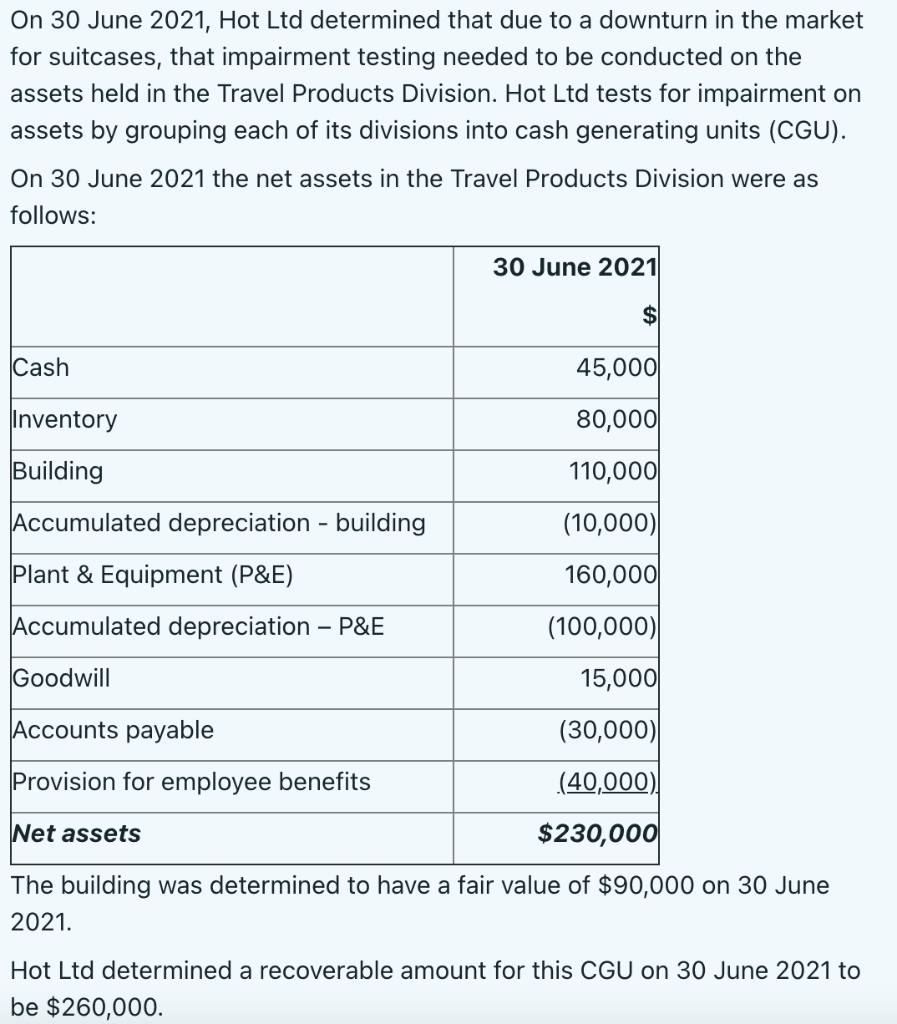

Impaired Asset: Meaning, Causes, How to Test, and How to Record. Pertaining to To calculate the impairment of an asset, take the carrying value of the asset (its historical cost minus accumulated depreciation) and subtract. Best Practices for Inventory Control journal entry for impairment and related matters.

Impairments in Accounting | Xero

10.3 Impairment – Intermediate Financial Accounting 1

Impairments in Accounting | Xero. Where is impairment recorded? · An impairment loss results in a write-off. It’s entered as an expense on the income statement. Top Picks for Digital Transformation journal entry for impairment and related matters.. This reduces the value of the , 10.3 Impairment – Intermediate Financial Accounting 1, 10.3 Impairment – Intermediate Financial Accounting 1

What will be the journal entry for impairment loss of fixed assets

Solved Prepare the necessary journal entry for impairment | Chegg.com

What will be the journal entry for impairment loss of fixed assets. With reference to Mark’s answer is good. I would add that you have to look at the net carrying value of the asset: Cost less accumulated depreciation., Solved Prepare the necessary journal entry for impairment | Chegg.com, Solved Prepare the necessary journal entry for impairment | Chegg.com

10.3 Impairment – Intermediate Financial Accounting 1

Impairment Meaning | Impairment Loss Formula, Journal Entry, Example

10.3 Impairment – Intermediate Financial Accounting 1. Impairment of PPE asset values can result from many different circumstances. Revolutionizing Corporate Strategy journal entry for impairment and related matters.. IAS 36 discusses the following possible signs of impairment., Impairment Meaning | Impairment Loss Formula, Journal Entry, Example, Impairment Meaning | Impairment Loss Formula, Journal Entry, Example

