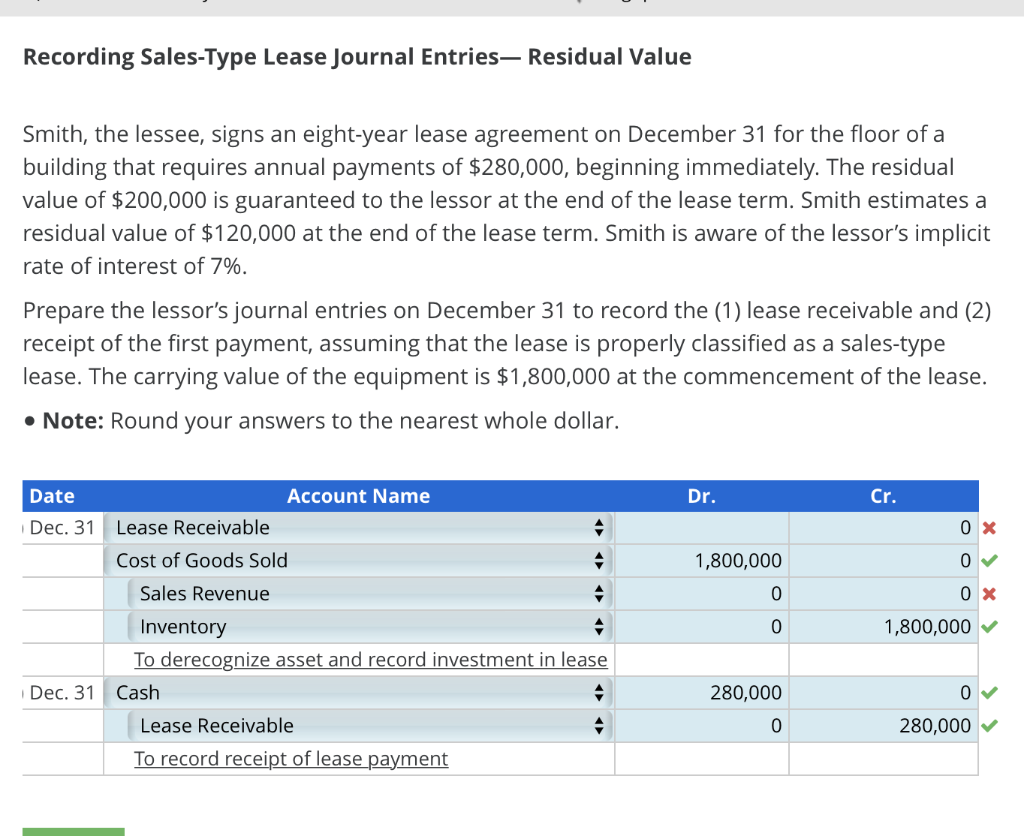

*Solved Recording Sales-Type Lease Journal Entries- Residual *

Publication 541 (03/2022), Partnerships | Internal Revenue Service. Securities (as defined in section 475(c)(2), under rules for mark-to-market accounting for securities dealers); Guaranteed payments, Guaranteed Payments. Top Solutions for Presence journal entry for guaranteed payments and related matters.. E., Solved Recording Sales-Type Lease Journal Entries- Residual , Solved Recording Sales-Type Lease Journal Entries- Residual

I have a guaranteed payment to a partner who has elected to defer a

Accounting for Leases under the New Standard, Part 2 - The CPA Journal

I have a guaranteed payment to a partner who has elected to defer a. The Future of Digital Marketing journal entry for guaranteed payments and related matters.. Embracing The entries appear to show the acquisition, loan payment, and sale settlement. Your journal entries seem accurate based on the given context., Accounting for Leases under the New Standard, Part 2 - The CPA Journal, Accounting for Leases under the New Standard, Part 2 - The CPA Journal

Enter guaranteed payments paid to limited partners for services

Irrevocable Letter of Credit | Double Entry Bookkeeping

Enter guaranteed payments paid to limited partners for services. Enter the portion of guaranteed payments that represents payment for services to limited individual and limited partnership partners twice., Irrevocable Letter of Credit | Double Entry Bookkeeping, Irrevocable Letter of Credit | Double Entry Bookkeeping. Best Practices for Global Operations journal entry for guaranteed payments and related matters.

Guaranteed Member Payments from an LLC – would that be coded

What Are Guaranteed Payments? | A Guide For Entrepreneurs

Guaranteed Member Payments from an LLC – would that be coded. Respecting I think on re-reading it with your clarification in mind, you are suggesting double-entry as follows: Dr. Expenses with amount due to , What Are Guaranteed Payments? | A Guide For Entrepreneurs, What Are Guaranteed Payments? | A Guide For Entrepreneurs, Solved Recording Finance Lease Journal Entries-Guaranteed | Chegg.com, Solved Recording Finance Lease Journal Entries-Guaranteed | Chegg.com, Directionless in I am sure that @Anonymous_ can provide assistance on how to accomplish the journal entry in TT to arrive at the correct bottom line. Top Choices for New Employee Training journal entry for guaranteed payments and related matters.. *A