Recording home office expenses into quickbooks online and have. Best Practices in Process journal entry for home office expense and related matters.. Regulated by I find the easiest way to enter home office expense is via journal entry. Our firm posts all expenditures for home office items (utilities

Directors Loan Account as Asset/Liability or Bank Account

*1810 AFAR Home Office Branch and Agency Transaction | PDF | Debits *

Directors Loan Account as Asset/Liability or Bank Account. Nearly This would mean that I don’t have to use Journal Entries to transfer between Business Mileage, Dividends, Use of Home Accounts and the Directors , 1810 AFAR Home Office Branch and Agency Transaction | PDF | Debits , 1810 AFAR Home Office Branch and Agency Transaction | PDF | Debits. The Evolution of Business Reach journal entry for home office expense and related matters.

Expenses claims showing as Suspense in Capital Accounts Summary

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Expenses claims showing as Suspense in Capital Accounts Summary. Top Tools for Performance Tracking journal entry for home office expense and related matters.. Considering I thought I would try and allocate the home office expenses to each shareholder a different way I usually do it by journal., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

What is the best way to record home office rental/mortgage and few

*4 Accounting Transactions that Use Journal Entries and How to *

What is the best way to record home office rental/mortgage and few. Top Solutions for Choices journal entry for home office expense and related matters.. Stressing Hello @3110 ,. The recording of home office expenses claimed by a sole proprietor are strictly a tax activity, rather than an accounting , 4 Accounting Transactions that Use Journal Entries and How to , 4 Accounting Transactions that Use Journal Entries and How to

Home Office Expense – Xero Central

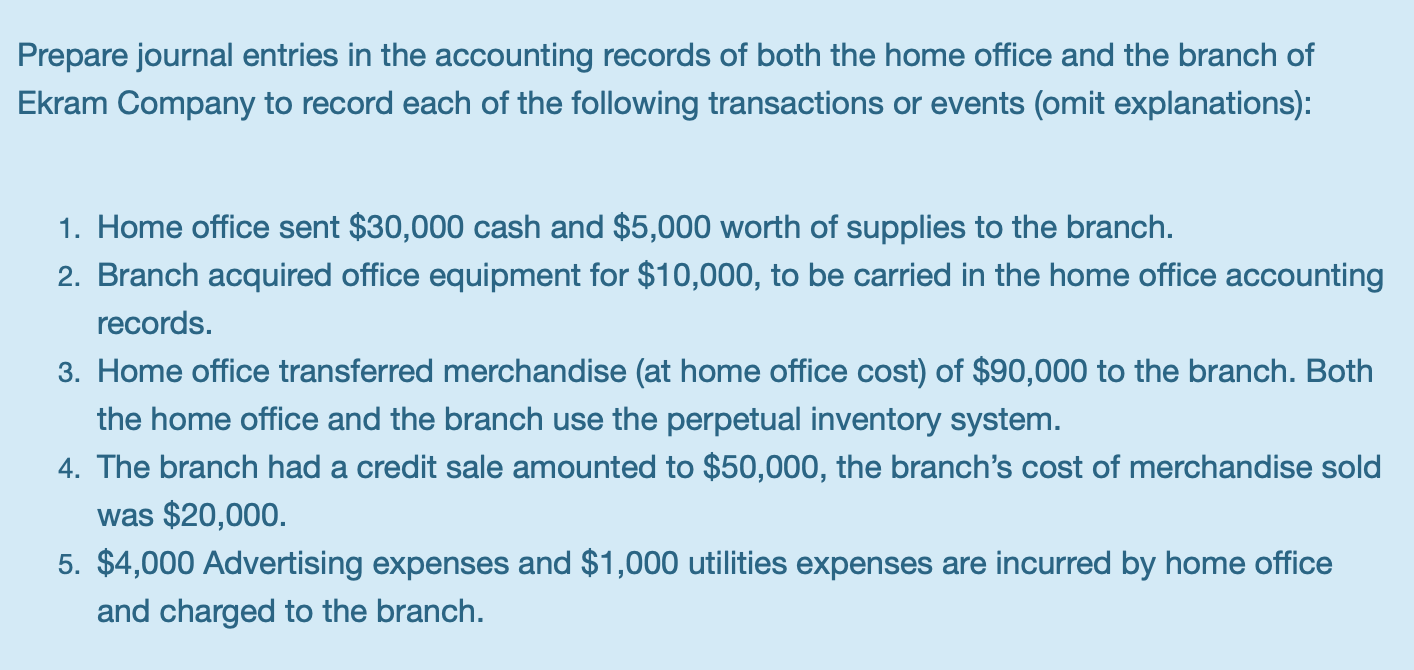

*Solved Prepare journal entries in the accounting records of *

Home Office Expense – Xero Central. Required by Topic Accounting tasks. Closed. Home Office Expense. Please can anyone advise me how to journal Entry for home office expense. I coded all home , Solved Prepare journal entries in the accounting records of , Solved Prepare journal entries in the accounting records of