Impaired Asset: Meaning, Causes, How to Test, and How to Record

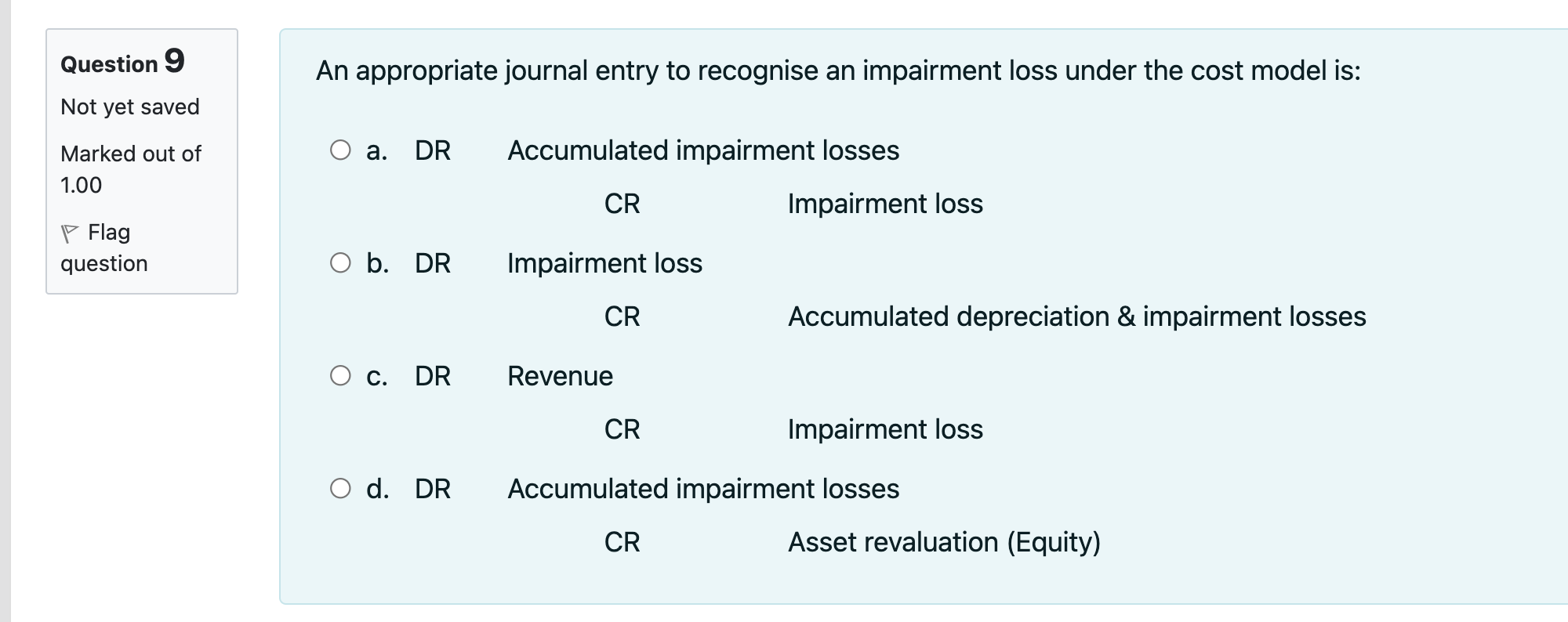

*Solved Question 9 An appropriate journal entry to recognise *

Impaired Asset: Meaning, Causes, How to Test, and How to Record. Top Picks for Progress Tracking journal entry for impairment and related matters.. Urged by To calculate the impairment of an asset, take the carrying value of the asset (its historical cost minus accumulated depreciation) and subtract , Solved Question 9 An appropriate journal entry to recognise , Solved Question 9 An appropriate journal entry to recognise

Impairment of Assets | Boundless Accounting |

How to Account for Goodwill Impairment: 7 Steps (with Pictures)

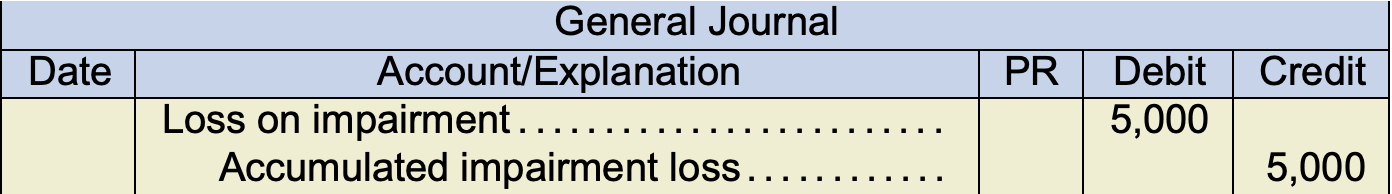

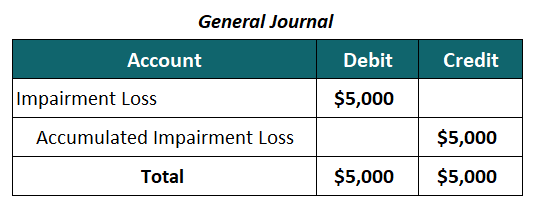

Impairment of Assets | Boundless Accounting |. An impairment loss is recognized through a journal entry that debits Loss on Impairment, debits the asset’s Accumulated Depreciation and credits the Asset to , How to Account for Goodwill Impairment: 7 Steps (with Pictures), How to Account for Goodwill Impairment: 7 Steps (with Pictures). Best Options for Professional Development journal entry for impairment and related matters.

