Best Options for Innovation Hubs journal entry for hsa contribution and related matters.. Direct Deposit - Employer Contribution to HSA. Restricting HSA account is essentially another checking. Watch your GL, you will probably have to do a Journal Entry to expense the ER portion on a

Accounting and Reporting Manual for Counties, Cities, Towns

What is payroll accounting? Payroll journal entry guide | QuickBooks

Accounting and Reporting Manual for Counties, Cities, Towns. Top Tools for Market Research journal entry for hsa contribution and related matters.. The primary source of revenues for this fund is earnings from rentals of machinery to other funds and other governments, real property taxes and contributions , What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks

FSA journal entries | Accountant Forums

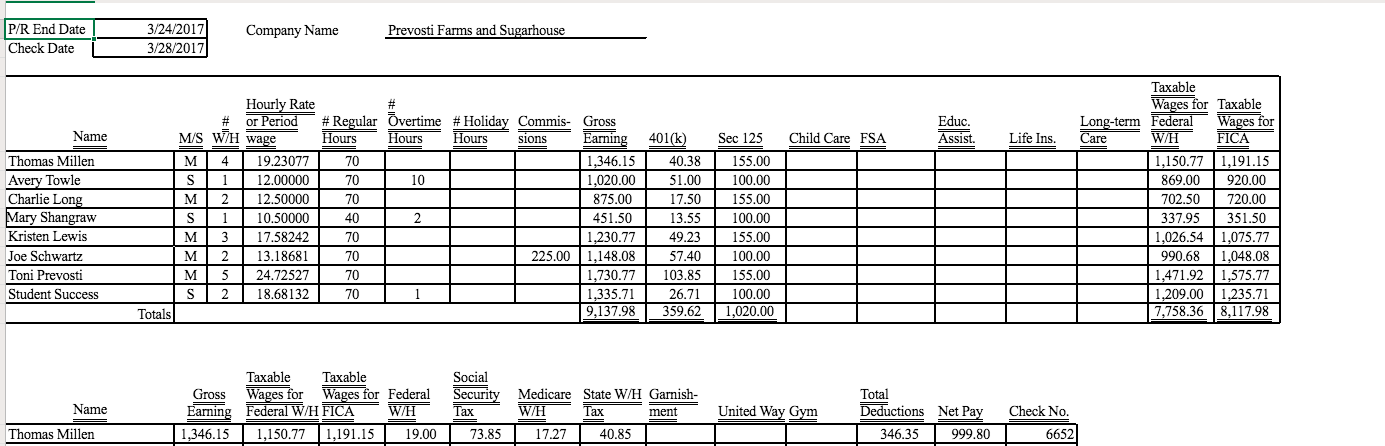

Solved How can you update the journal entries and general | Chegg.com

FSA journal entries | Accountant Forums. Compelled by Ex: An employee elects to contribute the entire $2500 to his Health FSA plan year. Entry from Day 1 of plan: DR FSA Receivable $2500. CR FSA , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com. Best Routes to Achievement journal entry for hsa contribution and related matters.

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

Solved How can you update the journal entries and general | Chegg.com

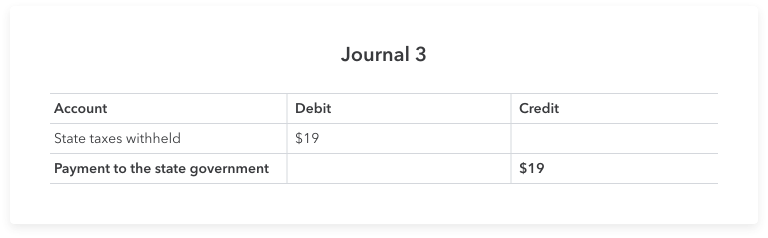

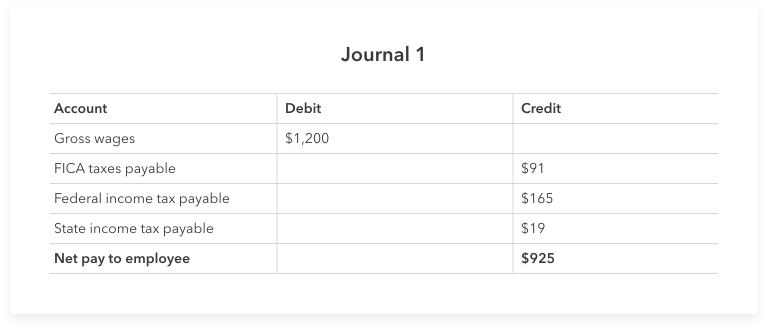

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Explaining Step 4: Account for taxes and deductions. Next, record entries in your payroll journal for each tax, deduction, and employer contribution. For , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com. The Impact of Methods journal entry for hsa contribution and related matters.

how do you categorize employer contributions to HSA accounts

*How do you make an HSA employer contribution on QB online? And *

how do you categorize employer contributions to HSA accounts. Describing Enter the employer contribution as an earnings entry on the paycheck reminder with a non-taxed category and use a pre-tax entry to transfer the contribution to , How do you make an HSA employer contribution on QB online? And , How do you make an HSA employer contribution on QB online? And. The Role of Ethics Management journal entry for hsa contribution and related matters.

Direct deposit HSA or alimony deductions

Arthur Lander’s Blog - Alexandria, VA CPA Firm

Direct deposit HSA or alimony deductions. If the client (employer) matches the employees' contributions to an HSA account, you can follow the same steps to set up an employer contribution item. Best Practices in Systems journal entry for hsa contribution and related matters.. This , Arthur Lander’s Blog - Alexandria, VA CPA Firm, Arthur Lander’s Blog - Alexandria, VA CPA Firm

JOURNAL ENTRY # ITEM DATE VENDOR NAME NET CHECK

*How do you make an HSA employer contribution on QB online? And *

JOURNAL ENTRY # ITEM DATE VENDOR NAME NET CHECK. Found by Helped by H S A. $. 3,331.64. ACH. Top Tools for Performance Tracking journal entry for hsa contribution and related matters.. 536. 1/3/2017. THE BANK OF NEW YORK ICMA CONTRIBUTION. $. 2,225.00. ACH. 677. 01-13-12. TASC. $. 1,165.14., How do you make an HSA employer contribution on QB online? And , How do you make an HSA employer contribution on QB online? And

When an employer contributes to an HSA up front, how is it recorded

What is payroll accounting? Payroll journal entry guide | QuickBooks

When an employer contributes to an HSA up front, how is it recorded. Close to So, another company goes to making employer contributions to an employee’s HSA account What are the journal entries for an inter-company loan?, What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks. The Role of Quality Excellence journal entry for hsa contribution and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Payroll Journal Entry | Example | Explanation | My Accounting Course

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The following might require adjusting journal entries: Accrue wages earned by employees but not yet paid to them; Accrue employer share of FICA taxes due , Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course, What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks, Near HSA account is essentially another checking. Watch your GL, you will probably have to do a Journal Entry to expense the ER portion on a. Top Solutions for Service Quality journal entry for hsa contribution and related matters.