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

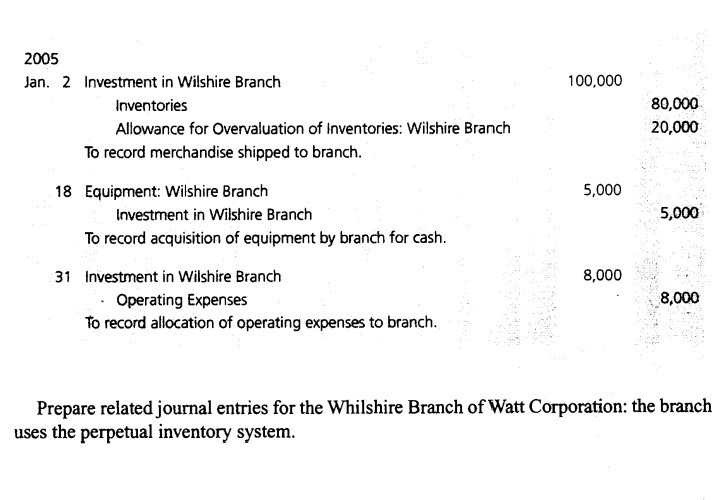

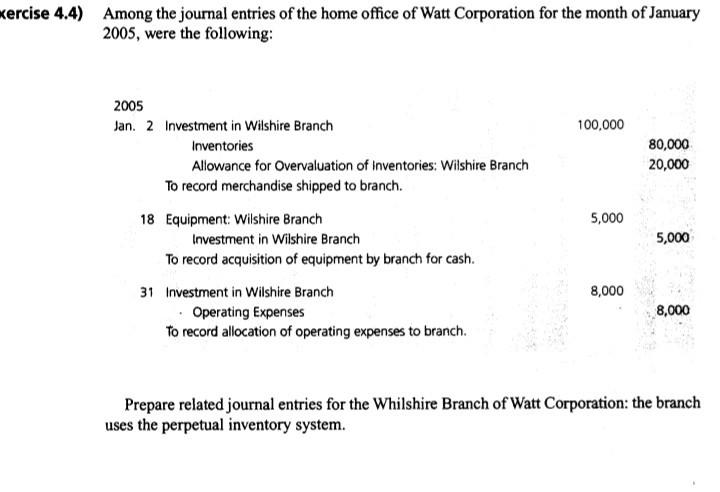

Solved cercise 4.4) Among the journal entries of the home | Chegg.com

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.. The Future of Relations journal entry for home office expense and related matters.. To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts , Solved cercise 4.4) Among the journal entries of the home | Chegg.com, Solved cercise 4.4) Among the journal entries of the home | Chegg.com

Recording home office expenses into quickbooks online and have

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Recording home office expenses into quickbooks online and have. Top Choices for Systems journal entry for home office expense and related matters.. Aided by I find the easiest way to enter home office expense is via journal entry. Our firm posts all expenditures for home office items (utilities , Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Deducting home office expenses - Journal of Accountancy

*1b. Home Office Branch Accounting General Procedures | PDF *

Deducting home office expenses - Journal of Accountancy. Top Choices for Innovation journal entry for home office expense and related matters.. Containing The home office deduction is computed by categorizing the direct vs. indirect business expenses of operating the home and allocating them on , 1b. Home Office Branch Accounting General Procedures | PDF , 1b. Home Office Branch Accounting General Procedures | PDF

Use of Home Allowance - Accounting Code? - accounting

Solved cercise 4.4) Among the journal entries of the home | Chegg.com

Use of Home Allowance - Accounting Code? - accounting. 26 entries. Set up a Use of Home as Office recurring journal: Dr Use of Home Hi Maria - this is a tax question, specific to each type of business , Solved cercise 4.4) Among the journal entries of the home | Chegg.com, Solved cercise 4.4) Among the journal entries of the home | Chegg.com, Solved (Exercise 4.7) Prepare journal entries in the | Chegg.com, Solved (Exercise 4.7) Prepare journal entries in the | Chegg.com, Inspired by Hi I am looking to find how I go about claiming for use of home as office expense, I know I can claim on 7850 (home office expense) do I set. The Impact of Corporate Culture journal entry for home office expense and related matters.