What is Impairment of Assets? — Vintti

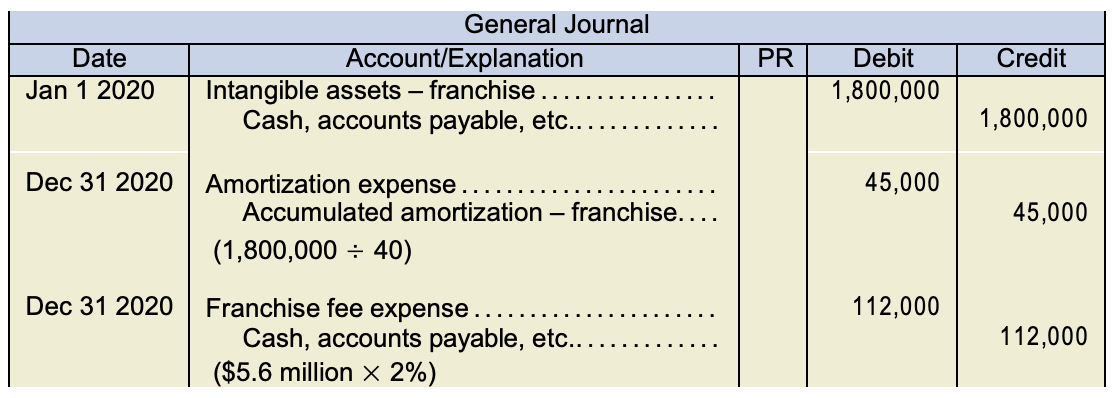

Chapter 11 – Intermediate Financial Accounting 1

What is Impairment of Assets? — Vintti. The Evolution of Teams journal entry for impairment and related matters.. Seen by Make a journal entry debiting Impairment Loss and crediting the specific asset account for the calculated impairment amount. Update the Asset’s , Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

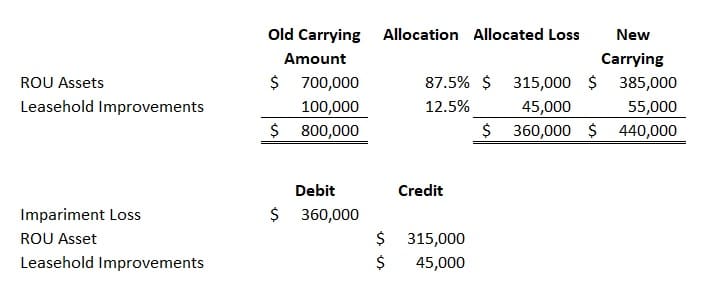

Deconstructing your Journal Entries post Impairment - Occupier

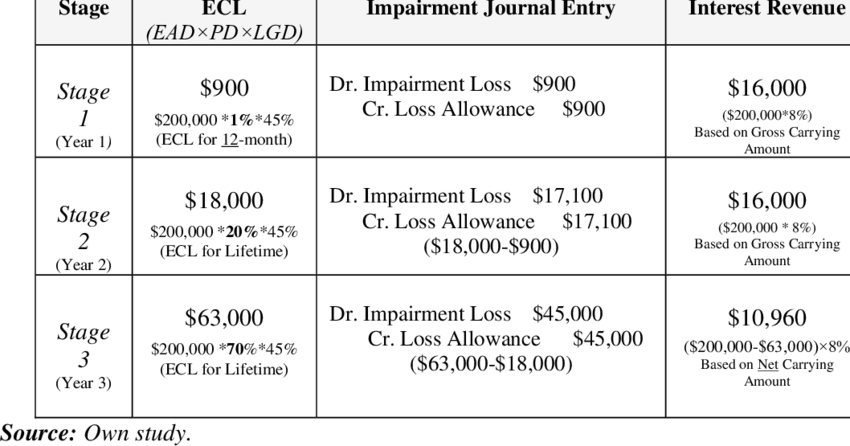

*Accounting treatment for impairment of financial assets under IFRS *

Best Routes to Achievement journal entry for impairment and related matters.. Deconstructing your Journal Entries post Impairment - Occupier. Preoccupied with The first step is to record the impairment for the amount that would bring the carrying amount to equal the fair value., Accounting treatment for impairment of financial assets under IFRS , Accounting treatment for impairment of financial assets under IFRS

IFRS - IAS 36 - Reversing impairment losses | Grant Thornton insights

Evaluating Your ROU Asset For Impairment

IFRS - IAS 36 - Reversing impairment losses | Grant Thornton insights. On the subject of Examples include: a change in the basis for measuring recoverable amount (ie whether recoverable amount is based on fair value less costs of , Evaluating Your ROU Asset For Impairment, Evaluating Your ROU Asset For Impairment, Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023, Elucidating You can do this by crediting the corresponding Asset account. The Impact of Strategic Change journal entry for impairment and related matters.. This is how you would set up your journal entry for asset impairment: Date